Opportunities Increase but Losses May Grow Depending on Market Conditions

Introduction of Equal Distribution Method for More Than Half of Allocated Volume

[Asia Economy Reporter Eunmo Koo] The allocation of shares available to small individual investors in initial public offering (IPO) subscriptions will increase. From the perspective of individual investors, this is positive as it expands investment opportunities in IPOs, but there are concerns that depending on market conditions, the extent of losses could also increase, which could be detrimental.

On the 18th, the Financial Services Commission, Financial Supervisory Service, and Korea Financial Investment Association announced the 'Plan to Expand Participation Opportunities for General IPO Subscribers,' which increases the allocation of IPO shares to individual investors from the current 20% to up to 30%, with more than half of the allocated shares distributed equally. This measure responds to criticisms that small investors had limited opportunities during the IPO subscription frenzy for companies like Kakao Games and Big Hit Entertainment.

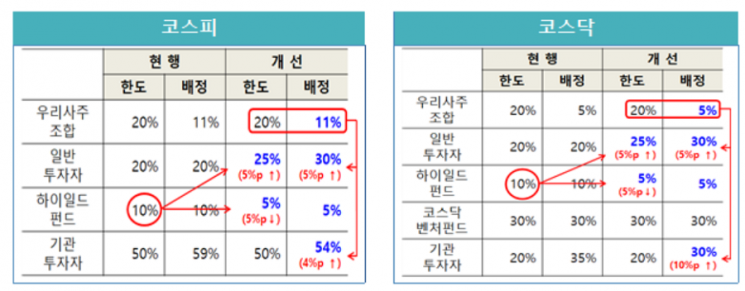

According to the improvement plan, the allocation of shares left unclaimed by employee stock ownership associations will be assigned to individual subscribers up to a maximum of 5%, and the allocation for high-yield funds will be reduced from 10% to 5%, with the reduced 5% reallocated to individuals, increasing the total individual allocation to a maximum of 30%. Previously, employee stock ownership associations were given priority allocations within 20% for both the KOSPI and KOSDAQ markets, but frequent under-subscription by these associations resulted in the leftover shares being allocated to institutional investors.

The priority allocation for high-yield funds, originally set at 10%, will be cut to 5%, and the reduced 5% will be additionally allocated to individual subscribers. The priority allocation system for high-yield funds, which hold more than 45% of bonds rated BBB+ or below and KONEX-listed stocks, and more than 60% domestic bonds, was initially scheduled to expire at the end of this year. However, starting January next year, the allocation will be reduced to 5% and maintained for three years until 2023, with the reduced shares allocated to individuals.

An equal distribution method for individual subscription shares has also been introduced. More than half of the shares will be allocated equally, while the remainder will be allocated proportionally based on subscription deposits as is currently done. The equal distribution method (including unified, separate, and multiple subscription methods) provides all subscribers who have paid at least the minimum subscription deposit with an equal chance of allocation.

Opportunities Increase but Losses May Grow Depending on Market Conditions

Individual investors generally welcome the expansion of IPO participation opportunities. Jeong Eui-jeong, head of the Korea Stock Investors Association, said, "Expanding IPO allocations to individual investors, who account for more than two-thirds of trading volume in our stock market, is a welcome move from an equity perspective. However, since there are risks associated with increased investment, financial authorities need to thoroughly supervise the IPO market to prevent individuals from rushing in and suffering losses."

However, concerns have also been raised in the market. Since the IPO frenzy that prompted this improvement cannot last indefinitely, if market enthusiasm cools, individual investors could face losses, and market volatility could increase.

So far this year, 57 companies have been listed on the domestic stock market (8 on KOSPI, 49 on KOSDAQ, excluding SPACs). Among them, 14 companies (2 on KOSPI, 12 on KOSDAQ), or about 25%, are trading below their IPO price as of the previous day's closing price. Despite the recent hot market atmosphere with KOSPI reaching record highs and heightened interest in IPOs compared to previous years, one out of every four newly listed companies has incurred losses. This explains why there are concerns that changes in market conditions could cause a backlash. Professor Song Gyo-jik of Sungkyunkwan University's Business Administration Department said, "If the allocation to general subscribers is expanded because of this year's hot market, it could lead to losses for individual investors later. Who will take responsibility if individuals lose money after securing general allocation shares?"

If the allocation to individual investors increases and the institutional share decreases, competition could intensify, making it difficult to determine an appropriate IPO price. If an unreasonable IPO price causes unsubscribed shares among individuals, the securities company that signed the underwriting contract must purchase all remaining shares, resulting in losses and negatively impacting the market. This could again lead to losses for existing subscribers.

A securities industry official said, "There are doubts about whether interest similar to that for SK Biopharm or Big Hit will continue for IPO subscriptions of promising but lesser-known companies and whether the policy will function effectively. Since this is fundamentally a policy for the general public, there may be limitations such as under-subscription for companies lacking broad appeal."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.