First Surge Above $15,000 Since January 2018

Pro-Cryptocurrency Figures Included in Biden's Economic Team

Expectations for Institutional Adoption Rise... "Value Increase, Not Price Increase"

[Asia Economy Reporter Minwoo Lee] The price of Bitcoin, a representative virtual currency, has surpassed $15,500 (approximately 17.23 million KRW) for the first time in three years. This marks a recovery to levels approaching the 'coin frenzy' period from 2017 to early 2018. Unlike back then, institutional sectors and various companies are increasingly adopting virtual currencies, leading analysts to suggest that this is accompanied not just by a price increase but also by a rise in value.

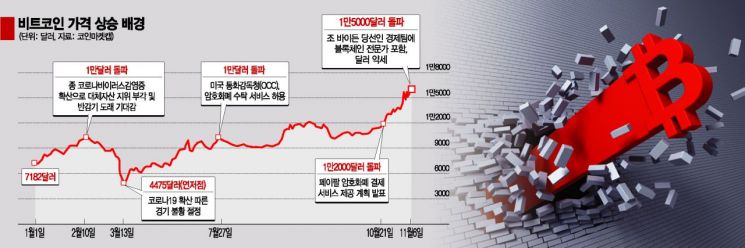

According to CoinMarketCap, which tracks global virtual currency markets, as of 9:46 AM on the 12th, Bitcoin was priced at $15,589. This is the highest since January 9, 2018. It has surged more than threefold from the year's low of $4,475 on March 13. After plummeting just before breaking the $20,000 mark at the end of 2017, Bitcoin is now experiencing a steep upward trend for the first time in a while.

Bitcoin briefly surpassed $10,000 in February as well, but that was a reflexive gain due to its status as an alternative asset amid the spread of the novel coronavirus (COVID-19). During the peak of the COVID-19 pandemic in March, Bitcoin’s price collapsed again to the $4,000 range, reflecting this context.

The full-fledged price rally began in late July. The U.S. Office of the Comptroller of the Currency (OCC) allowed major banks such as Bank of America, Citibank, and Goldman Sachs to provide custody services for virtual assets like Bitcoin, which acted as a positive catalyst. This decision enabled U.S. banks to custody virtual assets similarly to financial assets like stocks and bonds or tangible assets like real estate. It laid the groundwork for entry into the institutional sector. This was seen as a significant advancement compared to the past when institutions like the Federal Reserve (Fed) were extremely cautious due to concerns about money laundering. Additionally, Amazon’s video streaming platform Twitch resuming Bitcoin payments also influenced the price increase.

Last month, PayPal’s announcement of plans to introduce virtual currencies became an even bigger catalyst. PayPal revealed it would add virtual currency trading functions and support payments with four types of virtual currencies?Bitcoin, Ethereum, Bitcoin Cash, and Litecoin?at all online merchants by early next year. With 350 million users and 26 million merchants worldwide, PayPal’s move to enable practical use of virtual currencies in daily life raised expectations that major corporations were recognizing the legitimacy of virtual currencies. Bitcoin’s price, which had struggled to surpass $12,000, quickly rose to the $13,000 range.

Joe Biden’s victory as the Democratic candidate in the U.S. presidential election also served as a positive factor. News that Biden’s economic team includes individuals favorable to virtual currencies heightened expectations for institutional acceptance. According to the virtual currency specialized foreign media CoinDesk, Biden’s economic team includes many pro-virtual currency figures, such as former Commodity Futures Trading Commission (CFTC) Chairman Gary Gensler. Gensler recently testified before the U.S. Congress that Facebook’s virtual currency project 'Libra' met legitimate security requirements. Simon Johnson, a professor at the MIT Sloan School of Management, has consistently researched the impact of blockchain technology?the foundation of virtual currencies?on the financial industry. Other members include Mehsa Baradaran, a professor at the University of California, Irvine, who advocated for blockchain and virtual currency regulatory frameworks at U.S. Senate Financial Committee hearings, and Lev Menand, a Columbia University professor who originated the concept of the 'digital dollar.' This is why expectations are growing, unlike in 2017 when institutional entry ultimately failed.

In this atmosphere, the financial industry, which previously held negative views on virtual currencies, is also shifting its stance. JP Morgan, the largest investment bank in the U.S., is a prime example. Jamie Dimon, JP Morgan’s CEO, strongly criticized Bitcoin in September 2017, calling it a "fraud" and saying it would "eventually collapse." However, since May, JP Morgan has started providing banking services to major U.S. virtual currency exchanges Coinbase and Gemini. Last month, JP Morgan also released a report stating that as corporate adoption of Bitcoin increases, the gap with gold could rapidly narrow, indicating ample long-term growth potential.

A blockchain industry insider explained, "In the past, many investments were aimed solely at speculative gains without practical services or institutional acceptance, but this time it’s different. Unlike before, virtual currencies are being accepted institutionally, various services are emerging, and more investors are investing with the belief in the value of practical use in daily life."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.