Calls for Applying the Same Regulations to Big Tech

Naver Pay and Kakao Pay: "Fee Rates Cannot Be Simply Compared"

[Asia Economy Reporter Park Sun-mi] As political criticism mounts over the exorbitantly high commission rates charged by big tech (large information and communication companies) to their merchants, calls for urgent regulatory measures are growing louder.

Amid the already severe damage and hardship faced by small business owners due to the novel coronavirus disease (COVID-19), politicians argue that big tech merchants are profiteering in regulatory blind spots. While big tech companies claim it is unfair to simply compare them to card companies, there are calls to apply the same regulations to big tech firms using payment methods similar to card companies, especially as non-face-to-face transactions become more prevalent.

According to political and financial circles on the 28th, ahead of the amendment to the Electronic Financial Transactions Act, there is a consensus within the National Assembly that if the amendment fails to properly regulate big tech, a comprehensive investigation by case will be conducted to prevent big tech from benefiting in regulatory blind spots.

Yoon Chang-hyun, a member of the National Assembly’s Political Affairs Committee from the People Power Party, stated, "Currently, big tech companies like Naver Pay and Kakao Pay are actively providing payment services and crossing into the business areas of traditional financial companies, but there are no relevant regulations due to the lack of legal grounds." He added, "There is a consensus among many ruling and opposition lawmakers in the National Assembly on the need for regulations targeting big tech companies that are in regulatory blind spots."

"Naver Pay and Kakao Pay Charge Small Business Merchants 2 to 3 Times Higher Commission Fees"

A representative example of big tech’s unfairness is the payment service commission rates, which are set absurdly higher than credit card fees due to the absence of regulations. It is pointed out that Naver Pay and Kakao Pay charge small business merchants about 2 to 3 times more in commission fees than card companies.

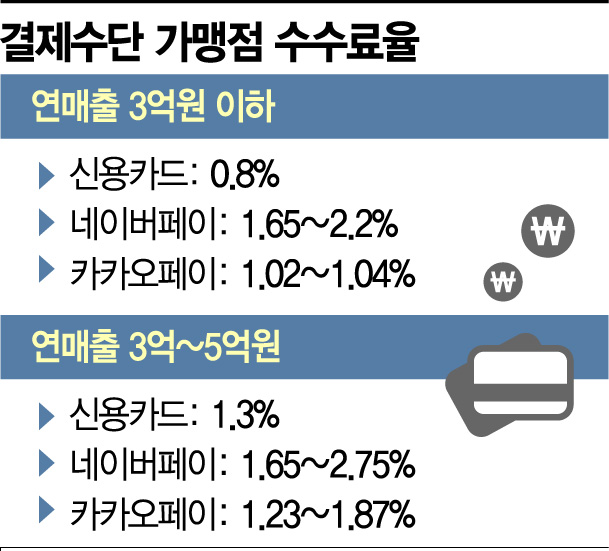

According to data disclosed by Representative Yoon, as of the first half of this year, the credit card commission fee for small merchants with annual sales under 300 million KRW is 0.8%, whereas Naver Pay’s rate ranges from 1.65% to 2.2%, and Kakao Pay’s rate ranges from 1.02% to 1.04%. For merchants with annual sales between 300 million and 500 million KRW, credit card fees are 1.3%, while Naver Pay and Kakao Pay’s fees rise to as high as 2.75% and 1.87%, respectively.

Taking advantage of the regulatory gap, the market size of the pay industry is snowballing. Kakao Pay’s payment amount in the first half of this year reached 4.8483 trillion KRW, surpassing five times the total of 890.2 billion KRW in 2017.

No Woong-rae, a senior member of the Democratic Party of Korea, also sharply criticized the simple payment services that have evaded big tech regulations on the 25th. No said, "Naver Pay and Kakao Pay are charging more than 1% higher fees compared to credit cards. The reason they are not penalized despite high commission rates is because they are in a regulatory blind spot."

No reminded that the simple payment amount reached 39 trillion KRW in the first half of this year, with Naver Pay and Kakao Pay accounting for 41% of that total, and pointed out that lowering the high commission fees imposed by the pay industry is an urgent issue.

Pay Industry’s "Unfair" Explanation: Commission Rate Comparison Cannot Be Made by Simple Numbers Alone

On the other hand, the pay industry claims it is unfair.

They argue that the commission rates charged to merchants include various service provision costs, operating expenses, and card company fees, so it is inappropriate for politicians to simply compare the numbers with credit card companies. For example, Naver Pay provides merchants with 'sales tools' such as order receipt and management, shipping, exchanges, and returns, so even if the commission rate is high, the company is not making excessive profits.

Kakao Pay also explained, "The commission fees charged to merchants mainly include card company fees, payment gateway (PG) fees, and system operating costs. About 80% of the total commission is the cost paid to card companies, and Kakao Pay, as a PG company, recruits, screens, and manages merchants on behalf of card companies, while providing user benefits such as instant discounts and coupons, contributing to customer acquisition and sales growth for merchants."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)