The novel coronavirus infection (COVID-19) has transformed our daily lives from being offline-centered to online-centered. This is because activities such as dining and shopping, which were mainly done outside, can now be completed at home with just one click on the internet. As online becomes the center, marketing areas such as corporate advertising are also moving online. Although the advertising sector was already shifting from traditional media like TV and radio to online (mobile), the COVID-19 situation has accelerated this trend. In fact, in this year's Advertising Business Outlook Index (KAI) survey, while traditional media were expected to perform poorly, online was forecasted to remain solid. This shows that online advertising is one of the areas with promising growth potential. Asia Economy aims to examine the current status of online growth and financial structure of advertising companies Cheil Worldwide and Eco Marketing.

[Asia Economy Reporter Yoo Hyun-seok] Cheil Worldwide is expected to recover from its sluggish performance in the first half and show improvement in the second half. This is because it possesses long-term growth drivers through digital enhancement alongside the recovery of the advertising market.

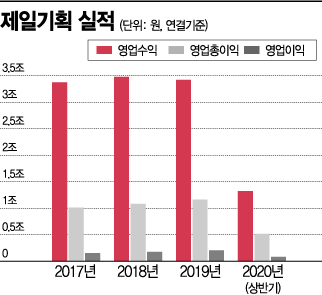

According to the Financial Supervisory Service's electronic disclosure system on the 19th, Cheil Worldwide recorded consolidated operating revenue of 1.324 trillion KRW and operating profit of 84.3 billion KRW in the first half. Compared to the same period last year, operating revenue decreased by 21% and operating profit by 17%.

In some industries such as financial companies and advertising, sales, cost of sales, and gross profit are not separately stated in the income statement. This is due to the nature of the business where production and sales timing are not distinct, unlike manufacturing. Advertising companies typically use operating gross profit, which excludes cooperative partner payment costs (a cost concept) from operating revenue, as a performance indicator.

The operating gross profit in the first half was 520.2 billion KRW, down 7% from the same period last year. The headquarters' operating gross profit was 133.7 billion KRW, a 3.26% decrease from the previous year, due to a reduction in agency volume from major advertisers. During the same period, the consolidated subsidiaries' operating gross profit was 386.5 billion KRW, down 8.5%, affected by poor performance in key markets such as Europe and China. This is interpreted as a result of decreased advertising volume due to the COVID-19 situation.

Instead, cost reduction helped to reduce the decline in operating profit compared to operating revenue. Cheil Worldwide's labor and expense costs totaled 459 billion KRW in the first half of last year but decreased to 435.9 billion KRW in the first half of this year. Notably, selling and administrative expenses (S&A expenses) as a percentage of gross profit, which was 88% in the first quarter, dropped to about 79.56% in the second quarter.

The growth in the digital sector was impressive. The digital business proportion, which was 19% in 2010, rose to 39% last year and 42% in the first half of this year, continuing to grow. This is evaluated as a successful structural improvement through strengthening digital capabilities.

The financial structure is also stable. The consolidated short-term borrowings dependency ratio was 2.7% as of the first half of this year. The debt ratio decreased from 134.4% at the end of last year to 122.4%. Cash equivalents amount to 472.8 billion KRW.

Expectations for performance improvement in the second half are high. According to FnGuide, securities firms estimate Cheil Worldwide's operating revenue and operating profit for the third quarter to be 695.7 billion KRW and 55.8 billion KRW, respectively, representing increases of 8.2% and 3.7% from the previous quarter. In the fourth quarter, performance is also expected to improve compared to the third quarter due to the peak season. Estimated sales and operating profit are 802.8 billion KRW and 64.8 billion KRW.

The biggest factor for performance improvement is the recovery of advertising expenses and new product launches by major clients. Cheil Worldwide handles all domestic advertising volume for Samsung Electronics. When advertising spending increases due to new product launches, it benefits Cheil. Researcher Lee Hyun-ji of Eugene Investment & Securities said, "In the second half of this year, many new products will be unveiled by Samsung Electronics, and advertising spending is expected to increase. Cheil Worldwide's gross profit is also expected to increase accordingly."

The performance growth of overseas subsidiaries is also an anticipated factor. This is because the overseas subsidiaries that showed negative growth in the second quarter are expected to turn around in the third quarter. In particular, it is expected that the decline will be mitigated compared to the first half, centered on Southeast Asia where digital transformation is underway, China with a high digital proportion, and the U.S. where captive volume is secured. Researcher Eom Tae-woong of Bookook Securities explained, "Europe, where the proportion of non-affiliated companies is relatively high, is still slow to recover from the impact of COVID-19, so negative growth is inevitable. However, the recent increase in Samsung Electronics' advertising execution and performance improvement centered on North America, China, and Southeast Asia, where digital advertising is high, will cover this and lead to a rebound in the performance of all overseas subsidiaries in the second half."

The global advertising market's continuous expansion of the online market is also a positive aspect. According to U.S. market research firm eMarketer, global advertising expenditure this year is expected to be 614.73 billion USD, a 4.9% decrease from the previous year, but digital advertising is projected to increase by 2.4% to 332.84 billion USD. The same applies domestically. According to the Korea Online Advertising Association, the online advertising market size, which was 64.213 trillion KRW last year, is expected to exceed 77 trillion KRW this year, surpassing the offline market for the first time. This shows that despite the COVID-19 situation, the online advertising market remains solid.

Cheil Worldwide is expected to grow in this field as it has strengthened its digital sector by acquiring various overseas advertising companies in the past. Researcher Lee emphasized, "Through mergers and acquisitions (M&A), it is securing non-affiliated advertiser volume and internalizing digital capabilities by acquiring numerous digital and retail-based advertising companies. Major digital subsidiaries, China's Pungtai and the U.S.'s TBG (The Barbarian Group), are steadily growing, and the proportion of digital business through local subsidiaries is increasing every year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.