AA- 5-Year Bonds More Attractive for Investment Than A+ 3-Year Bonds

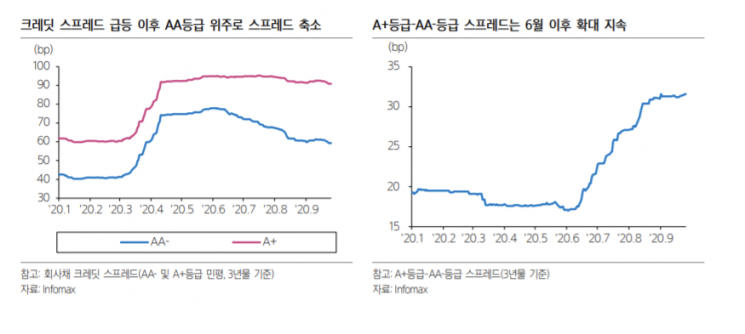

[Asia Economy Reporter Minji Lee] While AA-rated corporate bonds are showing strength in the credit market, A-rated bonds continue to exhibit weakness. Following a sharp widening of credit spreads due to credit market instability caused by short-term funding market tightening in March, credit spreads for high-grade corporate bonds have narrowed through policy support, but A-rated corporate bond credit spreads have shown a different trend.

On the 30th, Samsung Securities analyzed that the reason why credit spreads for non-investment grade corporate bonds rated A and below have not narrowed after widening is that their absolute yield investment attractiveness is relatively low, causing them to be sidelined in the corporate bond market. In the context of increased credit risk due to corporate earnings slowdown following the spread of COVID-19, the absolute yield appeal is significantly lower compared to high-grade bonds.

Researcher Eun-gi Kim of Samsung Securities explained, “For A-rated corporate bonds, the absolute yield merit compared to AA-rated bonds is important,” adding, “If A-rated corporate bonds do not possess the absolute yield attractiveness, the investment proportion in A-rated corporate bonds will decline accordingly.”

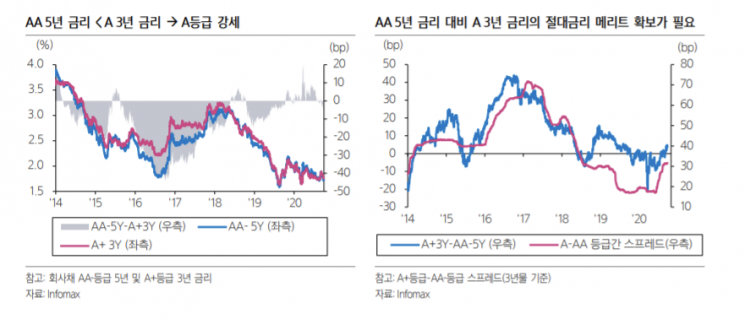

Looking at the 3-year yields of AA- and A+ rated bonds, it is generally the case that A+ rated bonds have higher yields. However, due to the recent widening of the short- and long-term spread, the yields of AA- rated 5-year bonds and A+ rated 3-year bonds are at similar levels. From an investor’s perspective, if investing in AA- rated 5-year bonds can secure an absolute yield comparable to A+ rated 3-year bonds, it is generally preferable to invest in AA- rated 5-year bonds. Given the same yield, investors would rather take on duration risk by investing in AA-rated bonds, which have lower credit risk, than invest in A-rated bonds. This means investing in AA-rated bonds offers an opportunity to increase absolute yield.

Researcher Kim stated, “From the perspective of credit spread narrowing, sufficient returns can be achieved through investment in AA-rated corporate bonds,” and forecasted, “Since AAA-rated bonds have already seen their spreads narrow to pre-COVID-19 levels, credit spreads for AA-rated bonds are also expected to narrow to pre-COVID-19 levels in the credit market by the first quarter of next year, similar to AAA-rated bonds.”

The timing for expanding the proportion of A-rated corporate bonds is considered appropriate when the investment attractiveness of AA-rated bonds declines. If AA-rated corporate bond spreads narrow to COVID-19 levels, there will likely be limited room for further credit spread compression in the near term. Subsequently, investors are expected to broaden their interest in A-rated corporate bonds.

In terms of absolute yields, if the yield on AA- rated 5-year corporate bonds decreases to a level closer to that of A+ rated 3-year bonds, the absolute yield investment appeal of A-rated corporate bonds is expected to increase relatively. In the past, between 2016 and 2017, when the yield on AA- rated 5-year bonds fell significantly below that of A+ rated 3-year bonds, the investment proportion in A-rated corporate bonds began to expand starting in 2017.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.