KB Financial Group Publishes '2020 Korea Wealth Report' Analyzing Asset Management Methods of Korean Millionaires

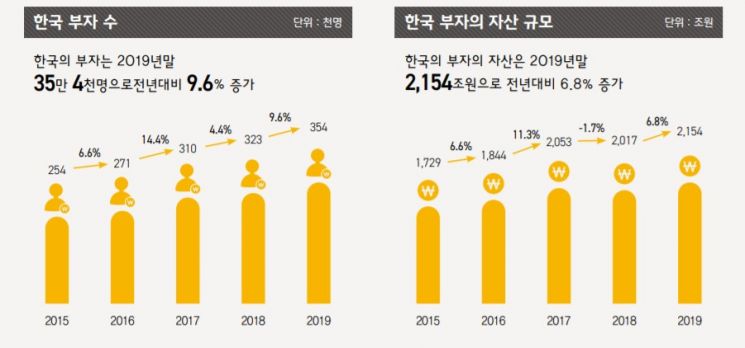

[Asia Economy Reporter Park Sun-mi] The number of wealthy individuals holding financial assets worth more than 1 billion KRW in South Korea has increased 2.2 times over the past decade, reaching 354,000.

According to the '2020 Korea Wealth Report' published on the 28th by KB Financial Group, which analyzed the status and asset management methods of wealthy individuals in Korea, the number of wealthy people in Korea, which was 160,000 in 2010, rose to 354,000 in 2019, a 2.2-fold increase over 10 years. This represents an annual growth rate of 9.2%, which is higher than the global wealthy population's annual growth rate of 6.8% during the same period and the overall Korean population growth of 4.3% (annual average 0.47%).

Looking at the regional distribution of wealthy individuals in Korea, 45.8% or 162,000 live in Seoul, followed by Gyeonggi (77,000), Busan (25,000), Daegu (16,000), and Incheon (10,000).

Over the past decade, the total financial assets of wealthy individuals increased from 1,158 trillion KRW to 2,154 trillion KRW, a 1.9-fold increase. The proportion of wealthy individuals' financial assets within the total household financial assets also rose from 53% in 2010 to 57.3% in 2019, indicating a 4.3 percentage point increase in wealth concentration among the wealthy.

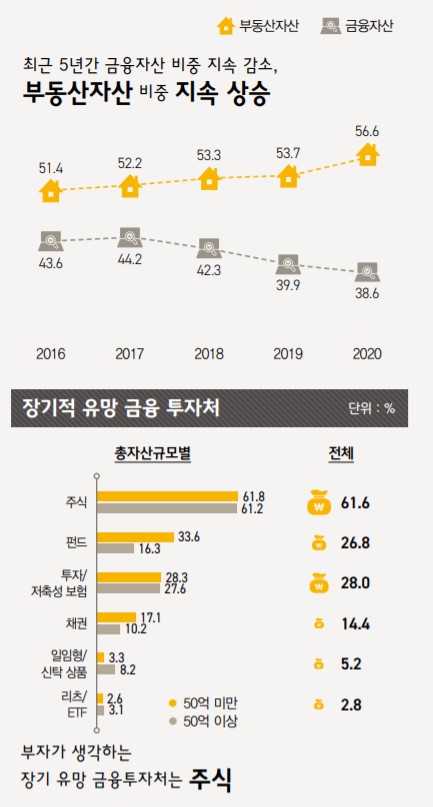

More than 50% of the assets held by wealthy individuals in Korea are real estate assets, with about 40% being financial assets.

This is influenced by the strong upward trend in Seoul apartment prices since the mid-2010s, which rapidly increased the value of homes owned by wealthy individuals. Among their assets, the proportion of cash and cash equivalents in financial assets and the share of residential and investment housing in real estate assets have increased. Compared to 2011, the proportion of 'cash and cash equivalents' in wealthy individuals' financial assets increased by 16 percentage points in 2020, while the shares of stocks and funds decreased by 9 and 11 percentage points, respectively. Among real estate assets, wealthy individuals with total assets under 5 billion KRW increased the proportion of 'residential housing' compared to 10 years ago, whereas those with assets over 5 billion KRW saw a significant increase in the proportion of 'investment housing.'

