'BTS' BigHit Surpassed by Heungsaeng, Stirring Excitement and Entering Stock Market

Unrivaled No.1 in Domestic Chicken Market... Successful Entry into Ready Meals Expected

Haemaro Food Aiming for Both Cost-Effectiveness and Premium Quality

On the morning of the 12th, a ceremony commemorating the new listing on the KOSPI market of the chicken franchise company Kyochon F&B Co., Ltd. was held at the Korea Exchange in Yeouido, Seoul.

On the morning of the 12th, a ceremony commemorating the new listing on the KOSPI market of the chicken franchise company Kyochon F&B Co., Ltd. was held at the Korea Exchange in Yeouido, Seoul.From the left: Seongbeom Kang, Executive Director of Mirae Asset Daewoo; Unggi Jo, Vice Chairman of Mirae Asset Daewoo; Jinse Soh, Chairman of Kyochon F&B Co., Ltd.; Jaejun Lim, Head of the KOSPI Market Division at the Korea Exchange; Haksoo Hwang, CEO of Kyochon F&B Co., Ltd.; Seongchae Ra, Deputy Head of the KOSPI Market Division at the Korea Exchange.

Photo by Yonhap News

[Asia Economy Reporter Minwoo Lee] Kyochon F&B, led by 'Kyochon Chicken,' is receiving significant attention as it goes public. There are expectations of a 'chicken battle' with Haemaro Food Service, which has already entered the stock market with 'Mom's Touch.'

According to the financial investment industry on the 14th, Kyochon F&B, which was listed on the KOSPI market on the 12th, opened at 23,850 KRW, 93.9% higher than the public offering price of 12,300 KRW. It then closed at the upper limit price of 31,000 KRW. Although it was not a 'ttasang' (opening at double the public offering price followed by hitting the upper limit), the return rate compared to the public offering price reached 152%. This contrasts with Big Hit Entertainment, which started with a 'ttasang' on its first day of listing but soon lost upward momentum as the upper limit was lifted.

"Kyochon Chicken, a Strong Player with 30 Years of Tradition... Already on the Shortcut to 'Tenbagger' Returns"

It is interpreted that the competitiveness, which recorded the number one market share in a stable market that is not easily shaken even during a recession, was highly evaluated. Samsung Securities analyzed that Kyochon F&B is a franchise chicken company with 30 years of tradition, holding the number one position in sales within the market. The main business model is product supply sales. They sell raw materials such as chicken and sauce (64%) and auxiliary materials like chicken radish (29%) to franchise stores nationwide.

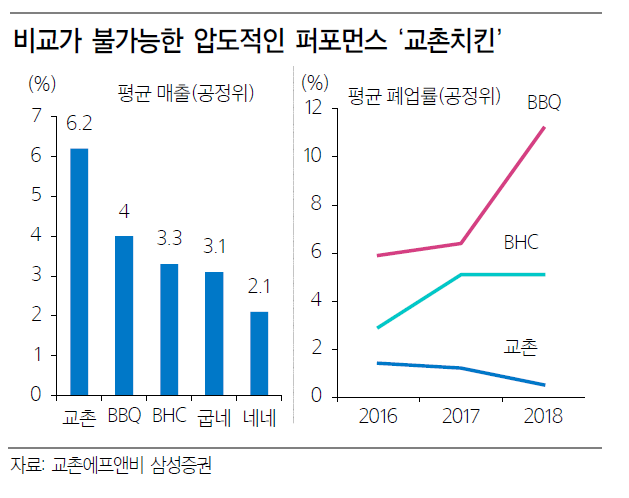

It is evaluated that the company has overwhelming competitiveness in both the scale of franchise store openings and store sustainability, which are key investment indicators for franchise companies. As of August this year, it has opened 1,234 domestic and 36 overseas franchise stores. The average sales per store are about 620 million KRW annually, which is twice the industry average. Accordingly, the store closure rate has also remained at the lowest level. According to the Fair Trade Commission, Kyochon Chicken's closure rate is 0.5%, overwhelmingly lower compared to competitors BBQ at 11.2% and BHC at 5.1%.

