[Asia Economy Reporter Koh Hyung-kwang] Recently, the price of gold has been on a downward trend. Gold, which had attracted attention as a safe-haven asset and soared to an all-time high last August, has been weakening this month amid growing expectations for the development of a COVID-19 vaccine. It is observed that investing in gold driven by safe-haven preference remains valid until COVID-19 risks are fully resolved, and that gold prices are likely to rebound due to falling real interest rates and a weakening dollar.

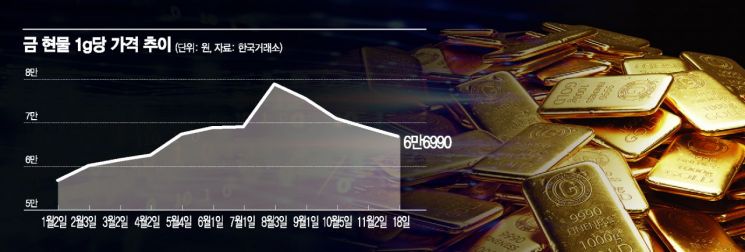

According to the financial investment industry on the 19th, the price per gram of 1kg gold spot in the Korea Exchange (KRX) gold market closed at 66,990 won the previous day, dropping to the 66,000 won range for the first time in about five months since June 11 (66,690 won). Gold prices have fallen 4.9% over the past ten days. In particular, on the 10th, the price dropped 3.52% in a single day, marking the largest decline since August 12, when gold prices fell 6.01%. The price per gram of gold spot has fallen 16.3% since reaching an all-time high of 80,100 won on July 28. Currently, the gold spot price is at its lowest level in about five months since mid-June.

This trend is also confirmed in international gold prices. The COMEX gold futures price recorded an all-time high of $2,051.5 per ounce on August 6 and has been declining since. It fell below the $1,900 level in late last month, then plunged 4.97% on the 9th of this month (local time), and dropped another 0.58% on the 18th, closing at $1,873.5.

Experts analyze that the downward trend continues as uncertainties related to the U.S. presidential election have disappeared and news of COVID-19 vaccine development has emerged. This is interpreted as investment funds flowing out of gold, which had been spotlighted as a safe-haven asset this year, due to a significant expansion of risk appetite.

In the KRX gold spot market, the price per gram of gold, which was 56,540 won at the end of last year, rose about 42% to an all-time high by the end of July. This was also a period of high stock market volatility due to the spread of COVID-19. Although signs of a second pandemic appeared from late August, gold prices remained in a relatively high range and rarely fell.

The mood changed when COVID-19 vaccine development came into sight. On the 9th, Pfizer, an American pharmaceutical company, announced progress in vaccine development, causing stock markets worldwide to surge on vaccine expectations. Furthermore, on the 11th, another U.S. pharmaceutical company, Moderna, released interim results of its vaccine research, strengthening risk asset investment sentiment. The appeal of safe-haven gold relatively declined.

However, experts predict that further declines in gold prices will be limited. They argue that investing in gold driven by safe-haven preference remains valid until COVID-19 risks are fully resolved. They also expect the recent weakening of the dollar to limit the decline in gold prices. Since gold prices move inversely to the U.S. dollar, the dollar is likely to remain weak. Jeon Gyu-yeon, a researcher at Hana Financial Investment, explained, "The U.S. dollar is expected to maintain a weak trend next year based on abundant liquidity from monetary and fiscal policies. The dollar and gold prices usually have an inverse correlation, so the recent decline in the dollar's value can increase gold's relative value."

There is also a view that gold prices will rise in the mid to long term, based on the expectation that the dollar's weak environment will continue. U.S. President-elect Joe Biden and the Democratic Party plan to push for a large-scale economic stimulus package worth $2 to $3 trillion, which is expected to increase the supply of dollars in the market and lower the dollar's value. Since gold is traded in dollars, its price will rise accordingly. Gold is used as an inflation hedge against the decline in the dollar's value. Kim Young-ik, an adjunct professor at Sogang University Graduate School of Economics, said, "As the dollar continues to decline, gold prices are bound to rise. Moreover, with major central banks around the world pumping enormous amounts of money, inflation could eventually follow, and gold prices, as an inflation hedge, are likely to keep rising."

However, the consensus is that it is difficult to expect a gold price surge like that in July and August. Although the upward trend will continue, the effect of stimulus policies is expected to be weaker than before. Experts also see little chance of a sharp drop in the dollar's value due to the euro's weakness caused by the resurgence of COVID-19. Kim So-hyun, a researcher at Daishin Securities, said, "As international gold prices rise, domestic gold prices will follow to some extent, but a rapid increase is hard to expect."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.