At the end of 2019, the primary source of wealth for the 354,000 wealthy individuals in Korea was business income (37.5%). This marks a significant change from 2011, when 45.8% identified 'real estate investment' as their main source of wealth. While real estate investment played a major role as a source of wealth due to rising real estate asset values before 2011, the success stories from the venture and startup boom in the 2010s shifted the primary source of wealth toward business income.

The Wealth Threshold Considered by the Wealthy Rose from 5 Billion KRW to 7 Billion KRW

The median wealth threshold considered by wealthy individuals in 2020 was 7 billion KRW, a 1.4-fold increase from 5 billion KRW ten years ago. This rise is attributed to inflation and the increase in the number of wealthy individuals.

The investment values of wealthy individuals have also changed significantly compared to ten years ago. They tend to prefer investments that can generate high returns rather than acquiring residential housing, and they increasingly rely on their own judgment rather than expert opinions when making investment decisions.

This reflects an intention to avoid opportunity costs related to housing and to prioritize other high-return investment opportunities first. Although they listen to expert opinions, they mainly use them as references for investment decisions. This change in values varies according to the total asset size of the wealthy; those with larger total assets show stronger interest in high-return products and a greater tendency to invest under their own responsibility. Wealthy individuals with total assets over 5 billion KRW showed a 10.4 percentage point increase in the tendency to invest under their own responsibility compared to ten years ago, which is a larger increase than the 7.5 percentage point rise among those with assets under 5 billion KRW.

Among the surveyed wealthy individuals, 80% own real estate other than their residence, with commercial buildings (44.3%), general apartments (41.5%), and land/forests (39.0%) being the most commonly held. Among those with financial assets under 3 billion KRW, the most common ownership was general apartments (37.4%), followed closely by commercial buildings (36.6%) and land/forests (34.9%). In contrast, among those with financial assets over 3 billion KRW, ownership of commercial buildings (64.8%) was relatively higher than general apartments (52.3%) and land/forests (50%).

In 2020, Financial Products Remain in 'Maintenance' Mode

Long-term Promising Investment: Stocks

Regarding how wealthy individuals plan to manage their financial assets in 2020, most responded that they intend to maintain rather than increase their investments overall.

For most financial products except 'stocks' and 'savings/deposits,' 80-90% of respondents planned to maintain their holdings. This reflects a cautious attitude among wealthy individuals due to expanded economic uncertainties from the US-China trade dispute and the global low-growth trend continuing since last year. Although the proportion planning to increase investments is lower than those planning to maintain, 24.5% intend to expand investments in 'stocks,' and 17.8% in 'savings/deposits,' showing relatively higher expansion plans compared to other financial products.

The most promising long-term financial investment destination, according to wealthy individuals, is stocks. When selecting only the top choice for promising financial products, stocks accounted for 57.1%, followed by pensions, variable and variable universal investment/savings insurance (17.6%), and funds including ELS or DLS (14.3%).

Wealthy individuals were also affected by COVID-19. 30.5% experienced income reduction due to COVID-19, and 27.5% experienced a decline in asset value. Wealthy households that experienced income reduction due to COVID-19 saw an average monthly income decrease of 21.3%. Those with financial assets under 3 billion KRW experienced an average 22.0% income decrease, while those with assets over 3 billion KRW saw an average 18.3% decrease, indicating that higher financial assets correlated with lower income reduction rates.

Due to COVID-19, one in four wealthy individuals experienced a decline in overall asset value. The average loss rate among those who experienced losses was 14.2%. Conversely, despite COVID-19, 6.5% of wealthy individuals saw an increase in overall asset value, with an average return of 2.9%, which is low compared to the loss rate. This situation indicates that the economic slowdown caused by COVID-19 through the first half of this year generally had a negative impact on asset values.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)