<Medium-Sized Public Rental Housing>

Including units under 85㎡ exclusive area by next month

Aimed at absorbing the middle class but remains rental housing

Limitations noted in substituting demand for home ownership

<Equity Accumulation Sale Housing>

Advantage of low initial cost burden

Risk of profit sharing if sold before equity purchase completion

President Moon Jae-in is delivering the 2021 budget address at the National Assembly in Yeouido, Seoul, on the morning of the 28th.

President Moon Jae-in is delivering the 2021 budget address at the National Assembly in Yeouido, Seoul, on the morning of the 28th. [Image source=Yonhap News]

[Asia Economy reporters Moon Jiwon and Lee Chunhee] As the government introduces various housing supply plans such as 'equity accumulation-type sale housing' and 'medium-sized public rental housing' as measures for the real estate market, consumer interest is growing. Although both housing types can reduce the housing cost burden for low-income households, there are concerns about their marketability due to unclear target quantities and supply timing, as well as limited demand. This article introduces the characteristics, advantages, and disadvantages of each housing type.

Medium-sized public rental housing: larger area but not your own home...

Hong Nam-ki, Deputy Prime Minister and Minister of Economy and Finance, is delivering opening remarks at the '9th Real Estate Market Inspection Meeting of Related Ministers' held on the 28th at the Government Seoul Office in Jongno-gu, Seoul. Photo by Kang Jin-hyung aymsdream@

Hong Nam-ki, Deputy Prime Minister and Minister of Economy and Finance, is delivering opening remarks at the '9th Real Estate Market Inspection Meeting of Related Ministers' held on the 28th at the Government Seoul Office in Jongno-gu, Seoul. Photo by Kang Jin-hyung aymsdream@

According to sources inside and outside the government on the 29th, the Ministry of Land, Infrastructure and Transport will finalize and announce a plan next month to include medium-sized rental housing of around 30 pyeong (85㎡ exclusive area or less) in the integrated-type public rental housing. Compared to the existing public rental housing supplied only up to 60㎡, this housing can absorb middle-class tenant demand in terms of area.

The integrated-type rental housing combines previously separate rental housing types such as permanent rental, national rental, and Happy Housing into one, and will be fully introduced from 2022. Originally, this type was planned to standardize the move-in criteria to 56㎡ for families of four or more and income below 130% of the median income, but to supply medium-sized units, the area is expected to expand to 85㎡ and the income criteria to 140-150%.

Additionally, the government plans to improve housing quality in terms of location, layout, and landscaping. A Ministry of Land official said, "We are consulting with the Ministry of Economy and Finance to announce a plan to allocate medium-sized units to integrated-type public rental housing in November," adding, "Specific rent levels and supply standards will be disclosed in the first half of next year after a feasibility study."

However, unlike 5-year or 10-year 'sale conversion' public rental housing, the integrated-type public rental housing is intended solely for rental purposes. Given the skyrocketing housing prices, it has limitations in replacing the demand of non-homeowners seeking to own a home. An industry insider pointed out, "It is practically impossible to supply enough medium-sized public rental housing to replace the private rental market," and "there are limits to suppressing purchase demand."

Initially, the Ministry of Economy and Finance showed some differences of opinion with the Ministry of Land regarding the need for additional fiscal input to increase medium-sized public rental housing, but it is known that they agreed on the necessity to improve the quality level as the quality of public rental housing has been too low and the jeonse (key money deposit) crisis is worsening. The fiscal burden will be somewhat addressed through rent adjustments.

Equity accumulation-type housing: low initial burden but limited price advantage...

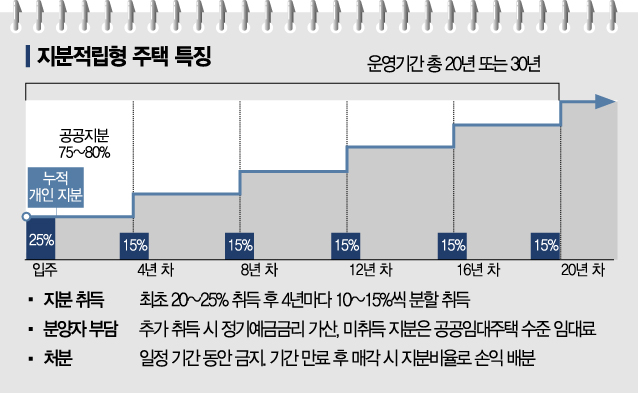

Equity accumulation-type sale housing allows buyers to initially acquire only 20-25% of the land and building equity at the time of sale and move in, then acquire 10-15% of the equity evenly every four years, eventually owning 100% of the house after 20-30 years. Until all equity is secured, tenants pay rent on the public equity at rates lower than market prices.

The government plans to mainly supply equity accumulation-type housing in new public land such as the 3rd New Towns and in public redevelopment and reconstruction project areas in urban centers. Hong Nam-ki, Deputy Prime Minister and Minister of Economy and Finance, said at the 9th Real Estate Market Inspection Ministerial Meeting held at the Government Seoul Office yesterday, "Sales are expected to be possible from 2023." The Seoul Metropolitan Government plans to supply 17,000 units by 2028.

This is evaluated as a great help for low-income households or newlyweds with insufficient assets to secure housing. It allows for loans exceeding the current loan-to-value (LTV) ratio regulations and has the advantage of a long financing period. Long-term residence supports asset formation for occupants and has sufficient public nature to partially disperse demand concentrated in sales or the general jeonse market.

However, if the equity purchase is not completed and the property is sold, profits must be shared between the public and private parties according to the equity ratio. In the actual market, opinions such as "Considering rent and other costs, it may cost more than mortgage interest" or "There are significant risks due to resale restrictions and mandatory residence requirements" have emerged.

Considering that general sale apartments supplied under the price ceiling system are flooding the market at about half the market price, demand is inevitably limited. It is also pointed out that public equity is recorded as debt by entities such as the Korea Land and Housing Corporation (LH), making large-scale supply difficult. According to Seoul City, the first equity accumulation-type model housing includes public rental housing in Seongdui Village, Seocho-gu, Seoul.

Lee Eun-hyung, senior researcher at the Korea Construction Policy Research Institute, said, "Being able to secure a home with 20% of the sale price means, conversely, providing an effective loan of 80%," adding, "Ultimately, it is nothing more than easing loan regulations for actual buyers by circumventing existing loan restrictions."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)