Recent new businesses such as expanding overseas entry and entering the ready-to-eat meal market are also attracting attention. Currently, they operate 37 overseas stores in six countries including the United States, China, and Malaysia. Shifting from a conservative approach, they announced plans to newly enter 537 stores across 25 countries including the Middle East, Taiwan, and Australia. Hyukjin Lee, Senior Researcher at Samsung Securities, analyzed, "The likelihood of success for this strategy is quite high," adding, "Chicken is relatively free from religious issues, delivery business is easy, and they also have a mobile ordering platform that can be used anywhere."

He emphasized that attention should also be paid to the ready-to-eat meal (HMR) market entry and sauce sales (B2B) business. Currently, the utilization rate of chicken in the ready-to-eat meal market is about 33%, and initial products such as Samgyetang, Dakgalbi, and fried rice are already popular in major open markets, making it a favorable market for Kyochon F&B, which has strengths in chicken cooking methods. The researcher stated, "Ready-to-eat meals will also contribute to increasing the turnover rate of unpopular parts such as chicken breast," and diagnosed, "This trend closely follows the success story of China's 'Yihai,' which recorded a tenfold return over the past four years."

Haemaro Food Service Aiming for Both Cost-effectiveness and Premium

Haemaro Food Service operates franchise businesses and food material distribution under the brands 'Mom's Touch' (chicken, hamburgers) and 'Boombata' (pizza, sandwiches). As of the second quarter of last year, the sales ratio was 88.6% from franchises and 11.1% from food material distribution.

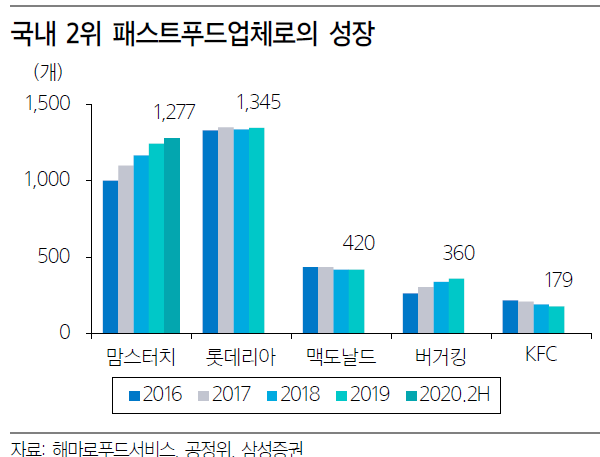

Jongmin Kim, Senior Researcher at Samsung Securities, evaluated that the secret to the success of Haemaro Food Service's 'Mom's Touch' was an excellent price-performance superiority strategy. Mom's Touch started in the Gangbuk area of Seoul right after the foreign exchange crisis. At the same time, 'Craze,' a premium handmade burger specialty store, opened in the Gangnam area of Seoul. Mom's Touch steadily grew from 2004 and broke the four major chains of Lotteria, McDonald's, Burger King, and KFC to become the second-largest in terms of store count (about 1,300 stores). In contrast, Craze faced severe management difficulties to the point that its trademark was sold. The strategy of securing 'taste' by cooking after ordering and targeting university areas and alley markets with a 'cost-effectiveness' strategy was the result.

Franchise owners also favor it for low investment costs and high profitability. Since franchises are only permitted in areas near subway stations or spacious locations, the initial opening cost is lower compared to other companies (140 million KRW for 81 square meters). Nevertheless, profitability is at the industry's highest level, with over 17 million KRW per 3.3 square meters.

Recently, they have also targeted the premium burger market. On the 10th, they launched a premium new product, 'Real Beef Burger,' priced at 7,500 KRW for a single item and 9,500 KRW for a set. This differs from the existing 'cost-effectiveness' image, and concerns have arisen due to the failure of competitors' premium burger strategies. However, it is analyzed that this is not a significant problem for Haemaro Food Service. Jongmin Kim explained, "The biggest failure of competitors was losing their strength in fast cooking times," adding, "Mom's Touch originally prepares handmade burgers after ordering and has an image of healthy ready meals, so consumers are tolerant of cooking time, making the possibility of success high."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.