Detected 100,000 Fraud Cases During 2-Month Pilot Operation

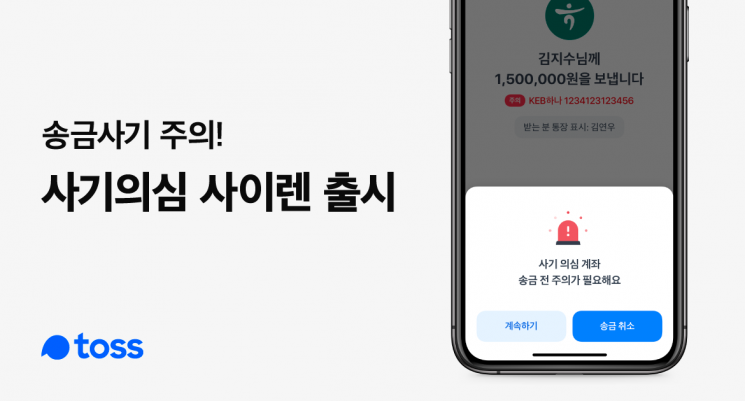

[Asia Economy Reporter Kim Min-young] Viva Republica, the operator of the mobile financial service Toss, announced on the 30th that it has launched the ‘Suspicious Fraud Siren’ service to prevent remittance fraud such as voice phishing when using its simple remittance service.

The Suspicious Fraud Siren service allows users to immediately identify suspicious transactions through account and contact history registered with The Cheat, a financial fraud prevention service, as well as Toss’s abnormal transaction detection features.

The service is simple to use. After entering the transfer amount on Toss’s simple remittance screen and inputting the recipient’s information, it automatically checks whether the recipient’s account or contact corresponds to suspicious fraud transactions. Even if the user presses the ‘Send’ button to remit money, a warning message appears before the transfer if the account or contact is identified as suspicious.

In particular, the biggest feature of this service is that it checks for the risk of fraudulent transactions throughout the entire remittance process without requiring a separate inquiry.

During the two-month pilot operation period since last September, the service detected more than 100,000 suspicious accounts and contacts, helping provide a safe and convenient remittance experience on Toss.

Lee Seung-gun, CEO of Toss, said, “Along with the Suspicious Fraud Siren service, we have been making various efforts to protect Toss users, including the full compensation policy for customer damages implemented in July this year. We will continue to enhance the service by adding collaboration partners so that the entire nation can use Toss with peace of mind.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.