Non-face-to-face Finance Specialized

Digital Loan One Box Launch

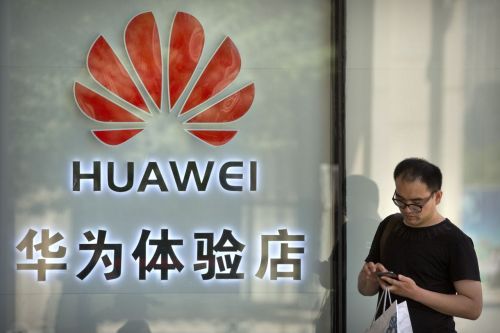

[Asia Economy Reporter Koo Chae-eun] Despite comprehensive pressure from the United States, Huawei is expanding its business scope into fintech and other areas.

On the 28th, Huawei announced on its official website that it had launched a non-face-to-face financial solution called 'Digital Loan One Box' in collaboration with China's Sunline. This solution enables customer credit evaluation, loans, online product campaigns, and risk assessment to be conducted remotely, and is built on Huawei FusionCube HCI (Hyper-Converged Infrastructure). It is an untact financial service designed in response to the spread of COVID-19, targeting markets in Southeast Asia, the Middle East, Latin America, and Africa.

Remote account opening and biometric authentication for identity verification are also possible. Online loan application and approval, fund payments, and real-time account information updates can be performed as well. Jason Cao, Head of Global Financial Services at Huawei Enterprise Business Group, stated, "Starting with 5G, we will continue to steadily expand our business areas into cloud computing and artificial intelligence (AI), with a focus on smart solutions. In the ongoing pandemic situation, this will be an efficient solution for both financial institutions and customers."

Meanwhile, the United States is exerting strong pressure on Huawei, a leading company in the 5G network construction sector, which is expected to be a core infrastructure for future advanced industries. The U.S. government claims that important information could flow to the Chinese Communist Party through networks built by Huawei and is urging countries worldwide to exclude Huawei from 5G network construction projects. In contrast, the Chinese government and Huawei argue that there is no scientific basis for these U.S. allegations and are pushing back against them.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.