First Half Year Insurance Premiums for 10 CM Channels

Up 27.3% YoY

Likely to Increase Further Due to Non-Face-to-Face Activation

[Asia Economy Reporter Ki Ha-young] The cyber marketing (CM) channels of domestic non-life insurance companies are showing remarkable growth. As the prolonged COVID-19 pandemic has expanded contactless consumption, the growth of CM channels is expected to accelerate further in the future.

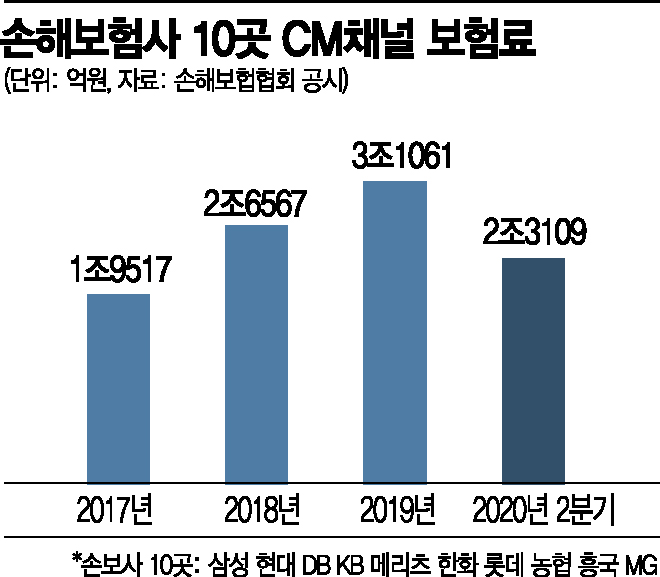

According to the disclosure by the General Insurance Association on the 22nd, as of the first half of this year, the CM channel premiums of 10 non-life insurers including Samsung Fire & Marine Insurance, Hyundai Marine & Fire Insurance, DB Insurance, KB Insurance, and Meritz Fire & Marine Insurance amounted to 2.3109 trillion KRW, a 27.3% increase compared to last year (1.8155 trillion KRW).

Samsung Fire & Marine Insurance earned 1.3198 trillion KRW through CM channels, up 28.3% from 1.0826 trillion KRW the previous year. This accounts for 57.1% of the total CM channel premiums of all non-life insurers. DB Insurance followed with 350.3 billion KRW, a 50.8% increase compared to last year. During the same period, KB Insurance ranked third with 307.2 billion KRW, up 56.8% from the previous year. Hyundai Marine & Fire Insurance collected 283 billion KRW in premiums, a 28.3% increase compared to the same period last year.

In the case of Heungkuk Fire & Marine Insurance, CM channel performance during this period rose 142.5% to 8.1 billion KRW from 3.4 billion KRW in the previous year. NH Nonghyup Insurance and MG Insurance also recorded increases of 13.7% and 13.5%, respectively, compared to the previous year. While most non-life insurers saw their CM channel premiums increase, only Hanwha General Insurance and Lotte Insurance experienced declines. Hanwha Insurance's withdrawal from CM channels such as automobile and general insurance was influenced by the launch of the digital insurer Carrot Insurance.

CM channels of non-life insurers are continuously growing. For automobile insurance, a representative product of non-life insurers, CM channels are highly preferred. Since it is a mandatory insurance standardized for all, subscribers can easily enroll without going through an agent, and the premiums are relatively affordable. In fact, the CM channel performance of non-life insurers increased from 1.9517 trillion KRW in 2017 to 2.6567 trillion KRW in 2018, and further expanded to 3.1061 trillion KRW last year.

In particular, with the spread of COVID-19 activating the contactless economy, the growth of CM channels is expected to accelerate, according to industry forecasts. With the emergence of digital insurers and big tech companies also entering the digital insurance market, competition to target CM channels will inevitably become fiercer. Earlier, Hana Financial Group launched Hana Insurance in June under the policy of developing The-K Insurance, specialized in automobile insurance, into a digital comprehensive non-life insurer capable of providing various coverages in daily life.

An insurance industry official said, "As contactless consumption increases due to COVID-19, fierce competition among insurers over online channels is expected," and added, "As the market grows, insurance products offered through CM channels will become more diverse, not only in automobile insurance."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)