FedChamber Summarizes Key Courier Industry Issues as '3P (People, Place, Price)'

"Regulatory Easing on Foreign Employment and Swift Logistics Facility Expansion Needed"

Calls for Courier Fee Realignment

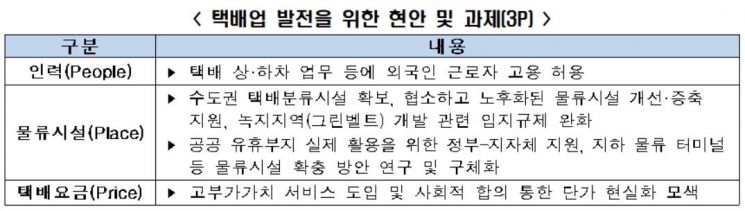

[Asia Economy Reporter Kim Hyewon] There has been a claim that support is needed to foster the courier industry in South Korea by flexibilizing the employment of foreign workers and expanding logistics facilities. On the 16th, the Federation of Korean Industries (FKI) announced policy tasks for the development of the courier industry and summarized the major issues in the courier industry as '3P (People, Place, Price).' The 3P refers to 'Personnel (People)', 'Logistics Facilities (Place)', and 'Courier Fees (Price)'.

Personnel (People) = Permission and expansion of foreign worker employment for courier loading and unloading tasks

Courier services collect cargo during the day and perform direct loading and unloading work at logistics terminals overnight to deliver the next day. The loading and unloading work at logistics terminals is known as a representative task avoided by domestic workers due to its labor intensity and working hours (evening to next morning), causing a serious labor shortage.

Due to limits in workforce replenishment and frequent absences, the workload of workers responsible for loading and unloading inevitably increases, causing delays in delivery work and deterioration of courier service quality such as product spoilage. Therefore, it is necessary to add 'courier industry' to the service sectors eligible for foreign worker employment under the employment permit system to secure night shift workers at logistics terminals.

The government regulates the industries allowed to employ foreign workers through the employment permit system. Details such as industries and number of foreign workers allowed are reviewed and decided annually by the 'Foreign Workforce Policy Committee' chaired by the Prime Minister's Office since 2004.

Currently, foreign workers can be employed in small and medium manufacturing industries (with fewer than 300 regular workers or capital of 8 billion KRW or less), construction, etc., but in the 'service industry' including the courier industry, there are differences by detailed sectors. Also, among the total approved foreign worker quota of 56,000, only 100 are for the service industry, and the maximum allowed per workplace is 10.

In December last year, the 27th Foreign Workforce Policy Committee reviewed whether to permit foreign worker employment for courier loading and unloading tasks, but it was reportedly canceled due to disagreements among ministries. An FKI official pointed out, "With the prolonged COVID-19 pandemic and the expansion of non-face-to-face consumption, courier demand has rapidly increased. It is necessary to reconsider the chronic labor supply issues in the courier industry at the Foreign Workforce Policy Committee meeting scheduled for the end of this year."

Logistics Facilities (Place) = Relaxation of location regulations to expand courier sorting facilities

There was also a call to support the rapid expansion of courier sorting facilities. To collect and deliver cargo within urban areas, securing courier sorting facilities by region is necessary, but in the Seoul metropolitan area where courier volume is concentrated, there are limitations in locating facilities close to the city center. Courier sorting facilities require large sites where many large freight vehicles can smoothly enter and exit, and where large-scale logistics facilities and equipment can be installed. Therefore, site selection is difficult, and costs such as land and construction are high, compounded by complaints from nearby residents.

This year, the Ministry of Land, Infrastructure and Transport announced a plan to support site acquisition by preparing courier sorting infrastructure on idle land within urban railway vehicle depots and leasing it to courier companies. However, according to the courier industry, the sites supplied are limited compared to demand, and some sites have low practical utilization, requiring more detailed review. Also, cooperation from local governments is needed, such as revising ordinances of the competent authorities to align with the government's idle land utilization plan, and ultimately, regulatory relaxation such as the Building Act is necessary to allow site acquisition within greenbelt areas.

An FKI official stated, "We need to support smooth expansion and redevelopment of existing small-scale logistics facilities to improve working conditions for courier workers, and explore and specify various ways to expand logistics facilities such as developing underground courier terminals."

Courier Fees (Price) = Introduction of differentiated services and seeking courier fee rationalization

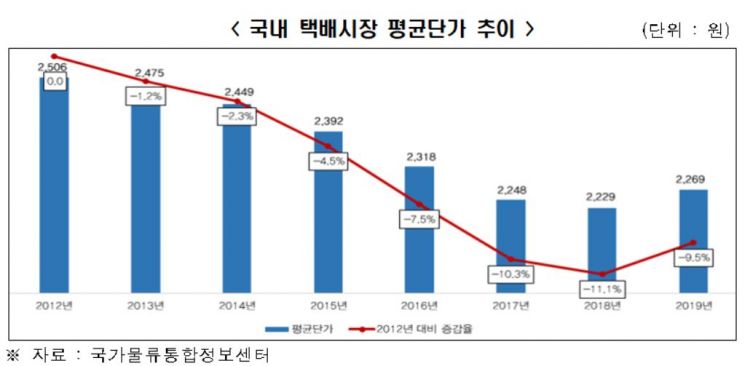

While courier volume is rapidly increasing, courier unit prices are declining, making the possibility of courier fee rationalization a major issue.

According to the National Logistics Integrated Information Center, total courier volume last year was 2.79 billion parcels, a 9.7% increase from 2.543 billion parcels in 2018. Year-on-year volume has increased by about 10% annually since 2015.

Despite the growth of the courier market, the average courier unit price has been continuously declining. The average unit price peaked at 4,732 KRW per box in 1997 and fell to 2,229 KRW in 2018. Last year, it slightly rebounded to 2,269 KRW, but it is expected to continue declining this year.

The decline in average courier unit price lowers courier companies' profit margins and forces courier drivers to deliver more parcels than before to maintain their income.

Courier companies must expand investment in facilities and equipment to respond to market changes such as surging volume and improve service quality, and continuously invest in improving working conditions and safety facilities. Considering the need to improve courier drivers' treatment, raising courier fees seems inevitable, but it is difficult due to fierce industry competition and there is a risk of being mistaken for price collusion.

It is pointed out that social consensus and opinion gathering on courier fee rationalization are necessary alongside seeking fee increases and enhancing consumer welfare through differentiated courier services.

Yoo Hwan-ik, Director of Corporate Policy at FKI, said, "We must timely support the necessary workforce and logistics facility expansion in the courier industry to resolve the industry's difficulties and create a virtuous cycle structure that leads to improved industrial competitiveness and better working conditions."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Hostess to Organ Seller to High Society... The Grotesque Scam of a "Human Counterfeit" Shaking the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)