Up to 100 Million KRW with 0.03~0.53% Interest Rates... Total Scale of 300 Billion KRW

Virtually 'No Screening' for up to 30 Million KRW... Mobile and Online Applications

On the 19th, the government strengthened social distancing measures in the Seoul metropolitan area to curb the explosive spread of the novel coronavirus infection (COVID-19). Gatherings and events with more than 50 people indoors or more than 100 people outdoors are, in principle, prohibited until the 30th of this month. This applies not only to exhibitions, public hearings, commemorative ceremonies, and recruitment exams but also to private gatherings such as weddings, alumni meetings, 60th birthday parties, funerals, and first birthday parties, which cannot be held with many people present. Twelve types of high-risk facilities will be closed. These include clubs, room salons, and other entertainment bars, colatecs, danran bars, emotional bars, hunting pochas, karaoke rooms, indoor standing concert halls, indoor group exercise (intense GX types), buffets (including those in wedding halls), PC rooms, direct sales promotion centers, and large academies (with 300 or more people). The photo shows the scene of the Youth Street in Jonggak, Seoul, on that day. Photo by Moon Honam munonam@

On the 19th, the government strengthened social distancing measures in the Seoul metropolitan area to curb the explosive spread of the novel coronavirus infection (COVID-19). Gatherings and events with more than 50 people indoors or more than 100 people outdoors are, in principle, prohibited until the 30th of this month. This applies not only to exhibitions, public hearings, commemorative ceremonies, and recruitment exams but also to private gatherings such as weddings, alumni meetings, 60th birthday parties, funerals, and first birthday parties, which cannot be held with many people present. Twelve types of high-risk facilities will be closed. These include clubs, room salons, and other entertainment bars, colatecs, danran bars, emotional bars, hunting pochas, karaoke rooms, indoor standing concert halls, indoor group exercise (intense GX types), buffets (including those in wedding halls), PC rooms, direct sales promotion centers, and large academies (with 300 or more people). The photo shows the scene of the Youth Street in Jonggak, Seoul, on that day. Photo by Moon Honam munonam@

[Asia Economy Reporter Jo In-kyung] On the 28th, the Seoul Metropolitan Government announced that it will provide special ultra-low interest loans with interest rates in the 0% range, up to a maximum of 100 million KRW per business, to 'businesses subject to gathering bans' and 'facilities required to comply with quarantine rules' that have been hit by business suspension or restrictions due to social distancing measures, including restaurants, PC rooms, and karaoke rooms. This measure is aimed at small business owners facing threats to their livelihoods beyond just a decrease in sales since the outbreak of the novel coronavirus disease (COVID-19), with a total scale of 300 billion KRW.

This loan support offers unprecedented ultra-low interest rates ranging from 0.03% to 0.53% per annum (based on current rates), which can be quickly applied through 'no-visit' and 'simplified screening' processes via mobile and online channels. In particular, for amounts up to 30 million KRW, the screening for support limits is boldly omitted unless there are special disqualifications, effectively processing the application without screening. Businesses with credit ratings up to grade 7 can receive support even without sales, even if they have already received loans with guarantees, and additional support is possible even if they have previously received emergency COVID-19 funds.

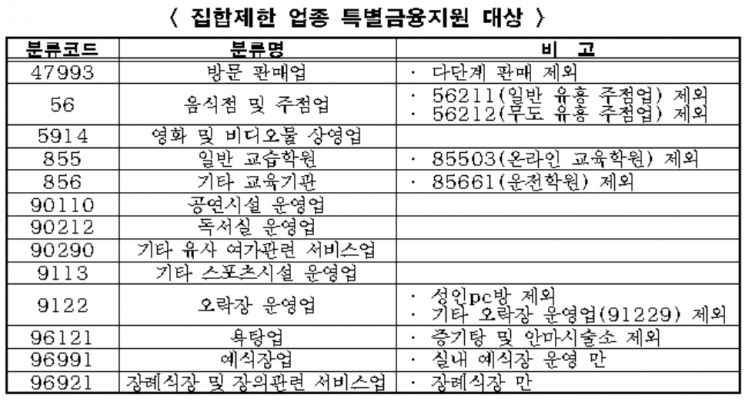

The support targets most gathering ban and restriction industries (including those required to comply with quarantine rules), excluding colatecs and adult entertainment bars. This includes gathering ban industries such as singing practice rooms, indoor standing concert halls, indoor sports facilities, door-to-door sales businesses (excluding multi-level marketing), academies, buffets, danranjupum (karaoke bars), gamseongjupum (emotion bars), hunting pocha (hunting pubs), as well as PC rooms, general restaurants, snack bars, bakeries, franchise coffee and beverage specialty stores, confectionery and bakery shops, ice cream and bingsu specialty stores, arcades, indoor wedding halls, multi-rooms, DVD rooms, study cafes, vocational training institutions, and funeral halls.

Eligible businesses must be located in Seoul with at least six months of operation, and the representative’s credit rating from a credit evaluation company (CB) must be between grades 1 and 7. The Seoul Credit Guarantee Foundation will provide a full guarantee of the debt (100% guarantee ratio) with a minimum guarantee fee of 0.5%. However, colatecs and adult entertainment bars are excluded from support as they are subject to re-guarantee restrictions by the Korea Credit Guarantee Fund Central Association, and businesses with overdue or delinquent payments are also excluded.

Applications can be submitted non-face-to-face through the Seoul Credit Guarantee Foundation website or the Hana Bank mobile app, and in-person applications can be made at the 'Seoul City Livelihood Finance Innovation Desk' established at five financial institutions (Shinhan, Woori, Kookmin, Hana, Nonghyup) for one-stop support.

Meanwhile, along with this special financial support for businesses subject to gathering bans, the Seoul Metropolitan Government plans to expand credit supply to small business owners to 7.2 trillion KRW, extend the principal repayment grace period by an additional six months, and implement preferential loan support for self-employed individuals with employment insurance coverage, thereby providing more comprehensive support to small business owners and the self-employed.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.