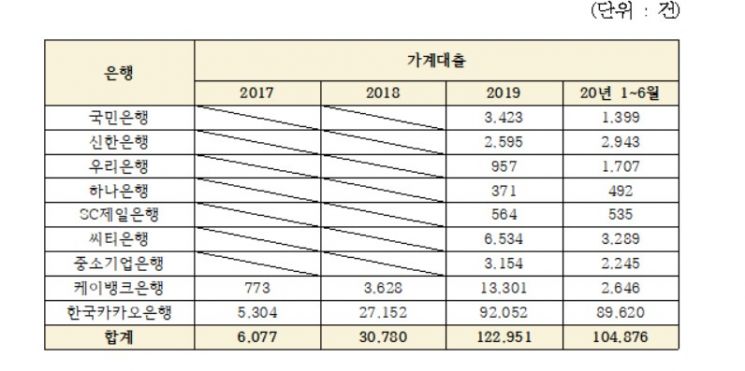

Number of Accepted Requests for Interest Rate Reduction (Non-face-to-face)

Number of Accepted Requests for Interest Rate Reduction (Non-face-to-face) Source: Office of Assemblyman Kim Byung-wook

[Asia Economy Reporter Park Sun-mi] The demand for interest rate reductions in the banking sector is rapidly increasing. This is attributed to the activation of non-face-to-face applications amid the COVID-19 atmosphere.

According to statistics submitted by the Financial Supervisory Service to Kim Byung-wook, a member of the National Assembly's Political Affairs Committee from the Democratic Party of Korea, the total number of interest rate reduction requests received by banks from 2017 to the first half of 2020 was 1,155,161. The estimated interest savings during the same period amounted to approximately 113.7 billion KRW.

The number of interest rate reduction requests increased from 113,071 in 2017 to 228,558 in 2018, 478,150 in 2019, and further to 338,082 in the first half of 2020, showing a steep upward trend. The number of accepted interest rate reduction requests also rose from 45,820 in 2017 to 60,877 in 2018, 143,059 in 2019, and 143,059 in the first half of 2020.

An interest rate reduction request is a right that allows customers to ask banks to lower their loan interest rates based on improved credit status, such as an upgraded credit rating, employment or promotion, or asset growth. The recent expansion of non-face-to-face applications, which were previously limited to internet banks, to commercial banks starting January last year has led to the surge in interest rate reduction requests.

Looking at the proportion of non-face-to-face applications among all interest rate reduction requests, it rose from 60.3% in 2017 to 85.9% in 2018, 95.2% in 2019, and 98.2% in the first half of 2020. This indicates that most financial consumers are reducing their loan interest easily and conveniently online without visiting bank branches.

Lawmaker Kim Byung-wook stated, “Although the application for interest rate reduction rights has been voluntarily implemented by each bank since 2002, it has been significantly increasing since its legalization in June 2019. However, it is regrettable that the acceptance rate of interest rate reduction requests remains in the 30% range, with 41.5% in 2017, 26.6% in 2018, 29.9% in 2019, and 32.5% in the first half of this year.” He emphasized, “Banks and financial authorities should actively promote and strive to increase the acceptance rate so that many financial consumers can enjoy their rights and benefits.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)