Debt-to-GDP Ratio Expected to Reach 365% by Year-End

Emerging Markets Also on Alert: "Next Year's Government Focus Shifts from Pandemic to Debt Management"

Calls for Stimulus Persist... "Essential for Household and Corporate Recovery"

[Asia Economy Reporter Jeong Hyunjin] Due to the COVID-19 pandemic, the global debt incurred this year has exceeded 1,600 trillion Korean won. Considering that South Korea's gross domestic product (GDP) last year surpassed 1,800 trillion won, this means that nearly ten times that amount has been added as debt that will have to be repaid someday.

However, as COVID-19 outbreaks continue in various places, calls for additional economic stimulus measures remain strong. Concerns are also rising that the debt could hamper future economic activities, leading to criticism that we may be caught in a stimulus "dilemma."

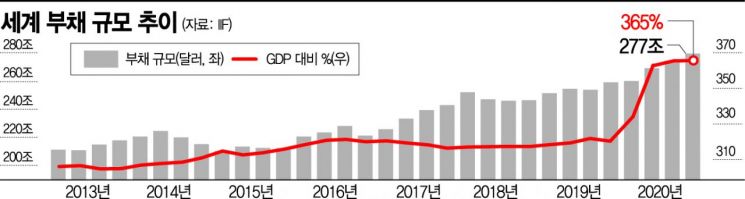

On the 18th (local time), the Institute of International Finance (IIF) reported that global debt (including private and government debt) increased by $15 trillion (approximately 1,659.7 trillion won) between January and September this year. As a result, the cumulative debt exceeded $272 trillion by the end of the third quarter, marking an all-time high. If the current trend continues, the debt size is expected to reach $277 trillion by the end of this year and exceed $360 trillion by 2030.

The debt-to-GDP ratio also rose sharply. The economic impact of the first wave of COVID-19 was concentrated in the second quarter, causing this ratio, which was 320% at the end of last year, to rise to 362% by the end of the second quarter this year, with an additional 2 percentage points increase in the third quarter. It is expected to reach 365% by the end of the year. In particular, the debt-to-GDP ratio in advanced countries rose by more than 50 percentage points over three quarters, reaching 432%. Half of this increase occurred in the United States, where total debt reached $80 trillion.

Emerging markets also saw their debt-to-GDP ratio rise from 222% at the end of last year to 248% in the third quarter of this year, centered on China. The IIF evaluated that although low interest rates have reduced government debt interest burdens, emerging markets will face pressure due to significantly reduced tax revenues. Unlike advanced countries, emerging markets do not have large reserves of funds, making it difficult to sustain financially as the COVID-19 pandemic prolongs. Zambia in Africa has already fallen into its first sovereign default since COVID-19, and several emerging countries such as Turkey and Argentina are experiencing financial difficulties.

Credit rating agency Moody's also expressed concerns about the creditworthiness of emerging countries, forecasting that their government debt levels will increase by an average of 12 percentage points compared to last year. Moody's stated, "The government's focus is expected to gradually shift from pandemic management to debt management," adding, "Next year, the focus will be on stabilizing fiscal deficits and debt levels," expressing concern over the rising debt in emerging markets.

The tsunami of mounting debt is becoming more serious amid the resurgence of COVID-19. If additional stimulus measures are implemented, the scale of this tsunami will grow, inevitably increasing the likelihood of hampering future economic activities. Employment and investment are expected to decline, productivity will be impacted, and financial markets may also be shaken. The IIF assessed, "There is uncertainty about how the global economy can deleverage (reduce debt) in the future without significant adverse effects on economic activities."

Despite the debt pressure, calls for additional stimulus measures remain. Although there is great hope that a COVID-19 vaccine will be developed soon, it will still take a long time for production, distribution, and economic recovery to follow.

The U.S. Treasury Department's Office of Financial Research (OFR) emphasized the need for stimulus measures in its annual report submitted to Congress on the same day, stating, "Without additional stimulus, recovery for many households and businesses will be impossible." The OFR also mentioned that "uncertainty will seriously burden economic activities," and credit risk remains one of the major concerns. The New York Times (NYT) reported, "The report was released amid congressional disputes over stimulus plans." The administration urged a resolution as Republicans and Democrats have been unable to agree on additional stimulus measures despite months of discussions.

Jamie Dimon, CEO of JP Morgan, strongly criticized the failure to reach a stimulus agreement at a conference on the same day, calling it "childish behavior by politicians." He appealed, "Additional stimulus is necessary for us to overcome COVID-19."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)