LG Group Holding Company LG Corp Forecasts Record High Operating Profit This Year

Balanced Growth Across Affiliates Highlights Chairman Koo Kwang-mo's 2nd Anniversary Management Achievements

[Asia Economy Reporter Changhwan Lee] LG Group's holding company, LG Corp., is expected to post record-high profits this year. This is thanks to the noticeably improved performance of key affiliates such as LG Electronics, LG Chem, and LG Household & Health Care. Analysts also say that the focused strategy chosen by LG Group Chairman Koo Kwang-mo, two years after his inauguration, is proving highly effective.

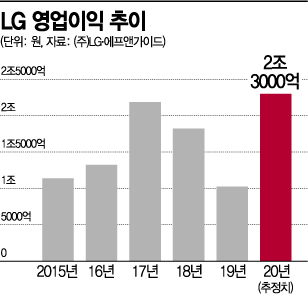

According to financial information firm FnGuide on the 13th, LG is projected to achieve an operating profit of 2.3 trillion KRW this year. This surpasses the operating profit of 2.186 trillion KRW in 2017, marking the highest performance ever. It is more than a 124% increase compared to last year's operating profit of 1.024 trillion KRW.

The heightened expectations for LG's performance this year stem from the effectiveness of Chairman Koo's management strategy, who marked his 2nd anniversary in office. Since his inauguration at the end of June 2018, Chairman Koo has managed LG Group with an emphasis on pragmatism, digital innovation, and focused selection.

The key factor driving improved results is the restructuring of affiliates through a focused strategy that decisively grows businesses with potential and boldly trims those without. Accordingly, LG Chem is concentrating more on its secondary battery business, while LG Electronics is streamlining some underperforming sectors and focusing on home appliances, OLED TVs, and automotive electronics.

Key Affiliates LG Electronics, LG Chem, and LG Household & Health Care Achieve Record-Breaking Results

Major affiliates are posting record-high performances. LG Electronics recorded an operating profit of 959 billion KRW in the third quarter, the highest quarterly profit ever. The improvement is driven by growth in the Home Appliance & Air Solution (H&A) division.

Strong sales of core products such as washing machines and refrigerators, along with high sales of new appliances like stylers, dryers, and dishwashers, led to the record performance. TV sales also improved, with premium large-sized OLED TVs selling well.

LG Display, a subsidiary of LG Electronics, also contributed by returning to profitability in the third quarter. LG Display posted an operating profit of 164.4 billion KRW in Q3, marking a turnaround after seven quarters of losses. The main drivers were the start of mass production at the new OLED factory in Guangzhou, China, and improved supply conditions for large LCD panels, which reduced the deficit.

LG Chem also posted a record operating profit of 902.1 billion KRW in the third quarter. The petrochemical division saw a recovery in demand for key petroleum products, achieving an operating profit of 721.5 billion KRW and an operating margin of 20.1%, the highest quarterly figures ever.

The new battery business also recorded a record operating profit of 168.8 billion KRW, driven by expanded supply of automotive and small batteries. Sales reached a record high of 3.1439 trillion KRW.

LG Household & Health Care continued its strong performance. The company posted third-quarter sales of 2.0706 trillion KRW and an operating profit of 327.6 billion KRW, up 5.4% and 5.1% year-on-year, respectively. Sales have increased for 59 consecutive quarters since Q3 2005, and operating profit has grown for 62 consecutive quarters since Q1 2005.

Despite the spread of COVID-19, improved performance in the core Beauty and Household & Daily Care (HDB) businesses helped the company achieve record cumulative sales and operating profits this year.

With affiliates continuing strong performances, LG Corp., the holding company, recorded sales of 1.956 trillion KRW and operating profit of 767.1 billion KRW in the third quarter. Sales increased 17% and operating profit surged 116% year-on-year, a surprising result.

Industry insiders expect Chairman Koo to pursue more aggressive group restructuring in the future. Last month’s decision by LG Chem to spin off its battery business as a separate entity to maximize operational efficiency is interpreted as part of this management strategy.

A business community official said, "Since Chairman Koo's inauguration, LG Group has shown success in improving its corporate structure. Being relatively young among business leaders, he is likely to pursue more aggressive management going forward."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.