Automobile Industry Association Surveys 185 Domestic Auto Parts Suppliers

Average 32.8 Months and 130 Million KRW Required for Mass Production of One Future Car Part

Parts Companies Cite "Lack of Funds" as Biggest R&D Challenge at 36%... Government Support Urgently Needed

[Asia Economy Reporter Seong Giho] As global companies accelerate their transformation toward future vehicles, it has been found that 6 out of 10 domestic auto parts suppliers deliver or develop parts related to future cars. Among them, only 18% are profitable, and only 16% of parts companies with annual sales under 50 billion KRW produce parts for future vehicles, according to the survey. With Chinese parts companies dominating the global electric vehicle parts supply chain, there are calls for tailored government policy support such as research and development (R&D) assistance for parts companies.

The Automobile Industry Association held the "10th Automobile Industry Development Forum" at COEX on the 21st and announced the results of a survey conducted on 185 parts suppliers delivering to five domestic automakers.

The average time from parts development to mass production was 32.8 months, with a maximum of 84 months. Producing one type of part costs an average of 1.315 billion KRW (529 million KRW for development and 1.161 billion KRW for equipment), but only 17.8% of mass production companies reported profitability, making it difficult to recover investments and limiting reinvestment. The biggest challenge hindering future car R&D investment was cited as lack of funds by 35.6% of parts companies.

Utilization of government support programs was low. 69.4% of respondents said they had no experience using government support programs. When asked why they had no future car response plans, 77.1% answered that they did not know how to respond, such as which products to enter, confirming the need for information provision and consulting. The most urgent support needed was financial support (49.3%), and the most effective financial support methods were expanded low-interest policy financing (67.1%), increased credit loans and guarantees (16.8%), and establishment of future car dedicated investment funds (10.7%). Regarding sources of equipment investment funds, respondents answered internal funds (58.4%), bank loans (19.5%), and government policy funds (9.1%).

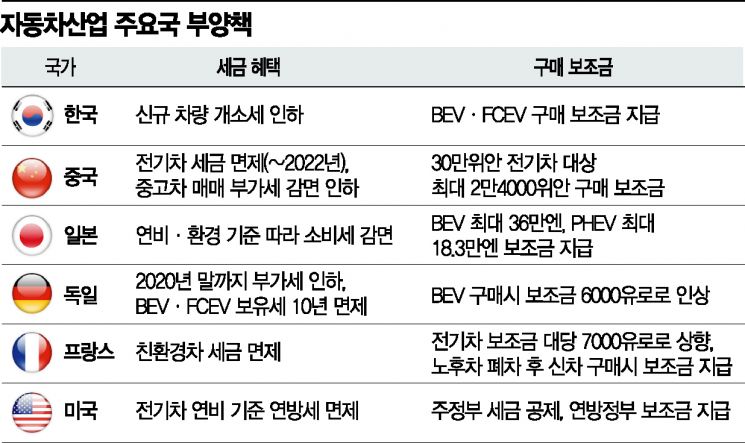

Meanwhile, in advanced automobile countries, thanks to active policy support for electric vehicle transition, electric vehicle sales from January to August this year showed growth compared to the same period last year: Germany 84%, France 102%, and Western Europe 46.3%. During the same period, electric vehicle sales in South Korea decreased by 14.8%. Attention must be paid to the movements of Chinese companies, with concerns that they could dominate the global electric vehicle parts supply chain. Currently, China's CATL supplies batteries for Tesla Model 3, and Chinese parts company Zhejiang Sanhua supplies electric vehicle thermal control parts to Volkswagen and GM, among others.

The competitiveness of Hyundai Motor Group's core parts for electric and autonomous vehicles was also pointed out as insufficient. Kim Yongwon, head of the Automobile Industry Association, said, "Among Hyundai Motor Group's electric vehicle parts, the Battery Management System (BMS) and drive motor are at levels comparable to advanced countries, but the technology competitiveness of battery packs and inverters/converters is inferior." Autonomous vehicles' sensor technology is only 30-80% of that of the U.S. and Germany, and camera recognition technology has not yet reached commercialization stage.

Jung Manki, chairman of the Korea Automobile Industry Association, emphasized, "Most parts companies develop parts and invest in equipment with their own funds, but only a few are profitable. It takes more than six years to recover investment, so there is a need to establish special loan programs or loan/guarantee programs that allow repayment over at least 10 years, along with tax support, and to strengthen systematic efforts to train specialized personnel."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.