On the 18th, the Financial Services Commission held a regular meeting and approved the amendment to the Insurance Business Supervision Regulations containing these provisions.

On the 18th, the Financial Services Commission held a regular meeting and approved the amendment to the Insurance Business Supervision Regulations containing these provisions.

[Asia Economy Reporter Oh Hyung-gil] 'No-surrender insurance,' which does not refund any money if canceled midway, and 'low-surrender insurance,' which offers low refunds, will be changed.

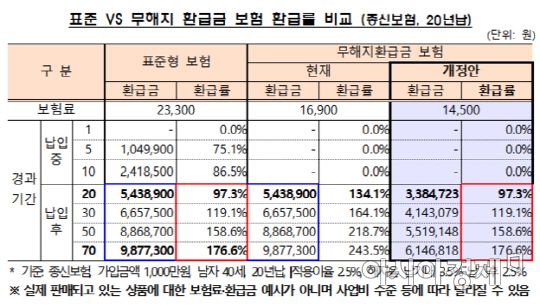

To prevent these products from being disguised and sold as savings products due to their higher maturity refund rates compared to standard insurance, their refund rates will be lowered to the level of standard products.

The Financial Services Commission held a regular meeting on the 18th and approved the amendment to the Insurance Business Supervision Regulations containing these details.

No (low) surrender refund insurance provides the same level of coverage as existing insurance products but offers lower premiums (10-30% less than existing ones), with little or no refund if canceled during the payment period.

The financial authorities have mandated that low-surrender refund insurance, which has no refund or less than 50% of the refund rate of standard insurance upon mid-term cancellation during the payment period, must be designed with refund rates within those of standard insurance during the insurance period.

As the refund rates decrease, premiums will also become cheaper, which is expected to increase consumer benefits for coverage purposes.

For example, if a 40-year-old man subscribes to insurance with a coverage amount of 10 million KRW and a 20-year payment period, the refund rate of standard insurance after 20 years is 97.3%. If the refund rate of the existing no-surrender refund insurance was 134.1% for the same period, it must now be adjusted to 97.3%. The premium will decrease by about 14%, from 16,900 KRW to 14,500 KRW.

Additionally, the definition of no (low) surrender refund insurance is specified as insurance using surrender rates in premium calculation or insurance benefit (annuity amount) calculation, excluding variable insurance products for which it is not reasonable to design as no (low) surrender refund insurance due to product characteristics.

"Only Consumers Suffer from Mid-Term Cancellation"

According to Lee Jung-moon, a member of the National Assembly's Political Affairs Committee from the Democratic Party of Korea, 2.14 million no- and low-surrender insurance policies were sold in the first half of this year alone, with 8.96 million sold over the past five years.

By year, ▲2016: 300,000 ▲2017: 770,000 ▲2018: 1.71 million ▲2019: 4.02 million ▲First half of 2020: 2.14 million were sold. Life insurance companies sold 4.95 million, and non-life insurance companies sold 4 million policies, respectively.

No-surrender insurance accounted for over 80% with 7.21 million policies, while low-surrender insurance accounted for 1.75 million. By sector, life insurance companies had 65.1% no-surrender and 34.9% low-surrender, while non-life insurance companies had 99.5% no-surrender and 0.5% low-surrender, showing a strong concentration of no-surrender insurance in non-life insurers.

In particular, the high cancellation rates of no (low) surrender refund insurance raise concerns about consumer damage.

Looking at the contract retention rates of no-surrender insurance sold by insurance companies, Samsung Life Insurance sold 810,000 no-surrender insurance policies over five years, with contract retention rates of 83.5% at the 13th installment and 54.6% at the 25th installment, halving in just two years.

DB Insurance sold 550,000 policies over five years, with contract retention rates of 88.7% at the 13th installment and 57.7% at the 25th installment.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)