E-commerce, Large Supermarkets, and Home Shopping All Impacted

Up to 1 Million KRW Price Difference for Large QLED TVs When Purchased Directly

After-Sales Service and Delivery Issues of Direct Purchase Expected to Improve

Manufacturers Unavoidably Affected by Global Pricing Policies

[Asia Economy Reporter Cha Min-young] A 'ultra-low price war' is anticipated in the distribution sector through the collaboration between 11st and Amazon, the global number one e-commerce platform. There is a growing view that price reduction policies and differentiated services are necessary to capture smart consumers who browse dozens of internet pages and check direct purchase sites to find products even one won cheaper. Domestic manufacturers are also expected to face increasing concerns over sales policies for products with different domestic and overseas prices.

Beyond e-commerce, supermarkets and home shopping also on alert

According to industry sources on the 17th, the strategic partnership between 11st and Amazon is expected to impact the domestic distribution sector comprehensively, including e-commerce, home shopping, and large supermarkets. Platforms dedicated to overseas direct purchase such as 'Malltail' and eBay Korea's 'G9', as well as open markets and home shopping channels that have introduced direct purchase products through parallel imports, are also inevitably affected.

The competitiveness of overseas direct purchase clearly comes from 'price.' The range of products is diverse, from health supplements and clothing to food ingredients and daily consumables. Especially for electronics such as TVs, unlocked smartphones, and laptops, purchases are possible at prices discounted by 30-50% or more, making them popular despite after-sales service (AS) issues and differences in parts. Popular domestic brand products like those from LG Electronics and Samsung Electronics sometimes show price differences up to twice as much. Direct purchase platforms compete fiercely by spending marketing costs during special sale seasons like Black Friday in November to increase transaction volume through additional discounts, aiming to dominate the market.

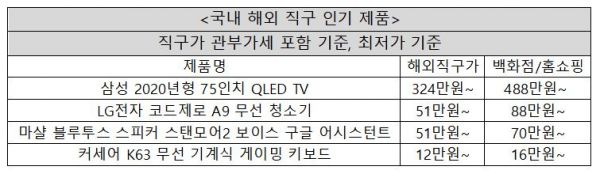

For expensive electronics including large TVs, overseas direct purchase can save more than 1 million won. For example, searching for 'Samsung 2020 75-inch QLED TV' on Naver Shopping shows it available for around 3.24 million won on the Singapore site Q10. In contrast, prices found in domestic department stores and home shopping channels hover around 4.88 million won, a difference of about 1.6 million won. LG Electronics' 'Code Zero A9 cordless vacuum cleaner' also shows a price gap of 370,000 won between domestic and overseas markets. Therefore, if Amazon sells TVs and home appliances available in the U.S. market domestically, the price difference becomes meaningless.

The distribution sector is paying close attention to the partnership between 11st and Amazon not only for the price reduction effect but also for the potential qualitative improvement in service. Overseas direct purchase has been criticized for high overseas shipping fees, long delivery times, and difficulties in after-sales service despite low product prices. For example, there is a risk of damage when shipping high-priced products like TVs and laptops. Considering that the domestic TV panel warranty period is typically two years, this remains a drawback. Amazon also sometimes requires a certain deposit under the name of a security deposit as a precaution against issues during customs clearance.

Home shopping channels are also expected to be affected since they have been offering differentiated services to enhance competitiveness through parallel imported products and direct import channels. For instance, K Shopping operated by KTH recently introduced an 'Australia direct purchase channel' through a strategic partnership with the Australian government during its MCN service improvement process. The aim is to offer health functional foods more easily and affordably.

Domestic and overseas price gaps becoming transparent... manufacturers also concerned

This could also impact the domestic manufacturing ecosystem. For TV products, the target customers differ between the U.S. and Korea, resulting in distinctly different price ranges. On Amazon, TVs under 20 to 40 inches dominate. OLED TVs, which are common domestically, are considered relatively premium versions. The refurbished product market is also active, leading to vigorous secondhand trading and less demand for high-priced TVs.

If inexpensive Samsung TVs made in Mexico enter the market, price differences with domestically produced and sold TVs are inevitable. This is because domestic and overseas labor costs and local prices are fully reflected in costs. The price of finished products varies greatly depending on components such as display panels. There are frequent misunderstandings that domestic consumers are being taken advantage of due to lower overseas prices. Therefore, changes in pricing policies by country may become unavoidable.

A representative from an overseas direct purchase specialized platform said, "In the TV market, only about 5% of domestic consumers currently use overseas direct purchase. Although the overseas direct purchase market is rapidly growing, it is still small compared to the overall domestic consumer market. However, as the saying goes, 'No one tries overseas direct purchase just once,' if partnerships become easier through 11st, growth potential is expected to increase further."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.