Grades 1-2 See Interest Rates Drop for 4 Consecutive Months

Grades 9-10 Remain Unchanged

[Asia Economy Reporter Ki Ha-young] Four months after card loan interest rates were disclosed based on a standard rating system using default rates, it has been found that the loan interest rates offered to high-credit borrowers in grades 1 to 2 are decreasing.

According to the disclosure by the Credit Finance Association on the 21st, as of the end of September, the average interest rate applied to grades 1 to 2 was the lowest at 6.54% by Woori Card. In August as well, Woori Card offered the most favorable rate of 7.46% for the same grades, which is 0.92 percentage points higher than the current rate. Woori Card originally has many high-credit customers, and the launch of the 'Wooka Minus Loan,' a card loan product for high-credit customers with an annual interest rate range of 4.0% to 10% in August, is also analyzed to have influenced this trend. Following Woori Card, IBK Industrial Bank Card (7.69%) and Citibank Card (8.67%) offered relatively low card loan interest rates to high-credit borrowers.

For low-credit borrowers in grades 9 to 10, DGB Daegu Bank Card was the most favorable at 18.90%, continuing from August. Last month, four card companies including DGB Daegu Bank, Samsung, KB Kookmin, and Hyundai Card provided card loans to grades 9 to 10. Hyundai Card followed DGB Daegu Bank by offering a favorable interest rate of 20.53% to low-credit borrowers.

The card loan interest rates applied to grades 1 to 2 have been decreasing for four consecutive months since the standard rating disclosure began in June. Since July, the Credit Finance Association has standardized internal ratings of card companies into a 10-grade system based on the 'default rate,' which is the probability of being overdue for more than 90 days within one year from the loan handling date, and discloses ▲base price (non-discounted rate) ▲adjusted rate (discounted rate) ▲operating rate (final rate). This is to prevent interest rate inversion caused by marketing and to facilitate comparison of loan interest rates.

The card loan interest rates for high-credit borrowers in grades 1 to 2 sequentially decreased from 9.66% by Samsung Card in June, 7.87% by IBK Industrial Bank Card in July, 7.46% by Woori Card in August, to 6.54% by Woori Card in September. On the other hand, the interest rate offered to low-credit borrowers in grades 9 to 10 has remained unchanged since July, with DGB Daegu Bank Card offering the lowest rate at 18.90%. While the rates for high-credit borrowers are falling, low-credit borrowers have fewer borrowing options and no change in interest rates, deepening the gap between the rich and the poor.

An industry insider said, "The main users of card loans are middle-credit borrowers between grades 4 and 6," adding, "Although the proportion of high-credit borrowers in grades 1 to 2 and low-credit borrowers in grades 9 to 10 is low, card companies have no choice but to operate different interest rates according to credit grades for risk management."

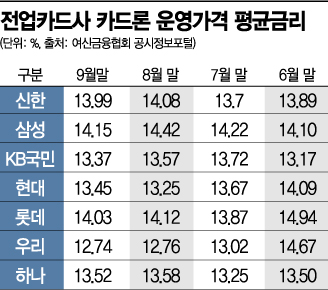

Meanwhile, as of the end of September, the average card loan interest rates (operating prices) based on the standard rating for seven full-service card companies (Shinhan, Samsung, KB Kookmin, Hyundai, Lotte, Woori, and Hana Card) recorded 12.74% to 14.15%, down 0.02 to 0.27 percentage points from the previous month. Six of the seven card companies, except Hyundai Card, lowered their rates, and the average rate of the seven companies was 13.61%, a decrease of 0.07 percentage points from 13.68% in the previous month.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.