Double-Digit Decline in Aviation Fuel, Diesel, and Gasoline Consumption

Urgent Need for Recovery in Petroleum Product Demand

Overseas Refiners Closing Plants or Selling Petroleum Businesses

[Asia Economy Reporter Hwang Yoon-joo] Although the refining margin, which gauges the profitability of oil refiners, has risen to the zero-dollar range, concerns are emerging that profitability improvement within the year will fall short of expectations due to delayed recovery in oil demand.

According to industry sources on the 29th, the Singapore complex refining margin for the fourth week of September was $0.5, down $0.1 from the previous week. The average refining margin price for this month barely maintained the zero-dollar range at $0.05.

Although the refining margin has remained positive for two consecutive weeks, the outlook for the refining industry in the second half of the year is bleak. This is because oil consumption remains at a low level.

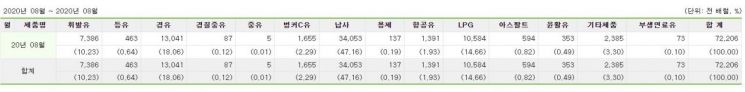

In August, petroleum product consumption was 72.206 million barrels, down 11.8% compared to the same period last year (81.915 million barrels). The product with the largest demand decline was jet fuel. Jet fuel, which accounted for 9-14% of refiners' sales and was a high-margin product, has recently faced sales difficulties due to restrictions on international travel.

In fact, jet fuel consumption in August was 1.391 million barrels, a sharp drop of 51.2% compared to 2.852 million barrels in the same period last year. Other major products also decreased: diesel by 20.7%, gasoline by 14.1%, and lubricants by 15.3%.

Despite international oil prices rising to the $30-40 range, the delayed recovery in petroleum product consumption is preventing refining margins from moving out of the zero-dollar range, according to the refining industry.

Overseas, cases of shutting down production plants or selling oil businesses due to a sharp drop in oil demand are emerging. Japan's largest refiner, ENEOS, has decided to close its Osaka refinery starting next month. Although it is a large-scale refining facility producing 115,000 barrels per day, the operating rate of ENEOS's 11 refineries plummeted to 68% from April to June following the COVID-19 outbreak.

British Petroleum (BP), the world's largest oil company, reduced its daily oil production from 2.6 million barrels to 1.5 million barrels and sold its petrochemical division. Marathon Petroleum, the largest refiner in the United States, plans to permanently close one refinery each in Martinez, California, and Gallup, New Mexico.

An industry official said, "We expected oil consumption to rebound from the second half of the year, but due to the recent resurgence of COVID-19 and the contraction of consumption mainly in transportation fuels, it will be difficult for the refining sector's profitability to improve within the year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.