The mornings of city dwellers begin with delivery boxes. The domestic courier industry was born in 1992 when Hanjin started corporate express services. It grew rapidly in the early 2000s with the spread of internet shopping malls and TV home shopping. However, except for the initial growth period, it has experienced continuous ups and downs. This was because the profitability of the courier industry was extremely reduced due to the proliferation of competing companies and reckless price competition. Large-scale logistics investments to secure competitive advantage led to deterioration of financial structure. Struggling with a low-margin structure, the courier industry began to run a second growth track with the activation of the mobile platform economy. Now, it has become an essential artery for all industries, increasing its industrial importance. Existing manufacturing and agriculture cannot maintain competitiveness without fast delivery. After the outbreak of the novel coronavirus disease (COVID-19), untact consumption surged, accelerating the emergency speed of courier companies. Investments to secure economies of scale are also continuing. Along with rapid growth, social demands such as improving working conditions for courier workers have increased. Can the courier industry continue to grow in the post-COVID era? We take a look at the management status of CJ Logistics and Hanjin, the leading domestic courier companies, to gauge their growth potential.

[Asia Economy Reporter Hyungsoo Park] As COVID-19 spread worldwide, the untact culture expanded throughout society. Online purchases increased, and courier shipment volumes also rose. Hanjin, a logistics affiliate of the Hanjin Group, saw a significant increase in profits this year compared to the previous year, based on growth in its courier business. Hanjin is also continuing investments to strengthen competitiveness in the domestic courier market.

According to the Financial Supervisory Service's electronic disclosure system on the 26th, Hanjin recorded sales of 549.1 billion KRW and operating profit of 27.6 billion KRW in the third quarter of this year. These figures represent increases of 1.2% and 7.4%, respectively, compared to the same period last year. The cumulative sales up to the third quarter this year reached 1.6178 trillion KRW, and operating profit was 81.9 billion KRW, marking increases of 6.1% and 24.1% year-on-year, respectively.

With the increase in untact consumption due to the COVID-19 pandemic, the domestic courier market continues to prosper. Profitability has improved due to growth in the courier business scale and alleviation of fixed cost burdens. Researcher Kyungah Eom of Shin Young Securities explained, "The growth rate of shipment volume is maintaining about twice the normal level," adding, "Next year, price increases can be expected due to supply shortages in the courier industry."

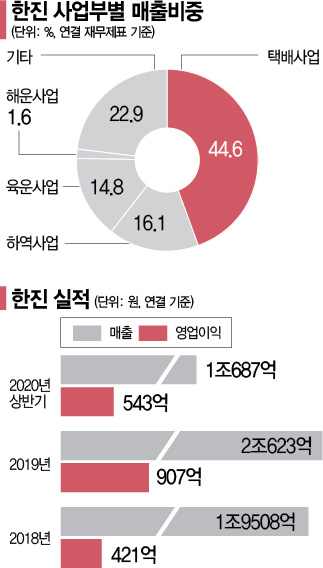

Hanjin, established in 1958, is one of the top comprehensive logistics companies in Korea. Its main businesses include courier services, land transportation, port cargo handling, and freight forwarding. The largest shareholder, Hanjin KAL, holds a 23.6% stake. As of the first half of this year, the courier business accounted for the largest share of sales by division at 44.6%. Hanjin started Korea's first individual and corporate parcel courier business in 1992.

The domestic courier industry is being reorganized around large companies that have secured price competitiveness through economies of scale. As expectations for courier services rise, shipment volumes are concentrated on large companies that have infrastructure capable of handling volumes without delay. The top four companies?CJ Logistics, Lotte Global Logistics, Hanjin, and Korea Post?account for about 84% of the shipment volume market share.

Hanjin continues to invest to strengthen its courier competitiveness. Since August 2017, it has collaborated with NongHyup to open courier support centers for farms and streamline logistics processes for local distribution, providing high-quality courier services to one million farmers nationwide. It is also making efforts to create shared value linked to this.

In 2019, Hanjin led service diversification to meet changing customer needs by launching unmanned parcel locker services, carrier transportation services, and dedicated courier services (One-Click Service) for solo entrepreneurs and small businesses. Additionally, customer consultation services have been improved through visible ARS and chatbot services.

Hanjin is pursuing a rights offering followed by a general public subscription for a paid-in capital increase. It plans to issue 2.97 million new shares at a ratio of 0.2 new shares per existing share. The expected issue price is 36,450 KRW per share, aiming to raise approximately 108.4 billion KRW. The raised funds will be used to build the Daejeon Mega Hub Logistics Center to expand courier processing capacity and automate facilities.

Hanjin has planned to invest a total of 329.6 billion KRW to build the Daejeon Mega Hub. The amount excluding the capital raised through the paid-in capital increase will be covered by a 150 billion KRW facility loan and partial proceeds from the sale of land in Beomil-dong, Busan. Earlier, on June 17, Hanjin's board resolved to sell the Beomil-dong land in Busan to Daewoo Construction for 306.7 billion KRW.

As investments continue, borrowings are increasing. As of the end of the first half of this year, consolidated total borrowings amounted to approximately 1.8852 trillion KRW, with a borrowing dependency ratio of 53.7%. The debt ratio rose from 182.3% in 2017 to 236.1% in the first half of this year.

Interest expenses on a consolidated basis for the first half were about 24.8 billion KRW, and the interest coverage ratio recorded 1.01. The interest coverage ratio is the operating profit divided by interest expenses. A ratio above 1 means the company earns profits even after covering interest expenses. Until the end of last year, Hanjin's interest coverage ratio was below 1.

The company explained that the increase in debt ratio and borrowings was due to changes in lease accounting standards last year, and that the debt ratio before reflecting the effects of the lease accounting changes was around 150%, indicating continuous strengthening of financial soundness.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.