Household Loans Approaching 1,000 Trillion Won, 'Zombie Companies' Expected to Reach Record High

Kookmin Bank Conducts Demand Forecast for 300 Billion Won Subordinated Bonds with 10-Year Maturity

First Half Issuance Expected to Exceed 4 Trillion Won, Doubling Last Year's Amount

[Asia Economy Reporter Kangwook Cho] Commercial banks are actively expanding their capital through the issuance of hybrid capital securities and subordinated bonds. The issuance volume this year is expected to exceed 4 trillion KRW, doubling last year's amount. This is due to concerns over risk management as household loans, which have ballooned like a snowball amid the prolonged COVID-19 pandemic, are expected to soon surpass 1,000 trillion KRW. Additionally, the number of 'zombie companies' (marginal companies) surviving on debt is expected to rise to a record high of about 5,000, making it urgent to secure ammunition for use in emergencies.

Shinhan and KB Kookmin Banks to Conduct Demand Forecasts for 300 Billion KRW Issuance Each This Month

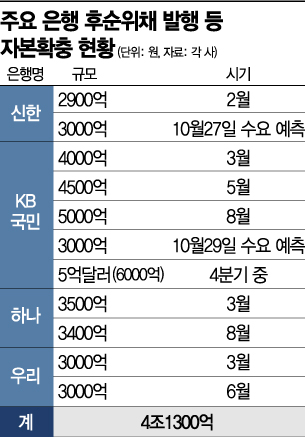

According to the financial sector on the 23rd, the total issuance of hybrid capital securities and subordinated bonds by the four major commercial banks?KB Kookmin, Shinhan, Hana, and Woori?planned for the second half of the year following the first half, amounts to 4.13 trillion KRW. This is double last year's issuance volume of 2.2 trillion KRW.

KB Kookmin Bank will conduct a demand forecast on the 29th for the issuance of 300 billion KRW in subordinated bonds with a 10-year maturity. The issuance is scheduled for the 9th of next month, and depending on the demand forecast results, the issuance volume could increase up to the limit of 400 billion KRW. This will be the fourth issuance by KB Kookmin Bank this year, following 400 billion KRW in March, and 450 billion KRW and 500 billion KRW in May and August, respectively. Additionally, in the fourth quarter, a foreign currency-denominated amortizing contingent capital securities (subordinated bonds) issuance of 500 million USD (approximately 600 billion KRW) is planned. Combined, the subordinated bonds issued by KB Kookmin Bank this year will total 2.25 trillion KRW, surpassing last year's issuance volume of the four major banks.

Shinhan Bank will conduct a demand forecast on the 27th for the issuance of 300 billion KRW in hybrid capital securities, earlier than KB Kookmin Bank. This is the second issuance this year following 290 billion KRW in February. The issuance date is scheduled for the 5th of next month. Both banks explained that the purpose of this issuance is to improve the total capital ratio based on the Basel Committee on Banking Supervision (BIS) standards, which are key soundness indicators. Earlier, Hana Bank issued subordinated bonds worth 350 billion KRW in March and 340 billion KRW in August. Woori Bank also issued 300 billion KRW twice, in March and June.

Urgent Capital Soundness Management... Decline in BIS Ratios and Record High Marginal Companies

The reason commercial banks are rushing to issue subordinated bonds is due to an urgent need to manage capital soundness amid provisions for loan losses. Subordinated bonds are used as a means for banks to expand capital. International organizations such as the BIS recognize long-term subordinated bonds with maturities of five years or more issued by banks as capital.

The soundness indicators of the four major banks have shown a sharp decline this year. According to the Financial Supervisory Service, the BIS ratios in the first half of this year compared to the end of last year fell across the board: Hana Bank (16.11% → 15.36%), Shinhan Bank (15.91% → 15.49%), Woori Bank (15.4% → 14.8%), and KB Kookmin Bank (15.85% → 14.38%). As of the end of September, the outstanding household loans in the banking sector stood at 957.9 trillion KRW, nearing the 1,000 trillion KRW mark. If this trend continues, there are even concerns that household and corporate loans could each surpass 1,000 trillion KRW as early as this year.

Moreover, there are growing concerns about a 'domino effect' of defaults as the number of marginal companies unable to pay even interest on their loans is expected to reach a record high. According to data received by Rep. Doohyun Yoon of the People Power Party from the Korea Credit Guarantee Fund, the number of 'zombie companies'?those with at least one of the following for three consecutive years: operating losses, interest coverage ratio below 1, or capital erosion?that have received guarantees increased from 4,829 in 2016 to 5,901 this year.

A representative from a commercial bank said, "Although the spread of COVID-19 has somewhat subsided, domestic and international uncertainties remain, so we are raising our capital to manage risks." He added, "With loan demand in the financial sector surging and principal and interest repayments deferred until early next year, the need for risk management in preparation for emergencies is increasing."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.