Market Kurly Reviews Entry and Additional Sales of AmorePacific and Vital Beauty

Over 50% of Digital Transformation Marketing Budget Invested... Restructuring Underway

[Asia Economy Reporter Lee Seon-ae] Amorepacific, which is experiencing the greatest crisis since its founding due to the worst performance slump, has established a strategy to accelerate its 'digital (online) transformation' as a 'survival strategy' to survive. Although the distribution flow rapidly shifted from offline to online, the company deeply reflected on its failure to actively transition to digital channels, which led to the crisis, and plans to boldly invest more than 50% of its marketing budget going forward.

Selling Premium Brand 'Amorepacific' on Market Kurly

On the 26th, it was confirmed that Amorepacific expanded its presence to Market Kurly following Coupang, Naver, and 11st. Currently, the premium cosmetics brand 'Amorepacific' and health functional food 'Vital Beauty' are available on Market Kurly. An Amorepacific official stated, "We recently entered Market Kurly to expand our channels," adding, "We will review additional products of 'Amorepacific' and 'Vital Beauty' as well as other brand entries based on future sales trends."

Market Kurly is a food-specialized online mall but has built a premium image and shown remarkable growth. The range of products handled is also expanding from just food to cosmetics, health supplements, and more. Accordingly, Amorepacific explained that "the customer-oriented services of the Market Kurly platform align well with the brand 'texture' that Amorepacific possesses, which led to the entry."

Amorepacific plans to continue its collaboration system with Coupang, Naver, 11st, and others where it has already established a presence. Internally, it is also formulating different channel strategies according to the characteristics of the brand’s products. This is to strategically differentiate product lines between offline and online to avoid channel cannibalization and to distinguish between premium (luxury) and masstige (mass prestige) lines within the brand.

An Amorepacific official explained, "For the luxury brand Sulwhasoo, the sales strategy in the direct sales channel focuses on the Jaumsaeng line preferred by those over 50, while the online channel emphasizes the Seollin line favored by younger consumers," adding, "All brands handled are currently establishing detailed sales strategies."

Digital Transformation 'Investing More Than Half of Marketing Budget'

Amorepacific invested about 50% of its marketing budget in digital channel transformation in the third quarter alone, including its entry into Market Kurly. Going forward, it plans to increase this proportion and invest more than half.

This reflects a deep reflection on the industry evaluation that Amorepacific faced a crisis by stubbornly sticking to offline channels while being late in transitioning to digital channels, which will require more time and cost to resolve in the future.

The late online transition was proven by the worst performance results. In the third quarter, Amorepacific Group recorded sales of 1.2086 trillion KRW and operating profit of 61 billion KRW, marking a 23% decrease in sales and a 49% decrease in operating profit compared to the previous year.

A securities firm official said, "Amorepacific should have transformed Aritaum into a multi-brand store like Health & Beauty (H&B) stores but missed the timing, and was late in responding to channel changes by insisting on its own online mall, leading to the crisis," adding, "Since growth has slowed, it must establish differentiated strategies as it entered digital transformation late."

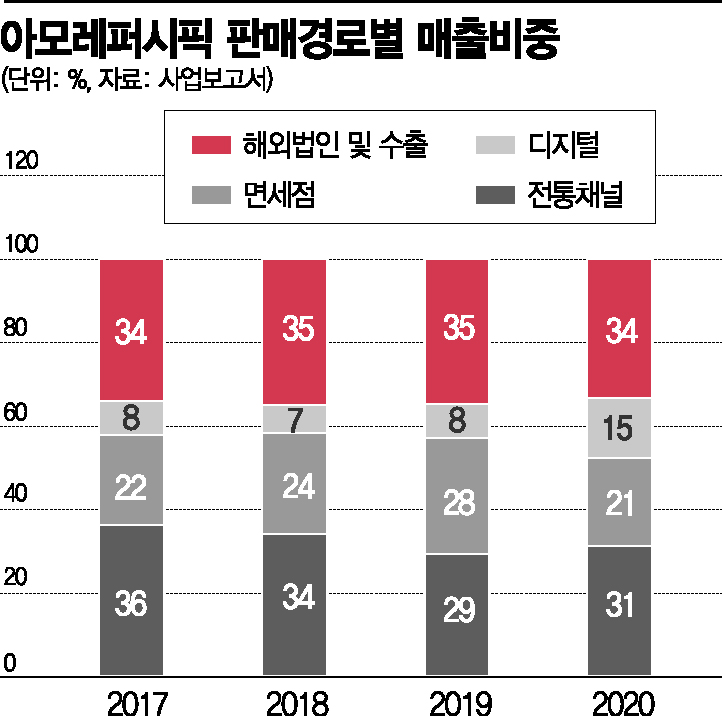

In 2017, the proportion of digital (including online and home shopping) sales in Amorepacific’s total sales was only 8%. It remained below 10% until last year, recording 7% and 8% in 2018 and 2019 respectively. Sensing the delay, Amorepacific hurriedly accelerated this year. Chairman Suh Kyung-bae of Amorepacific Group also declared 'digital transformation' as the management strategy early this year and focused on launching exclusive brands and products and marketing. As a result, the proportion increased to 15% as of the first half of this year.

However, discord has continuously arisen during this process. Conflicts with offline stores emerged while strengthening online channels. Selling products at lower prices online than offline provoked backlash from franchise owners, leading to a Fair Trade Commission judgment, and even resulted in Chairman Suh being summoned as a witness at the National Assembly audit.

Recently, Amorepacific has been focusing on resolving issues by signing win-win agreements with franchise owner councils of affiliated brands such as Aritaum, Etude, and Innisfree. The win-win plan includes ▲special rent support for franchisees ▲expansion of profit sharing from online direct malls ▲special stock returns ▲relaxation of store closure burdens ▲payment of separate sales activity support funds, providing 12 billion KRW in support in the second half alone.

Amorepacific plans to implement intensive restructuring while striving for digital transformation. Recently, it also started voluntary retirement, targeting employees with more than 15 years of service. An Amorepacific official said, "We plan to make every effort to overcome the crisis we face and accelerate sustainable growth through strong renewal efforts."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)