Financial Supervisory Service Cancels Lime Registration

"Issue Causing Social Controversy"

Disciplinary Hearing for 3 Sellers on 29th

Debate Expected Over Grounds and Scope of Sanctions

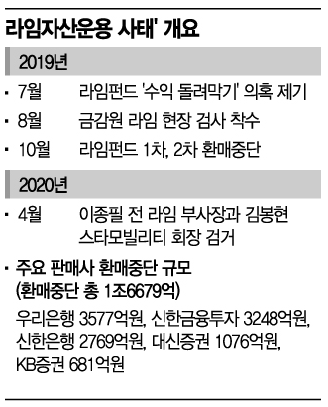

[Asia Economy Reporter Ji-hwan Park] As the financial authorities have decided to impose the highest level of sanction, 'registration cancellation,' on Lime Asset Management, which caused the private equity fund redemption suspension incident involving 1.6 trillion won, attention is focused on the results of the disciplinary committee for the securities firms that sold the funds next week. While the sanction against Lime Asset Management was considered a matter with almost no disagreement from the beginning, it is expected that there will be fierce disputes over the grounds for sanctions and the scope of responsibility regarding the fund sellers.

On the 20th, the Financial Supervisory Service (FSS) held a disciplinary committee meeting and decided to cancel the registration of Lime Asset Management. This is the highest level of sanction. Sanctions against financial companies are classified into five stages: 'registration/authorization cancellation - business suspension - corrective order - institutional warning - institutional caution.' The FSS explained, "Considering that the subject of the review is an important matter that caused social controversy, we fully listened to the statements and explanations of the management of the asset management company and the inspection department."

On the same day, the FSS also decided on a 'trust contract transfer order.' This is a preliminary measure to transfer the remaining funds of Lime Asset Management to the bridge asset management company (bad bank), 'Wellbridge Asset Management.' A dismissal request was made for key personnel of Lime Asset Management, including CEO Won Jong-jun and former Vice President Lee Jong-pil. This is also the highest level of sanction for executives of financial companies. Sanctions against financial company executives are divided into five stages: dismissal recommendation - suspension of duties - reprimand warning - cautionary warning - caution, with reprimand warning or higher classified as severe disciplinary action. The sanctions decided on this day are expected to be finalized as early as next month after going through the regular meetings of the Securities and Futures Commission and the Financial Services Commission.

Unlike Lime Asset Management, fierce disputes are expected at the disciplinary committee for the securities firms that sold the funds, scheduled for the 29th. On that day, the FSS will hold a disciplinary committee for three securities firms that sold the funds: Shinhan Financial Investment, KB Securities, and Daishin Securities. Former and current CEOs of these securities firms have been preliminarily notified of severe disciplinary actions, including suspension of duties, for failing to properly establish internal control standards and neglecting management. While the sanction on Lime Asset Management was concluded in one review, the case of the sellers is expected to be a long-term battle with multiple discussions regarding the subjects and levels of sanctions.

A financial industry official pointed out, "Sanctions against the companies or sales staff themselves are acceptable, but expanding the punishment to CEOs as actors due to insufficient internal control standards is an excessive measure." A financial investment industry official expressed concern, saying, "If CEO sanctions actually proceed, securities firms may make management decisions to completely avoid handling risky products in the future. Since these products are also a significant part of the capital market, this could lead to a systemic collapse."

The level of punishment against securities firm CEOs is also controversial because it is higher than the reprimand warnings given to Son Tae-seung, then CEO of Woori Financial Group, and Ham Young-joo, Vice Chairman of Hana Financial Group, related to the earlier DLF incident.

An FSS official explained, "In the case of banks, the product sales decision line is structured in multiple stages, and the final authority is understood to be at the head of the division level. However, in the case of securities firms, the settlement line is relatively simple, so it is judged that the CEO has that authority, making sanctions against CEOs inevitable."

Meanwhile, discussions on sanctions against banks are expected to be scheduled separately in the future. FSS Governor Yoon Seok-heon stated on the 24th of last month, "Regarding the Lime sanctions, we will first deal with the securities firms and then move on to the banks."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)