Korean Money Multiplier at 25.4, Halved in About 15 Years

Money Circulation Speed Hits Record Low

Money Hoarded and Invested Only in Real Estate

Economic Vitality Declines Further

Central Bank's Money Supply Faces Limits

Base Money 50,000-Won Note Issuance Surges

Cash Holding Tendency Strengthens

[Asia Economy Reporter Kim Eunbyeol] The speed of decline in Korea's money multiplier has been found to be more than five times faster than that of other countries such as the United States and Europe. This is because, following the financial crisis and the novel coronavirus disease (COVID-19) crisis, economic agents have increasingly tended to hoard money rather than spend or invest it. In Korea's case, the tendency to go "all-in" on real estate, where money inevitably remains tied up for a long period, is also related. This phenomenon results in an increase in the amount of money the central bank must inject to respond to crises. Compared to 10 years ago, the amount of money Korea needs to release to respond to the same crisis has more than doubled. There are ongoing calls for targeted support toward specific groups or sectors, as monetary easing by the central bank alone has limitations in economic recovery.

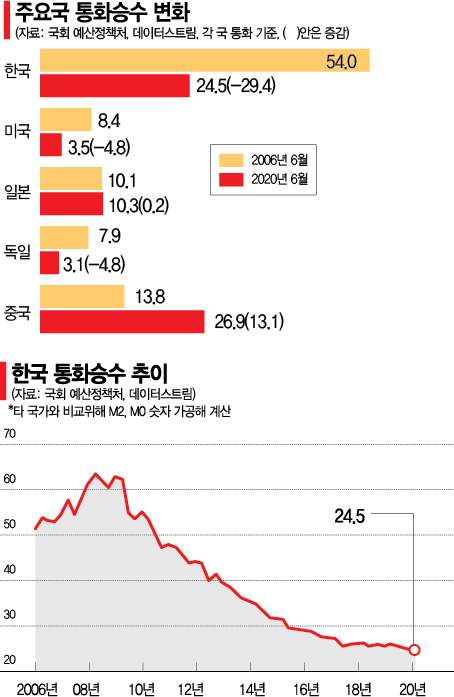

Money Multiplier Halved Compared to 2006

According to an analysis by the National Assembly Budget Office on the 22nd using Datastream data, Korea's money multiplier was 24.5 in June, down by 29.4 points from 54.0 in June 2006. Back in 2006, Korea's money multiplier was 3 to 7 times higher than other countries, but it has been rapidly declining over the past 15 years. During the same period, the U.S. money multiplier fell from 8.4 to 3.5, and Germany's dropped from 7.9 to 3.1, with a decline of about 4.8 points. China's money multiplier, however, rose from 13.8 to 26.9, nearly doubling.

The money multiplier is an indicator that shows how well money circulates in the market when the central bank supplies money. It is calculated by dividing the money supply in circulation (M2 - broad money) by the monetary base. The Budget Office used M2 and the monetary base figures processed in Datastream according to international standards to compare with other countries. The money multiplier calculated using Bank of Korea data was even lower at 14.8 as of last June.

The velocity of money, which indicates how many times money is used in transactions over a certain period, also fell to an all-time low. As of the end of June, the velocity of money had dropped to 0.62. In 2002, it was close to 1. However, it fell below 0.90 during the financial crisis, dropped below 0.80 in 2012, and entered the 0.60 range last year.

In fact, advanced countries with large monetary base supplies and a strong preference for holding cash already have lower absolute values of money multipliers than Korea. The U.S. money multiplier was around 9 to 10 before the financial crisis but fell to 3 to 4 afterward. Japan (10.3) and Germany (3.1) also have low absolute values of money multipliers.

However, experts say that one cannot claim Korea is better simply because advanced countries have lower money multipliers by comparing absolute values. Kim Yoonhee, an analyst at the National Assembly Budget Office, said, "It is difficult to make direct comparisons because of differences in cash holding preferences and reserve requirements among countries. The credit creation effect of the monetary base can be judged through the trend of increase or decrease." She added, "The decline in the money multiplier can also be interpreted as a decrease in the dynamism of our economy. The low interest rates have increased the tendency to hold cash or gold, which has also had an impact."

Issuance of 50,000-Won Bills Also Affects... Bank of Korea Says "Money Multiplier Is Only a Reference Indicator"

Another reason for the rapid decline in Korea's money multiplier is the issuance of 50,000-won bills starting in 2009. The monetary base, which is the denominator in the money multiplier formula (M2/monetary base), has surged due to the issuance of 50,000-won bills. A Bank of Korea official said, "Since the issuance of the 50,000-won bill began, economic agents' preference for holding cash has strengthened, and the monetary base has increased more rapidly, which has contributed to the decline in the money multiplier." Before the 50,000-won bill existed, people would hold 30,000 or 40,000 won, but now they hold 50,000-won bills instead.

Therefore, although the Bank of Korea is aware of the decline in the money multiplier, it does not use it directly as an indicator when conducting monetary policy. Especially in the current crisis situation, it is unavoidable to increase the monetary base (denominator), so the decline in the money multiplier does not mean that monetary easing can be stopped. A Bank of Korea official said, "Ultimately, the crisis must be overcome through fiscal policy that can provide targeted support, but if this situation continues too long, there is concern that the role of the central bank itself may be diminished."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.