[Asia Economy Reporter Koh Hyung-kwang] Recently, institutional investors have been aggressively selling stocks in the domestic stock market. The scale of stocks sold over the past four months has reached 14 trillion won. This is attributed to a combination of fund redemptions and pension funds adjusting their stock ratios. The selling trend by institutions is expected to continue until the end of the year.

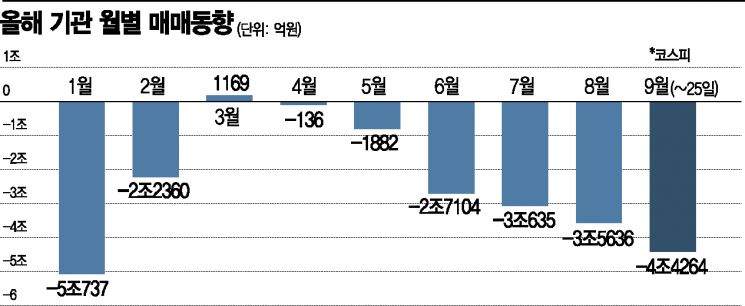

According to the Korea Exchange on the 28th, institutional investors have net sold 4.4264 trillion won in the KOSPI market from the beginning of this month until the 25th. This is the largest monthly amount since January this year (5.0754 trillion won). Since the beginning of this year, institutions have only recorded net buying once in March (116.9 billion won) in the KOSPI market, selling stocks continuously otherwise. In particular, the selling volume has gradually increased in the second half of the year with June at -2.7104 trillion won, July at -3.0635 trillion won, and August at -3.5636 trillion won.

Even this month, except for only three trading days on the 14th (107.4 billion won), 21st (39.2 billion won), and 25th (72.7 billion won), stocks were sold on 17 trading days. There were seven days when net selling exceeded 300 billion won per day. The total stocks sold over the past four months reached a staggering 13.7639 trillion won, which is 3.7 times the net selling amount by foreigners (3.7353 trillion won) during the same period.

The selling trend was led by pension funds. Over the past four months, pension funds net sold 4.5205 trillion won in the KOSPI market, accounting for one-third of the total institutional selling amount (13.7639 trillion won). Following pension funds were investment trusts (-3.5328 trillion won), financial investments (-1.8174 trillion won), private equity funds (-1.7492 trillion won), and insurance (-1.2799 trillion won).

Institutions showed a similar pattern in the KOSDAQ market. Except for March (49.6 billion won), they showed a selling dominance every month. This month, they sold the most this year with 1.7521 trillion won, and the net selling amount in the KOSDAQ market over the past four months reached 4.8977 trillion won.

The large-scale selling by institutions is largely analyzed as being influenced by pension funds adjusting their stock ratios and fund redemptions. In particular, for the National Pension Service (NPS), considered the main pension fund, the proportion of domestic stocks in total managed assets is fixed, so the selling trend continues as they adjust this ratio. As of the end of June, the NPS held 132 trillion won in domestic stocks, accounting for 17.5% of total assets (752.2 trillion won). This exceeds the NPS's target domestic stock ratio of 17.3% for this year by 0.2 percentage points. An asset management company official explained, "As of the end of June, to meet the 17.3% domestic stock ratio, the NPS would need to sell about 1.5 trillion won worth of stocks," adding, "Considering the performance of other assets held by the NPS since July, the actual selling volume could be much larger."

Fund redemptions are also cited as a factor increasing the selling pressure from institutions. As individuals shift from indirect to direct investment, institutions have no choice but to sell stocks to meet individuals' fund redemption demands. A securities company official said, "When money flows out of funds, asset management companies have to sell stocks held by the funds to prepare redemption payments. Recently, about 1.8 trillion won has flowed out of domestic equity funds in the past month," adding, "This is why the selling volume of investment trusts, represented by publicly offered funds managed by asset management companies, is large."

There is a forecast that the institutions' 'selling' trend will continue for the time being. A financial investment industry official said, "Among institutional investors, pension funds, which have the greatest influence, have already filled their domestic stock ratios, making it difficult to buy more stocks. With continued redemptions of equity funds by public and private fund investors, securities companies and investment trusts are also expected to maintain their selling pressure for the time being."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.