'Focus on Nuclear Phase-Out' Differs from Korean Government

US Actively Supports SMR Projects

Though Policy Goals Align,

No Guarantee of Expanded US Market Entry for Companies

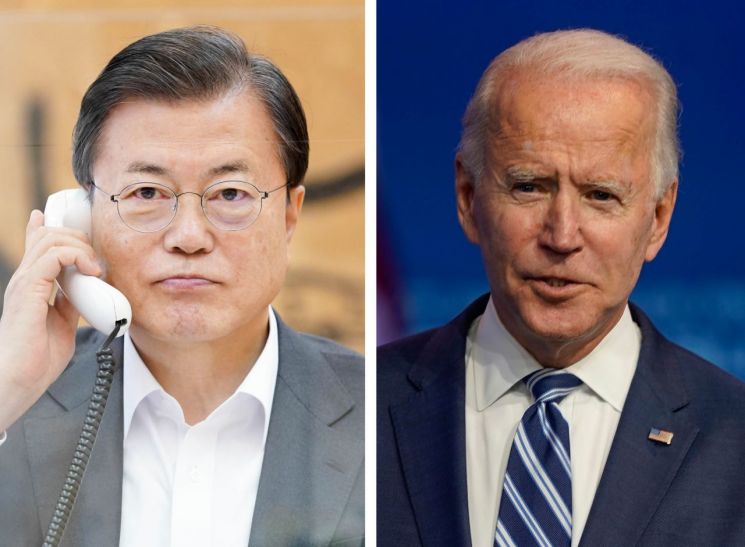

[Asia Economy Reporter Moon Chaeseok] Although the ruling party is promoting the Green New Deal following the election of U.S. President Joe Biden, there are criticisms that while the U.S. clean energy policy shares similar rhetoric, the details differ. Both share the goal of "carbon neutrality," but the U.S. has selected advanced nuclear power as one of its clean energy technologies, which contrasts with South Korea’s accelerated phase-out of nuclear power.

According to the energy industry on the 12th, President-elect Biden listed "climate change" as one of the four major national policy agendas on the transition committee’s website, highlighting advanced nuclear power as a clean energy technology. He emphasized accelerating cost reductions, commercializing the technology, and producing it "within the United States."

The advanced nuclear technology proposed by the U.S. is understood to refer to Small Modular Reactors (SMRs). Biden stated, "SMRs, which have construction costs at about half the level of traditional reactors, will contribute to achieving 100% clean energy goals." In South Korea, companies like Doosan Heavy Industries are exploring entry into the SMR business, but unlike the U.S., there is no government-level support. Research and development (R&D) is mainly conducted by national research institutes such as the Korea Atomic Energy Research Institute.

Although the national policy philosophies appear similar, they differ. The "9th Basic Plan for Electricity Supply and Demand," expected to be announced this year by the Ministry of Trade, Industry and Energy, is likely to maintain the Moon Jae-in administration’s philosophy of "reducing nuclear power." The draft released in May stated plans to reduce the number of nuclear reactors from 25 units (24.7 GW capacity) this year to 17 units (19.4 GW) by 2034.

In the six months following the draft announcement, a nuclear decommissioning cluster was established in Ulsan, and Korea Hydro & Nuclear Power announced last month that it plans to hold a public hearing this month on the draft final decommissioning plan for Kori Unit 1.

Even though the policy goals are similar, there is no guarantee that domestic Green New Deal-related companies will expand their entry into the U.S. market. The U.S. requires foreign companies to build production facilities domestically to contribute to local employment.

Professor Jeong Dong-wook of the Department of Energy Systems Engineering at Chung-Ang University said, "It will not be easy for small and medium-sized domestic solar companies, except Hanwha Solutions, to secure orders in the U.S. market." He added, "Since President-elect Biden has pledged clean energy policies, the U.S. government will likely promote localization of new and renewable energy, raising questions about whether Korean small and medium-sized companies can be recognized for their competitiveness."

Ultimately, U.S. environmental policies are likely to increase the share of new and renewable energy while simultaneously promoting localization and job creation. In contrast, in South Korea, cheap imported products are saturating the market, causing the domestic solar market share to decline. According to the Korea Energy Agency, the domestic solar market share in the first half of the year was 67.4%, down 12.4 percentage points from 79.8% last year.

Another issue is that the phase-out of nuclear power has increased power generation costs, slowing the growth of new and renewable energy companies. Solar material company OCI ceased domestic polysilicon production in February and moved its factory to Malaysia, turning a profit in the third quarter.

About 40% of the production cost of polysilicon is electricity charges, but due to the phase-out policy in South Korea, nuclear power is being replaced by liquefied natural gas (LNG) and other sources.

According to the Korea Power Exchange’s Electricity Information Statistical System (EPSIS), the LNG price in August was 103.5 won per kWh, 33.8 won more expensive than nuclear power at 69.7 won. To realize the national policy philosophy of "reducing nuclear power and increasing new and renewable energy," expensive LNG usage must increase until the supply stability of new and renewable energy improves.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)