Convenience as Boundaries Between Banks Disappear with Open Banking Introduction

Over Half of Customers Use Apps

Daily Average Mobile Banking Transactions Exceed 8 Trillion Won

[Asia Economy Reporter Park Sun-mi] Office worker Min Joo-wan (31, pseudonym) was an owner of an analog style that did not match his age. He used to visit bank branches with paper passbooks and cards or transfer funds through telebanking and automatic teller machines (ATMs). He did not use internet banking, which is also used by people in their 40s and 50s. This was due to the difficulty of remembering passwords and the inconvenience of logging in separately for each bank. However, with the advent of an era where downloading just one bank application (app) on a smartphone allows transactions with other banks through fingerprint and facial recognition, he made a big decision to switch to mobile banking users. As the introduction of open banking eliminated boundaries between banks and the inconvenience of internet banking was resolved at once with just one bank app, paper passbook users like Min have been switching to bank app users.

With the introduction of open banking eliminating boundaries between banks, more than half of bank customers are now using bank apps. As banks have increased non-face-to-face services in response to the spread of the novel coronavirus infection (COVID-19), the volume of transactions through bank apps is also rapidly increasing.

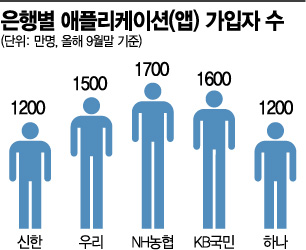

According to the banking sector on the 22nd, as of the end of September, the number of bank app users compared to the total number of customers of the five major banks?KB Kookmin, NH Nonghyup, Shinhan, Woori, and Hana?was recorded at 54%. More than half of the customers are using bank apps.

By bank, Nonghyup Bank had the largest number with 17 million users. Kookmin Bank had 16 million, Woori Bank 15 million, and Shinhan and Hana Banks each had 12 million users. The total number of app users for the five major banks amounts to about 72 million. In terms of the proportion of users relative to total customers, Woori Bank had the highest rate, with 7 out of 10 people (68%) using the app.

Transactions through apps are also surging. In the first half of this year, the average daily amount of mobile banking usage exceeded 8 trillion won. This is a 22.9% increase from 6.7457 trillion won in the second half of last year. Based on bank remittance transactions, the total number of mobile banking transactions in the banking sector in the first half of this year was 1.368 billion, which is seven times the 198 million internet banking transactions.

Bank App Users Expected to Increase Further with Expansion of Open Banking

Starting this December, mutual finance and savings banks will participate in open banking, followed by securities and card companies from next year, making it highly likely that the number of mobile banking users and the volume and scale of transactions will increase further. Open banking is a service that allows customers to view all their accounts and make withdrawals and transfers with just one app. Since its launch in December last year, the number of users has reached 22 million (as of September).

Consumer response has been high since the implementation of open banking due to increased convenience in financial transactions. For example, transferring money from rarely used accounts at other banks to the main transaction account is now possible instantly, and money in other bank accounts can be withdrawn from ATMs without passbooks or cards. Even without an account, users can sign up for a bank app, and new accounts can be opened immediately by simply taking a photo of an ID card non-face-to-face. With just one bank app, scattered bank account management and integrated asset management including securities, cards, and insurance have become possible. In the future, the accounts available for open banking will be expanded from demand deposit accounts with free deposits and withdrawals to savings and installment savings accounts.

Although mobile banking services provided through bank apps vary slightly by bank, they are generally similar overall. However, since app usage reflects intimate patterns such as users’ habits and daily routines, attracting new customers is difficult, and if a bank falls behind in the early competition, recovery may be challenging. This is why banks frequently hold various events to promote app sign-ups and constantly consider differentiation.

Active Bank App Events in Banking Sector...Special Savings with 5% Annual Interest Rate to Attract Customers

Nonghyup Bank is currently running a special savings event offering a 5% annual interest rate to encourage the use of its mobile platform All One Bank. Kookmin Bank’s KB Star Banking is holding a prize event for customers who do not have a deposit and withdrawal account or only have such an account. Shinhan Bank offers 10,000 won in cash to customers in their 20s who sign up for the Housing Subscription Comprehensive Savings or Youth Preferential Housing Savings through the Sol app.

Hana Bank is waiving transfer fees for life for customers who install the New Hana One Q app and register with facial recognition or simple number authentication by the end of this month. Woori Bank offers prizes to customers who receive their first salary of 500,000 won or more with the 'First Salary Woori Account' and apply through the bank app Woori One Banking.

However, since most services can be easily used through bank apps, there is concern that customers may impulsively sign up for products or use loan services without separate consultation. Another drawback is that the bank app screens are packed with so many functions that they may appear complicated, making it difficult for elderly users to use them.

One user said, "Bank app usage is convenient, so I have downloaded and use apps from two banks, but I mainly use services like managing accounts and transferring money at once. I tend not to use product subscriptions or loan services much due to concerns about impulsive sign-ups and sharing personal information."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.