Four Consecutive Trading Days of Decline After Listing

High Dependence on BTS and Potential Military Enlistment Risk... Significant Variance in Earnings Forecasts

Concerns Over Losses Among Individual Investors Following Herd Trading Behavior

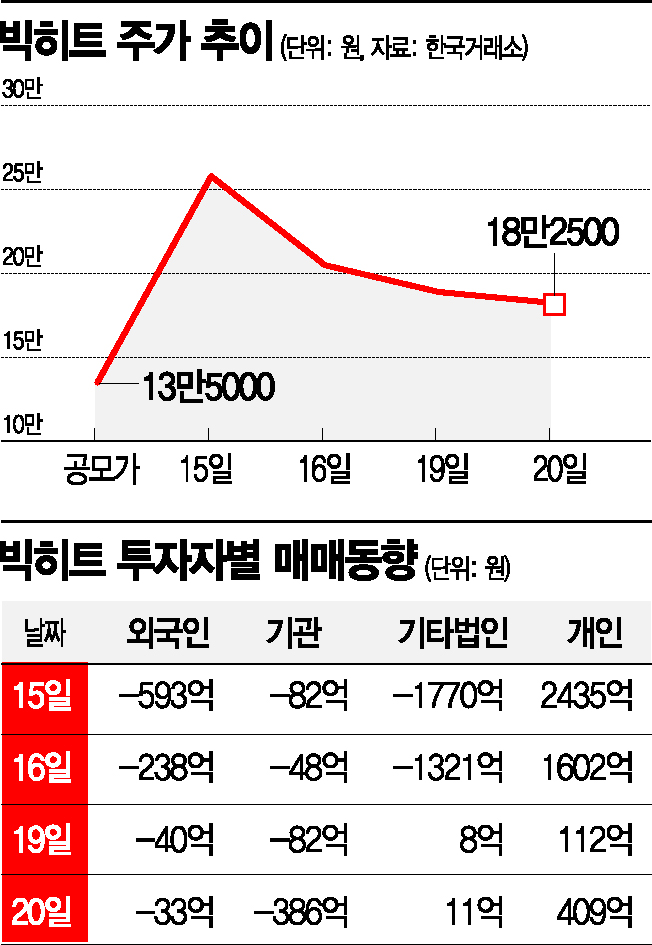

[Asia Economy Reporter Minwoo Lee] The stock price of Big Hit Entertainment (hereafter Big Hit), which was considered the biggest IPO of the year, has struggled since its listing. Foreign investors, institutional investors, and other corporations have been flooding the market with sell orders, causing a continuous decline. With varying annual performance forecasts from the financial investment industry, concerns about future growth have led to a selling trend primarily aimed at realizing profits.

According to the Korea Exchange on the 21st, Big Hit's stock opened at 180,500 KRW, down 1.1% from the previous day. Early in the session, it dropped as much as 2.74% to 177,500 KRW. As of 10:12 AM, it was at 179,000 KRW, down 1.92% from the previous day. After temporarily hitting 'ttasang' (twice the IPO price at the opening followed by the upper price limit) of 351,000 KRW on the first day of listing, the stock has been on a downward trend. If it hits the lower price limit today, it could fall to 126,300 KRW, meaning it could drop below the IPO price within just five trading days.

The biggest factor behind the stock price decline appears to be profit-taking sell orders from non-individual investors such as institutions, foreigners, and other corporations. Foreign and institutional investors have been net sellers since the first day of listing. Foreign investors sold a net 59.3 billion KRW on the first day (the 15th), followed by 23.8 billion KRW on the 16th, 4 billion KRW on the 19th, and 3.3 billion KRW on the 20th, selling Big Hit shares for four consecutive trading days. Institutional investors showed a similar pattern, selling 8.2 billion KRW on the first day and continuing to sell steadily. Over the past four trading days until the previous day, they net sold 59.8 billion KRW worth of shares.

The largest volume was sold by other corporations. These are general companies classified as other corporations, not financial investment firms or pension funds. They net sold 177 billion KRW on the first day of listing and followed with 132.1 billion KRW the next day. Over four trading days since listing until the previous day, they net sold a total of 307.2 billion KRW, more than twice the combined net sales of foreigners and institutional investors, which totaled 150.2 billion KRW during the same period. It appears that companies not primarily engaged in financial investment participated heavily in Big Hit's subscription and quickly realized profits by selling shares after listing.

The background for their selling is the concern that Big Hit's annual performance may fall short of expectations, leading to criticisms of overvaluation. Earnings forecasts for Big Hit vary by securities firms. Ebest Investment & Securities projected Big Hit to achieve sales of 745.8 billion KRW and operating profit of 118.7 billion KRW this year. Shin Young Securities forecast sales of 647.4 billion KRW and operating profit of 114 billion KRW. Meanwhile, Hyundai Motor Securities estimated sales up to 858.8 billion KRW and operating profit of 154.4 billion KRW. The sales forecast shows a variance of nearly 200 billion KRW.

According to financial information provider FnGuide, the market consensus for Big Hit's performance this year is sales of 698 billion KRW and operating profit of 118.4 billion KRW. These figures represent growth of 18.87% and 20.00%, respectively, compared to the same period last year, but are somewhat subdued compared to the growth rates of 162.5%, 226.19%, and 94.82% recorded over the past three years (based on sales). Since sales are excessively concentrated on BTS (Bangtan Sonyeondan), and with the military enlistment of BTS members overlapping, concerns about potential sales impact are reflected. This explains the surge in profit-taking sell orders at the early high stock price stage.

The buyers of these shares were individual investors. Since listing until the previous day, they net purchased a total of 455.8 billion KRW. Considering the average purchase price of individuals during this period was 243,666 KRW, comparing to 179,000 KRW as of 10:12 AM on the day means an average loss of 26.5%. In particular, there seem to be many investors who bought indiscriminately, relying solely on BTS's popularity without any knowledge of financial investment. A financial investment industry official said, "There are people who lack basic understanding of the capital market and financial investment to the extent that they demand refunds for Big Hit shares, and they are engaging in herd trading, which raises concerns about significant losses."

Meanwhile, due to the continuous decline, Bang Si-hyuk, chairman of Big Hit's board, has fallen out of the top 10 in the stock-rich ranking. Chairman Bang is the largest shareholder, holding 12,377,337 shares of Big Hit (34.74% stake). According to financial information provider FnGuide, on the 15th, Chairman Bang's stake was valued at 3.1933 trillion KRW, ranking 6th, but as of the previous day, he dropped to 10th place with 2.2589 trillion KRW. This represents a decrease of 1 trillion KRW in just five days.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.