Outstanding Corporate Loans of Top 5 Domestic Banks Reach 576.29 Trillion KRW by End of October

Increase of 55 Trillion KRW Since January

Banking Sector's Total Corporate Loan Growth Expected to Surpass 100 Trillion KRW This Year

[Asia Economy Reporter Park Sun-mi] The scale of corporate loans in the banking sector is breaking record highs every month. Due to the spread of the novel coronavirus infection (COVID-19), the increase in loans to small and medium-sized enterprises (SMEs) is expected to continue for the time being, raising red flags for risk management in the banking sector.

According to the banking sector on the 4th, the outstanding corporate loans of the five major commercial banks?KB Kookmin, NH Nonghyup, Shinhan, Woori, and Hana?stood at 576.2928 trillion won as of the end of last month. This is the largest scale ever, surging by about 55 trillion won compared to 521.0664 trillion won in January this year.

The scale of corporate loans in banks has maintained an upward trend every month, swelling to an all-time high. This reflects the reality that companies are relying on bank loans due to deteriorating financial conditions amid the spread of COVID-19 and economic uncertainties. In particular, loans to SMEs are noticeably increasing compared to large corporations. In the case of Bank A, corporate loans to large companies decreased by 290 billion won month-on-month in October, but SME loans, including SOHO loans, increased by 790 billion won, driving overall corporate loan growth.

Since corporate loans from the five major commercial banks increased by more than 6 trillion won in October alone, the total increase in corporate loans across the banking sector this year is likely to have already exceeded 100 trillion won as of last month. According to the Bank of Korea, the increase in corporate loans from January to September this year reached 97.1 trillion won, marking an all-time high. This figure is 1.5 times higher than the previous record of 64.3 trillion won during the 2008 global financial crisis.

Upward Trend in Banking Sector Corporate Loans

Significant Increase in SME Loans Due to COVID-19

Rising Risk of Zombie Companies... Burden on Banking Sector

Unlike personal credit loans, where the financial authorities’ concerns about 'Yeongkkeul' (borrowing to the limit) and 'Debt Investment' have led to total volume management measures such as limit reductions and interest rate hikes (monthly increase capped at around 2 trillion won), banks remain aggressive in corporate lending. The authorities’ pressure to actively support small business owners and SMEs affected by the spread of COVID-19 has also played a role.

The second financial support program for small business owners has surpassed 2 trillion won in support. According to the Financial Services Commission’s 'Financial Risk Response Team Meeting' held the day before, since the second small business support program’s limit was raised from 10 million won to 20 million won on September 23 and restructured to allow overlapping benefits, 2.35 trillion won has been provided. Banks have supported small business owners with loans under the government’s 'ultra-low interest rate (1.5%) financial support package' established in March and have been operating the second program since May.

The problem lies in the fact that there is no sign of improvement in companies’ financial conditions due to the prolonged COVID-19 pandemic. Despite massive capital injections, corporate performance remains negative.

The Bank of Korea forecasts a sharp increase in zombie companies this year due to the COVID-19 shock compared to last year. Even when narrowing the scope to only externally audited companies (external audit companies), the proportion of companies with an interest coverage ratio below 100% is expected to surge from 14.8% last year to 21.4% this year. This means that one out of five externally audited companies will have profitability so poor that they cannot even cover interest expenses. Hana Financial Research Institute predicted that the loan size of zombie companies would increase from 105 trillion won in 2018 to 116 trillion won in 2019 and 176 trillion won in 2020.

A banking official expressed concern, saying, "Although household and corporate loans have increased and banks have performed relatively well despite the COVID-19 situation, we must keep open the possibility that banks will bear the risk of corporate loan defaults after the COVID-19 financial support measures end in March next year due to the deterioration of corporate financial soundness."

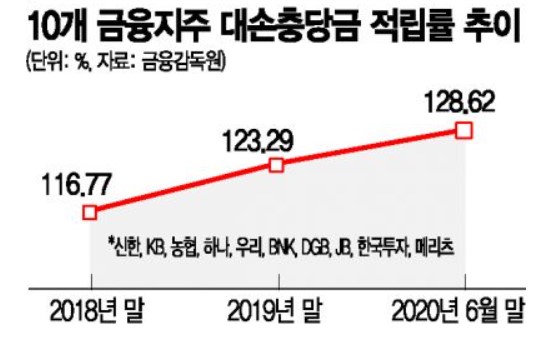

Meanwhile, Yoon Seok-heon, Governor of the Financial Supervisory Service, recently met with heads of commercial banks and urged the banking sector to faithfully perform its role as a financial intermediary to overcome difficulties caused by COVID-19. At the same time, he asked them to strive to firmly maintain loss absorption capacity by sufficiently setting aside loan loss provisions in preparation for the possibility of future expansion of non-performing loans.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)