The Accelerated Digitalization in the Banking Sector... Struggling to Resolve Side Effects

Financial Authorities Urge Banks to Especially Focus on Protecting the Digitally Disadvantaged Groups

[Asia Economy Reporter Park Sun-mi] As the digitalization speed in the banking sector accelerates, an urgent need has arisen to protect digitally marginalized groups such as the elderly and people with disabilities. The reduction of offline branches due to non-face-to-face and digitalization trends in the banking sector has highlighted financial exclusion as a problem, prompting busy efforts within the banking industry to resolve this issue.

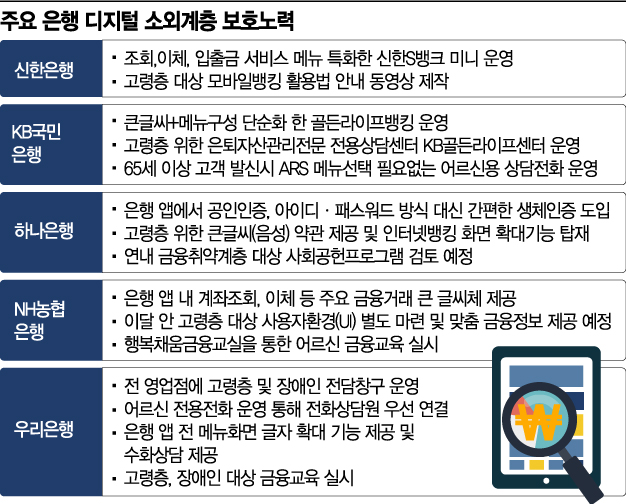

According to the banking sector on the 2nd, major domestic commercial banks recognize the reduction of offline branches and the shift to digitalization as a trend of the times and are making efforts to protect digitally marginalized groups by minimizing side effects that may arise during this transition.

KB Kookmin Bank operates the "Hand Withdrawal Service," which allows deposit withdrawals without passbooks, seals, or password input through a single palm vein authentication, supporting the elderly's transition to digitalization. This elderly-friendly financial service enables elderly customers who prefer face-to-face transactions to experience and learn digital services at face-to-face channels and naturally move to non-face-to-face channels. As of the end of October, the number of users of this service has exceeded 1.5 million.

Kookmin Bank also operates a separate "Golden Life Banking" channel within its banking app and internet banking, designed with simple menu configurations and large fonts to make it easy and convenient for elderly customers unfamiliar with non-face-to-face services to conduct transactions. Additionally, since July, it has established the "KB Golden Life Center," the first specialized retirement asset management consultation center for senior customers in the financial sector.

Shinhan Bank has established a policy to conduct thorough prior impact assessments in accordance with financial authorities' guidelines when consolidating branches and to prepare alternative channels such as unmanned branches and mobile branches to alleviate inconveniences for financial consumers, including the elderly. It operates the Shinhan S Bank Mini app channel, which specializes in inquiry, transfer, and deposit/withdrawal service menus tailored for the elderly. Customized instructional videos have also been produced to assist the elderly in using mobile banking.

Hana Bank sells exclusive installment savings products through its Customer Care Center (call center) targeting elderly customers unfamiliar with smartphones. This product offers preferential interest rates when newly subscribed via the call center, mainly targeting middle-aged and elderly people who have difficulties using digital services. The decision was made based on the judgment that preferential interest benefits, which are concentrated in non-face-to-face services, should also be available to digitally marginalized groups.

Services such as visible ARS systems for the elderly and hearing-impaired, braille terms and conditions, and ATM screen magnification functions for the visually impaired are also provided. The bank is also considering social contribution programs for financially vulnerable groups. Plans under review include collecting unused smartphones for recycling and donating them to vulnerable groups, as well as providing digital education to protected youth and the elderly using the bank's IT and human resources.

Dedicated phone lines for seniors, visible ARS services, exclusive app channels for the elderly, digital education, and customized video production for digitally marginalized groups

Woori Bank operates dedicated counters for the elderly and disabled at all branches and also runs non-face-to-face channel services to improve convenience for these groups. Through the "Senior Exclusive Phone," customers aged 65 and older are connected to dedicated counselors first, and a visible ARS service is provided that allows customers to view main menus and transactions on their smartphone screens.

The bank app operates "General Sign Language Consultation" and "Customer Complaint Reception via Sign Language Consultation" for the hearing impaired, and provides non-face-to-face identity verification services via video calls so that disabled customers who find it difficult to visit branches can access financial services such as account opening and electronic financial applications (reporting changes).

NH Nonghyup Bank plans to provide a separate user interface (UI) for the elderly on its banking app around the 20th of this month and offer customized financial information targeting the elderly. Although the bank already offers services to view major financial transactions such as account inquiry and transfers in large fonts on the app, the mid-month UI revision will place only one transaction process per screen, allowing the elderly to handle one process at a time without having to input multiple complex items on one screen.

Nonghyup Bank exempts electronic financial fees for single elderly households, disabled persons, and members of multicultural families to encourage the use of non-face-to-face transactions. It produces and distributes the "Safe Consumption Life Guide Video for Seniors" to prevent financial accidents and regularly conducts senior financial education through the Happy Filling Financial Classroom.

The financial authorities are especially urging the banking sector to make efforts to protect digitally marginalized groups. On the 26th of last month, Yoon Seok-heon, Governor of the Financial Supervisory Service, met with heads of commercial banks and requested, "Please make efforts to ensure that the inconvenience of digitally marginalized groups such as the elderly does not occur amid the trend of digitalization, the spread of non-face-to-face transactions, and the reduction of offline branches." The Financial Services Commission has ordered banks to prepare alternative counters to minimize inconvenience to the elderly caused by branch reductions and to develop dedicated banking apps for the elderly as countermeasures.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.