Fair Trade Commission files criminal complaint against Changsin INC for aiding unfair support practices

and imposes a fine of 38.51 billion KRW

[Asia Economy Reporter Moon Chaeseok] Changshin, a mid-sized company that manufactures Nike shoes through an Original Equipment Manufacturer (OEM) method, was caught by the Fair Trade Commission (FTC) for unfairly supporting Seohung, a company whose largest shareholder is the son of the group chairman, through its overseas production subsidiaries. The FTC decided to file a criminal complaint against Changshin INC and impose corrective orders along with a fine of 38.518 billion KRW.

Changshin Dominates the Shoe Material Purchasing Agency Market

On the 13th, the FTC announced that it imposed fines of 15.293 billion KRW on Changshin INC, the instigator of the unfair support; 9.463 billion KRW on Seohung, the beneficiary; 6.27 billion KRW on Changshin Vietnam; 4.678 billion KRW on Qingdao Changshin; and 2.814 billion KRW on Changshin Indonesia.

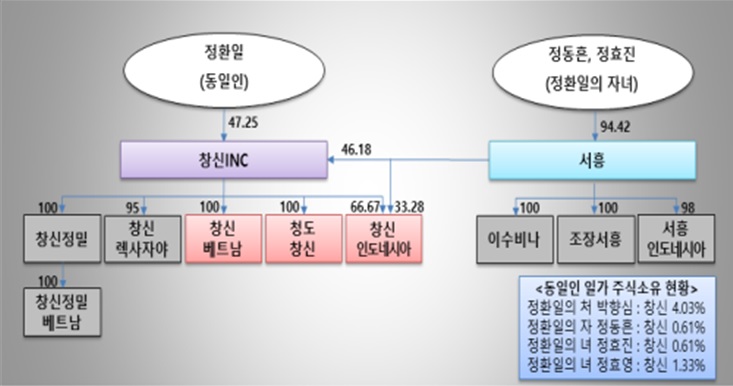

Changshin INC is a company that receives orders from Nike to manufacture shoes via the OEM method and supplies them to Nike through its overseas production subsidiaries. Among the materials (components) needed to manufacture Nike shoes, those produced domestically are purchased through Seohung, which acts as a purchasing agent, and in return, Seohung receives agency fees.

Unfair Support to Seohung, Led by the Son of Changshin Group Chairman

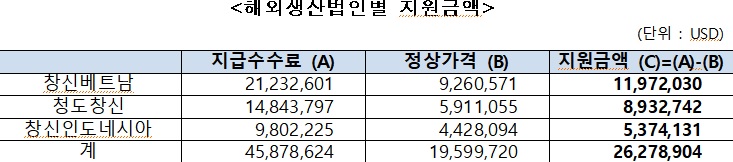

Changshin INC instructed its overseas subsidiaries to increase the commission rates paid to Seohung to secure Seohung’s liquidity. From June 2013 to June 2016, these subsidiaries raised the shoe material purchasing agency commission rate by about 7 percentage points. During this period, the overseas subsidiaries paid Seohung a total of 45.88 million USD (approximately 53.4 billion KRW) in agency fees.

This amount is 2.3 times the normal price of 19.6 million USD (approximately 22.9 billion KRW). As a result, Seohung received 26.28 million USD (about 30.5 billion KRW) in cash. This sum accounts for 44% of Seohung’s operating profit of 68.7 billion KRW during the same period. Until the end of 2012, the commission rates were only 4% for Changshin Vietnam, 5% for Qingdao Changshin, and 3.6% for Changshin Indonesia.

The FTC found no special changes in roles or circumstances that would justify the increased commission rates paid to Seohung. The overseas subsidiaries were struggling with management difficulties such as being fully capital impaired and operating losses. On the other hand, Seohung secured sufficient liquidity through the support. At the end of 2012, Seohung had only 2.1 billion KRW in cash, indicating a shortage of cash liquidity.

"Violation of the Fair Trade Act... Evidence of Unfair Support to Acquire Management Rights"

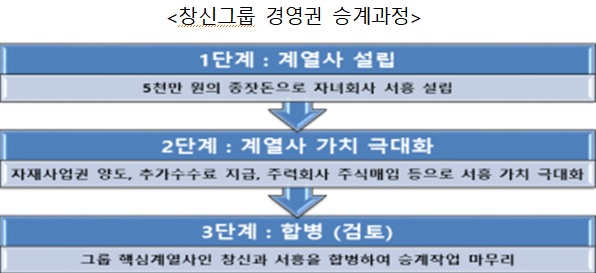

In April 2015, during the support period of this case, Seohung purchased a large number of shares of Changshin INC and became the second-largest shareholder. Seohung acquired 99,455 shares (30.14% stake, 58.6 billion KRW) from Jung Hwan-il, chairman of Changshin Group, and former Changshin executives, securing a 46.18% stake in Changshin INC. In 2018, a merger between Changshin INC and Seohung was also considered. Had the merger occurred, the largest shareholder of Changshin INC could have shifted from Chairman Jung to Jung Dong-heun, Seohung’s CEO and largest shareholder, effectively laying the groundwork for succession of management rights.

The FTC judged that these support actions by Changshin Group violated Article 23 of the Monopoly Regulation and Fair Trade Act (Fair Trade Act). Due to the support, Seohung’s monopolistic position in the shoe material purchasing agency market was strengthened, and potential competitors were blocked from entering. As a result, the FTC views that fair trade order was undermined. The transaction scale of this case (an average of about 157 billion KRW annually) accounts for approximately 39% of the total transaction amount in the shoe material purchasing agency market for shoe OEM and Original Design Manufacturer (ODM) companies (an average of about 401.7 billion KRW annually).

"Monitoring Unfair Support Regardless of Corporate Group Size"

The FTC emphasized that there are no exceptions to regulating unfair support acts even for mid-sized corporate groups that are not large conglomerates.

Lee Sang-hyup, head of the FTC’s Unfair Support Monitoring Division, explained, "It is significant that we identified and corrected illegal acts that caused unfair trade obstruction and wealth transfer effects through unfair support in markets where mid-sized corporate groups have high dominance. It is also meaningful that this is the first time a fine has been imposed on overseas affiliates involved in unfair support."

The FTC stated that it will continue to strengthen monitoring activities on mid-sized corporate groups with high market dominance in their respective markets. Regardless of corporate group size, it plans to prevent and correct unfair support acts by leading corporate groups.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)