Huawei's Market Share Expected to Plunge to 4% Next Year

Chinese Phones Undergo Cell Division... Xiaomi and Oppo Gain Reflex Benefits

Samsung Phones Seize Opportunity to Capture European Market Share

[Asia Economy Reporter Han Jinju] Huawei's wingless fall is shaking the global smartphone market landscape. As Xiaomi and Oppo step into Huawei's vacant spot, the 'cell division' of Chinese phones is becoming more evident. Meanwhile, Samsung Electronics finds itself needing to pay attention to the pursuit of other Chinese phones that have undergone this cell division, with no time to enjoy the rival's downfall. The fierce battle between 'Samsung Electronics and Chinese phones' is expected to heat up further in Europe and China, where Huawei had shown strong performance.

Huawei's Market Share Plummets from 14% to 4%

According to market research firm TrendForce on the 27th, Huawei's smartphone market share is expected to fall from 14% this year to 4% next year. Due to additional sanctions by the U.S. government, the supply of chipsets, a core component of smartphones, was halted from September, delivering a direct blow to Huawei's smartphone business. This is a shocking development for Huawei, which had been chasing Samsung closely, even vying for the top spot in smartphone shipments in Q2 this year. There is also a forecast that the shipment volume, which was 190 million units this year, will drop to 40 million units next year. Market research firm Omdia predicts that if sanctions continue until the first half of next year, Huawei's smartphone volume will decrease by about 67 million units compared to this year, and if they persist until the end of the year, the reduction could reach about 152 million units.

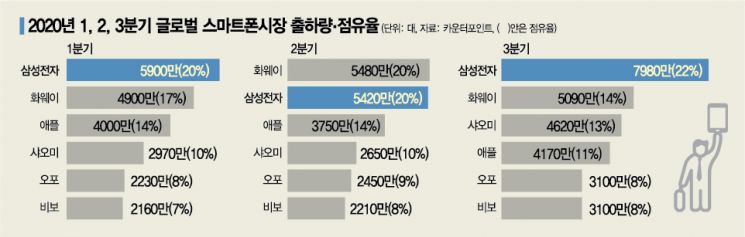

Signals indicating Huawei's sluggishness are already being detected in various places. According to market research firm Counterpoint, Huawei maintained second place in smartphone market share in Q3, following Samsung Electronics, but its share remained at 14%. Huawei's shipment volume decreased by 24% year-on-year and 7% quarter-on-quarter. Taking advantage of Huawei's downturn, Xiaomi increased its shipment volume by 75% compared to Q2, surpassing Apple to claim third place. With the smartphone market expected to grow by 11% next year compared to this year, manufacturers aiming to benefit from Huawei's decline have become active. Apple released four types of 5G iPhones, and Samsung Electronics plans to advance the launch schedule of the Galaxy S21 by a month to unveil it in January next year.

Samsung Seizes Opportunity to Dominate Europe

With Huawei selling its mid-to-low-end brand 'Honor,' which accounted for 25% of its smartphone shipments, competition between Samsung Electronics and Xiaomi is expected in the mid-to-low-end market. In Europe, where Huawei recorded the second-highest sales after China, Samsung Electronics has a greater opportunity to expand its market share. Huawei's market share in Europe is about 15%. As 5G infrastructure expands in Europe, Samsung Electronics' extension of 5G devices to mid-to-low-end smartphones is also a positive factor for increasing market share. Samsung Electronics' market share in Europe was 31.8% as of Q3 (Counterpoint).

Samsung Electronics targets Huawei's consumer base in the flagship category with strategies such as early release of the Galaxy S21, expansion of the foldable lineup, and increasing the 5G mid-to-low-end lineup. An industry insider said, "Samsung Electronics, part of the Android camp like Huawei, is expected to enjoy the benefits in Europe," adding, "Samsung Electronics' annual shipment volume next year could reach up to 300 million units, about 40 million units more than this year's 265 million units."

Xiaomi and Oppo Rising in Place of Huawei

In the Chinese market, other Chinese phone makers are benefiting from Huawei's decline. In Q3, the Chinese smartphone market share was highest for Huawei (45%), followed by Vivo (17%), Oppo (15%), and Xiaomi (11%). Xiaomi attracted attention by raising its share from 9% to 11%. Xiaomi achieved record-high sales and shipments in Q3 and rose to third place in global smartphone market share, surpassing Apple. According to Counterpoint, Xiaomi's smartphone shipments in Q3 were 46.2 million units, narrowing the gap with Huawei (50.9 million units) to 4.7 million units. In Q2, Huawei's shipment volume (66.8 million units) exceeded Xiaomi's (31.7 million units) by 35.1 million units, but the gap has significantly decreased.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.