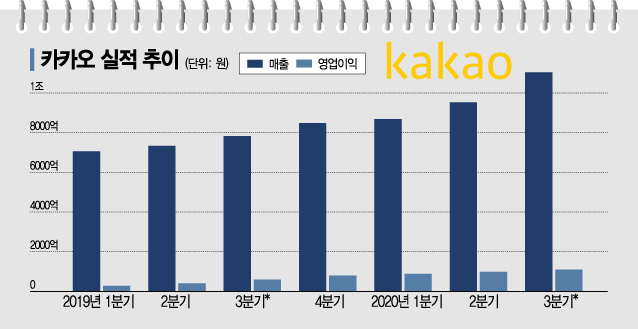

Record-Breaking 3Q Performance: Sales Surpass 1 Trillion KRW and Operating Profit Exceeds 100 Billion KRW for the First Time

KakaoTalk Ad Revenue and Webtoon Content Soar

Sharper Growth Expected in 4Q... Loss-Making New Businesses Also Improving Profitability One After Another

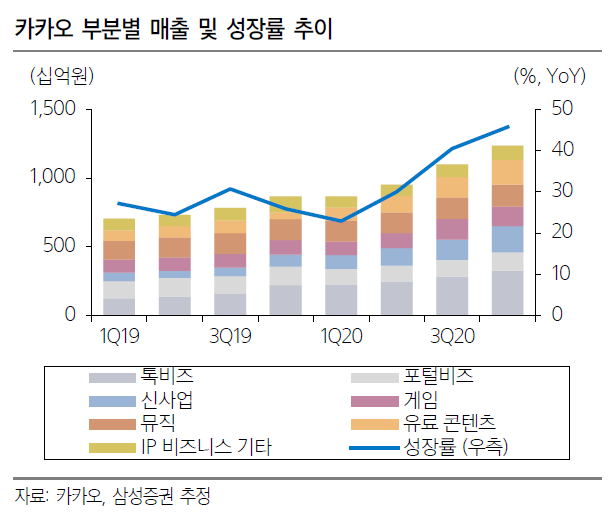

[Asia Economy Reporter Minwoo Lee] Kakao surpassed 1 trillion KRW in sales in the third quarter of this year. This marks an increase of over 40% compared to the same period last year, representing the fastest growth rate in the past three years. It is analyzed that both scale and substance are rapidly growing as new businesses have begun to generate profits in earnest.

According to the Financial Supervisory Service's electronic disclosure system on the 8th, Kakao recorded consolidated sales of 1.1004 trillion KRW and operating profit of 120.2 billion KRW in the third quarter of this year. Sales increased by 41% and operating profit by 103% compared to the same period last year. This is the highest quarterly performance ever, surpassing market consensus. This is the first time Kakao has exceeded both 1 trillion KRW in sales and 100 billion KRW in operating profit simultaneously.

Sales grew evenly across all businesses except the portal. KakaoTalk-related sales, driven by the growth of Bizboard, a banner ad displayed at the top of KakaoTalk chat room lists, and Gift, recorded 284.4 billion KRW, up 75.1% from the same period last year.

In particular, Bizboard is estimated to have grown more than 30% compared to the previous quarter due to expanded advertising inventory and increased page views. The daily average sales of Bizboard, which was around 50 million KRW in December last year, is expected to rise to about 100 million KRW in December this year. Donghwan Oh, a researcher at Samsung Securities, explained, "The current ad exposure rate in the chat tab has risen to 100% due to increased advertising demand," adding, "Sales growth is expected to continue with an increase in advertisers, rising cost-per-click (CPC) bidding ad prices, more precise targeting, and increased click-through rates through action-type ads."

Sales from new businesses, including Kakao Pay and Kakao Mobility, also increased by 139% during the same period, reaching 148.8 billion KRW. Kakao Pay's transaction volume in the third quarter was 17.9 trillion KRW, up 38% from the same period last year. This is attributed to increased payment and remittance transaction volumes as well as growth in sales of financial products such as funds and insurance. It is expected that with the expansion of large overseas online merchants and offline merchants, as well as diversification of monetization through affiliated loans, investment products, and insurance sales, Kakao Pay achieved operating profit at the breakeven point in the third quarter.

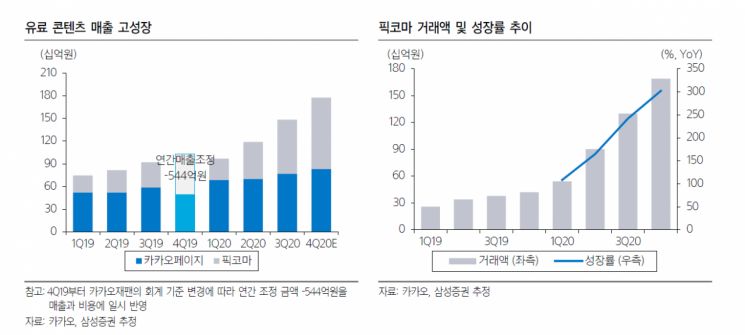

Paid content also recorded 546 billion KRW, up 61.5% from the same period last year, as Kakao Japan's 'Piccoma' sales more than doubled. Piccoma's transaction volume grew 247% year-over-year to 130 billion KRW. It achieved the number one position in sales in the global manga and novel app market, including Japan. Researcher Oh stated, "Kakao Page has dethroned the existing strong player Line Manga in Japan, the world's largest manga market, becoming the absolute leader," adding, "Although competition in the Japanese webtoon market intensified in the third quarter and overall marketing expenses increased, Piccoma maintained profitability through its 'Wait and Free' revenue model, showing an advantage over competing platforms."

Strong growth is expected to continue into the fourth quarter. Due to the peak season effect and the full monetization of new businesses, the sales growth rate is expected to increase from 41% in the third quarter to 46% in the fourth quarter. Although operating expenses will rise significantly due to year-end special incentives and increased marketing expenses related to new businesses such as Kakao Mobility and Kakao Pay, as well as the launch of the new game Elion, it is analyzed that the sales increase will fully offset these costs.

Against this backdrop, Samsung Securities raised Kakao's target stock price by 11.4%, from 440,000 KRW to 490,000 KRW, maintaining its Top Pick status in the industry. Researcher Oh explained, "The explosive growth in transaction volumes of Kakao Pay and Piccoma will drive overall sales growth and profitability improvement for Kakao," adding, "The fact that loss-making subsidiaries are turning profitable and that there is a high leverage effect on overall operating profit is a clear advantage over competing platforms whose profit growth has stagnated due to investment expansion."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.