FOMC Minutes Mention "Need for Adjustment Soon"

Possible Response to Future Economic Conditions Through Purchase Pace and Maturity Adjustments

[Asia Economy New York=Correspondent Baek Jong-min] The U.S. central bank, the Federal Reserve (Fed), hinted at the possibility of changing the asset purchase program introduced to overcome the COVID-19 crisis. Although the current level remains favorable, it is interpreted as a sign that the Fed plans to prepare for future economic conditions by adjusting the pace or maturity of asset purchases.

According to the minutes of the November Federal Open Market Committee (FOMC) meeting released by the Fed on the 25th (local time), there was discussion among members about changing the asset purchase program. The members stated that immediate adjustments to the pace and composition of the asset purchase program were not necessary but acknowledged that "the environment could change to justify adjustments."

Many members also expressed the view that guidance related to asset purchases needed to be revised "fairly soon."

Since June, the Fed has been supplying liquidity to the market by purchasing $80 billion in U.S. Treasury securities and $40 billion in mortgage-backed securities monthly. After the FOMC meeting earlier this month, the Fed indicated that the scale of asset purchases would continue for several more months.

A market insider said, "Such remarks usually mean changes will be made at the next FOMC meeting," but also evaluated that the minutes left some uncertainty.

The insider pointed out that while most members expressed the need to change the asset purchase guidance, some were negative about making an early decision. Some Fed officials also argued that the guidance should include the fact that the pace of asset purchases would slow before raising the benchmark interest rate.

The guidance the Fed refers to means the criteria that allow the market to anticipate how long the current asset purchase policy will be maintained. The Wall Street Journal (WSJ) commented, "The Fed may indicate that it will not reduce the scale of asset purchases until the COVID-19 situation improves or other conditions are met."

Reactions from the media to the minutes were mixed. A major outlet reported, "The Fed is converging on additional measures to promote economic recovery, but there is still a lack of agreement on details and timing." Meanwhile, CNBC evaluated that the Fed considered adjusting bond purchases to support the economy.

However, the Fed left hints about how changes to asset purchases might be made, including both dovish and hawkish directions.

The minutes explained, "Participants saw that, if appropriate, the pace of purchases could be increased or long-term Treasury securities could be purchased to provide additional accommodation." They also noted, "If appropriate, longer-term bonds could be purchased."

Some members expressed concerns that the benefits of increasing Fed assets in a low-interest-rate environment would be limited and that expanding asset holdings could lead to unintended consequences. Members also noted, "Risks to the economic outlook remain," and expressed concern that recent indicators suggest an increased possibility of a resurgence of the disease (COVID-19).

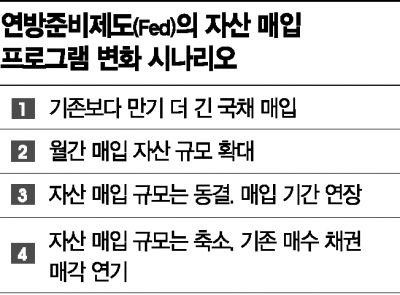

The market views possible changes as including purchasing longer-maturity bonds, increasing the monthly purchase amount, maintaining the purchase amount but extending the timeline, or slowing the purchase pace while holding previously purchased bonds longer.

WSJ forecasted that the Fed's judgment could be influenced by the resurgence of COVID-19, its impact on the economy and financial markets, and whether emergency lending programs are discontinued.

In the midst of the uncontrollable spread of COVID-19, the U.S. economic indicators released that day showed mixed directions. Last week, initial jobless claims increased by 30,000 from the previous week to 778,000, marking a second consecutive weekly rise. October personal consumption expenditures rose 0.5% month-over-month, continuing a six-month increase, but the growth rate was significantly lower than September's 1.2%. October personal income fell by 0.7%, raising concerns about future consumption declines.

On the other hand, October durable goods orders increased by 1.3% month-over-month. The preliminary estimate of U.S. economic growth for the third quarter was an annualized rate of 33.1%, consistent with the previously released flash estimate.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.