Aftermath of DLF and Lime Scandals... Approval of Model Guidelines for Internal Control of Non-Deposit Products such as Funds and Trusts

[Asia Economy reporters Kangwook Cho, Sunmi Park, Minyoung Kim] "Even now, when customers come looking to subscribe to any private or public funds, the procedures are so complicated that we end up recommending savings accounts. It's difficult to sell through non-face-to-face channels, so if customers want to subscribe, they have to come to the branch, but the model guidelines basically say not to sell at all." (A bank loan officer)

The aftermath of the interest rate-linked derivative-linked funds (DLF) and Lime incidents has ultimately hampered banks' operations. Going forward, the sale of 'non-deposit' products such as funds, trusts, and variable insurance, which do not guarantee principal, will be subject to stricter regulations. Banks must form an executive-level consultative body to oversee product policies, and if problems arise, the board of directors including the CEO will be held accountable. This essentially means that the sale of principal-loss products could be blocked. Amid concerns over profitability and financial soundness deterioration due to the COVID-19 pandemic and ultra-low interest rates, banks are likely to have to change their sales strategies as investment product sales face restrictions.

According to the financial sector on the 29th, the Financial Supervisory Service and the Korea Federation of Banks established internal control model guidelines for non-deposit products such as funds, trusts, pensions, over-the-counter derivatives, and variable insurance as a follow-up measure to the DLF incident. Banks plan to incorporate these guidelines into their internal regulations and implement them by the end of this year.

According to the guidelines, banks must form and operate an executive-level consultative body called the 'Non-Deposit Product Committee' to oversee policies related to non-deposit products. The committee must include external experts, the Chief Risk Officer (CRO), the compliance officer, and the Chief Consumer Officer (CCO). Particularly, high-difficulty financial products, overseas alternative funds, and products with a risk rating of medium or higher must be directly reviewed by the committee. The committee's review results must be reported to the CEO and the board of directors, and related materials must be kept for 10 years in written or recorded form. This means that if problems occur, the CEO and the board cannot avoid responsibility.

When selling funds at bank counters, the consultation process is recorded, and customers must read and sign the 'Investment Explanation Consent Form' by hand to subscribe to the fund. Also, the customer groups and total limits for sales are predetermined according to the product risk.

The market expects that it will become difficult to sell high-risk fund products at banks in the future. While this is welcomed from the perspective of risk management and fostering a mature investment culture, there are concerns that all investment products except savings and deposits might have to be discontinued. Sales of high-difficulty private funds by banks are already restricted. High-difficulty financial products refer to those with a maximum possible principal loss exceeding 20%, mixed with derivatives, and having a complex structure that is difficult for investors to understand.

A B bank official said, "It is natural to have additional verification processes when selling investment products," but added, "However, subscribing to investment products is about aiming for extra returns, and it seems that bank customers will start from the premise of only subscribing to principal-guaranteed products with no risk at all." The official also said, "In the end, it sounds like they are telling us not to sell investment products."

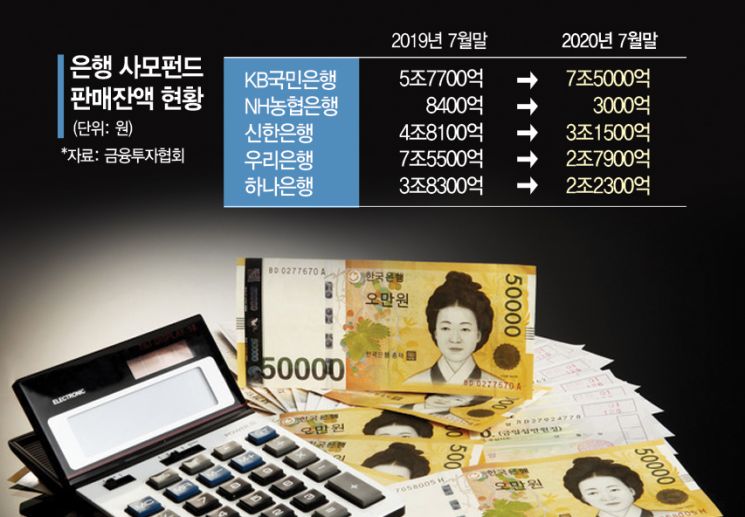

Sales of private fund products by banks are sharply declining. According to the Korea Financial Investment Association, as of the end of July this year, the proportion of private fund sales by banks was about 5.10%, shrinking by 2.51 percentage points from 7.61% a year earlier. This contrasts with the securities industry's private fund sales proportion, which rose from 82.02% to 83.87% during the same period.

With the financial support burden caused by the COVID-19 crisis and even interest margin income decreasing, the asset soundness of commercial banks is deteriorating. According to the Financial Supervisory Service, the net interest margin (NIM), a profitability indicator for banks' interest income, recorded a record low of 1.42% in the second quarter, down from 1.46% in the first quarter. Concerns over insolvency due to marginal companies are also growing.

A C bank official expressed concern, saying, "Sales of all investment products except deposits are already decreasing, and with the strengthened regulations, it will inevitably shrink further."

In fact, branches have started recommending savings accounts instead of investment products. For example, subscribing to a fund takes about 45 minutes to an hour, while a savings account can be opened in 15 minutes. Because of the time required to subscribe to funds, some customers get frustrated and give up. Also, some non-deposit products are excluded from bank employees' performance indicators, and the burden of having customer returns reflected in performance evaluations means there is no incentive to recommend investment products.

There are also voices expressing concern about future growth contraction due to regulations that shift all responsibility to banks. In particular, it is pointed out that banks will inevitably fall behind in competition with big tech companies like Naver Financial, which are not subject to such regulations.

A D bank official sighed, "Currently, banks are trying to strengthen internal controls and consumer protection to prevent incomplete sales, but if such regulations keep being created, it will act as a limit to bank growth," adding, "Big tech companies are expanding their financial businesses aggressively without proper regulation, so banks will naturally fall behind in competition with them."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.