In August of last year, demolition work was underway for reconstruction at Dunchon Jugong Apartment in Gangdong-gu, Seoul. / Photo by Mun Ho-nam munonam@

In August of last year, demolition work was underway for reconstruction at Dunchon Jugong Apartment in Gangdong-gu, Seoul. / Photo by Mun Ho-nam munonam@

[Asia Economy Reporter Lee Chun-hee] The apartment pre-sale market has officially entered the influence zone of the 'Pre-sale Price Ceiling System.' There are concerns that if housing associations switch to post-sale, which allows them to charge higher prices under the ceiling system, a 'supply cliff' could become a reality.

According to industry sources on the 29th, all pre-sale guarantee certificates issued by the Housing and Urban Guarantee Corporation (HUG) for projects that obtained them before the grace period for the price ceiling system expired the previous day have now expired. Representative cases include Raemian One Bailey in Banpo-dong, Seocho-gu (Shinbanpo 3rd Complex and Gyeongnam Apartment reconstruction) and Dunchon Public Apartment reconstruction in Dunchon-dong, Gangdong-gu.

The Raemian One Bailey association planned to sell at the higher price between HUG’s and the ceiling system’s pre-sale prices, but the prolonged price calculation period under the ceiling system disrupted their plans. A HUG official explained, "Pre-sale guarantee certificates cannot be extended, and even if reissued, they will be based on prices subject to the pre-sale price ceiling system." A Seocho District Office official said, "We understand that the association was not strongly inclined to sell at HUG’s price."

The Dunchon Public Apartment reconstruction in Gangdong-gu faced the same situation. Although the HUG pre-sale guarantee period expired on the 24th, the association requested an extension of the supplementation period from Gangdong District Office, citing the absence of a general meeting, and the office accepted, extending the approval period for the resident recruitment announcement until the 16th of next month. This led to speculation that there might still be a way to sell at the existing HUG pre-sale price, but HUG stated that since the recruitment announcement was not made by the 24th, the existing guarantee certificate has already lost its validity.

If it’s the ceiling system anyway, then post-sale... but the appropriateness evaluation of land cost is a 'hidden obstacle'

The problem is that many reconstruction associations, fearing that general pre-sale prices will fall under the ceiling system, are showing signs of choosing post-sale. While they cannot avoid the ceiling system itself, if land prices rise, they can raise pre-sale prices accordingly.

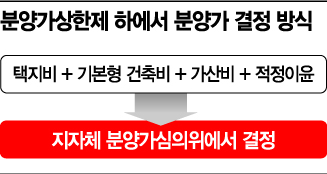

Under the ceiling system, pre-sale prices are determined by the local government’s pre-sale price review committee based on 'land cost + standard construction cost + additional costs' plus an appropriate profit margin. Since land prices continue to rise, if a higher land cost is recognized three years later, pre-sale prices can be expected to increase. In the case of Raemian One Bailey, there are predictions that the land cost alone could reach 44 million KRW per 3.3㎡, which is comparable to HUG’s pre-sale price of 48.91 million KRW.

However, conflicts may arise during the appropriateness review process conducted by the Korea Appraisal Board. Housing subject to the pre-sale price ceiling system in private land areas must undergo land price appraisal by an appraiser designated by the local government. Subsequently, the local government head must request the Korea Appraisal Board to review the appropriateness of the appraisal.

In fact, according to data submitted by the Korea Appraisal Board to Rep. Jeong Dong-man of the National Assembly Land, Infrastructure and Transport Committee from the People Power Party, after the expanded implementation of the pre-sale price ceiling system in private land, the Korea Appraisal Board requested reappraisal for all seven projects in Seoul where appropriateness reviews were requested.

The locations in Seoul where reviews were conducted at the request of local governments include ▲Nakwon and Cheonggwang Apartment Complexes in Seocho-dong, Seocho-gu ▲Byeoksan Villa in Sangil-dong and 632 Dunchon-dong in Gangdong-gu ▲Valcucine House in Gonghang-dong, Gangseo-gu ▲Sweet Dream Apartment in Sinwol-dong, Yangcheon-gu ▲1486-17 Seocho-dong, Seocho-gu ▲and Yeokchon 1 Housing Reconstruction in Eunpyeong-gu, totaling seven sites. According to Rep. Jeong’s office, except for Nakwon and Cheonggwang Apartment Complexes in Seocho-dong, land cost reductions actually occurred in the other six locations.

Within the industry, there are concerns that as more complexes choose post-sale and conflicts over land costs intensify, the supply cliff will accelerate. Professor Kwon Dae-jung of Myongji University’s Department of Real Estate said, "It is natural to face a supply cliff," and predicted, "There will be more cases of post-sale or rental pre-sale in the Gangnam area due to the pre-sale price ceiling system."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.