Convenience Store Owners and Small Business Operators "Penetrating Traditional Alley Markets"

No Online Platform Regulations Unlike Large Marts

Issue Also Lies in Being Foreign Companies

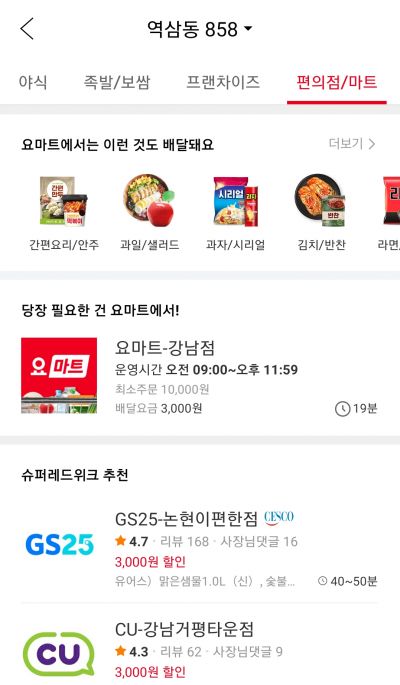

Screenshot of the 'Yomart' screen in the Yogiyo app. After setting the address to 'Gangnam Station,' the banner related to Yomart-Gangnam Branch is placed at the top of the convenience store/mart screen.

Screenshot of the 'Yomart' screen in the Yogiyo app. After setting the address to 'Gangnam Station,' the banner related to Yomart-Gangnam Branch is placed at the top of the convenience store/mart screen.

[Asia Economy Reporter Cha Min-young] Delivery platform companies Baedal Minjok and Yogiyo are aggressively promoting 'B Mart' and 'Yo Mart,' which purchase products in bulk and deliver them directly, raising concerns about the collapse of neighborhood commercial districts and intermediate distribution networks," said the Korea Convenience Store Owners Association in a statement on the 25th.

"Baemin (Baedal Minjok) and Yogiyo have expanded their businesses in response to COVID-19, destroying the foundations of small merchants and self-employed business owners," stated the Korea Federation of Small Merchants and Self-Employed on the 23rd.

The country's top two delivery applications, Baedal Minjok and Yogiyo, have become public enemies with their B Mart and Yo Mart services. They are criticized for infringing on traditional neighborhood commercial districts by exploiting regulatory gray zones as online-based platforms. Furthermore, if Delivery Hero Korea's acquisition of Woowa Brothers is finalized, it will hold over 90% market dominance, which is a concern for convenience store owners and small business operators.

According to industry sources on the 27th, Yogiyo began pilot operations of its first Yo Mart store in Gangnam, Seoul, on the 16th. As a logistics hub within the city, when an order is placed, employees pick up products and hand them over to delivery staff. Yo Mart promotes 'quick commerce.' It aims to provide next-generation logistics services that deliver anything to customers within 30 minutes without territorial restrictions, surpassing existing delivery services such as next-day, dawn, or three-hour deliveries. This is similar to B Mart, which Baedal Minjok first introduced in November last year.

Yo Mart, in particular, has sparked outrage among convenience store owners. Yogiyo has provided delivery agency services through business agreements with convenience stores such as GS25, CU, and 7-Eleven. In an instant, partners have turned into competitors. There are even suspicions among convenience store owners that information related to convenience stores was used in preparing the pilot operation of Yo Mart's first store.

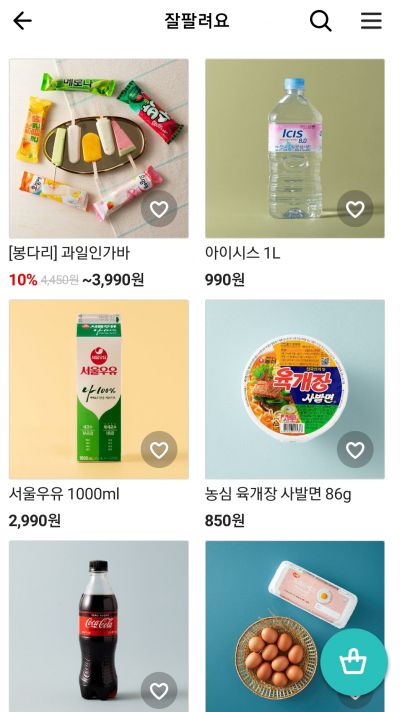

Screenshot of the 'B Mart' screen within the Baedal Minjok app. Ice cream, milk, bowl noodles, cola, and eggs are ranked at the top in the bestsellers section.

Screenshot of the 'B Mart' screen within the Baedal Minjok app. Ice cream, milk, bowl noodles, cola, and eggs are ranked at the top in the bestsellers section.

If Yo Mart follows B Mart in full-scale operations, intensified market competition is inevitable because customers in a limited area will be divided. According to B Mart, as of the 27th, best-selling items include bundled ice cream, water, milk, instant noodles, cola, and eggs based on sales popularity. These overlap with products sold at existing convenience stores or supermarkets. For ice cream, a 10% discount is applied to encourage sales.

Issues of fair competition have also emerged. Considering delivery speed and infrastructure levels, the competition between delivery apps and convenience stores or supermarkets is described as a 'tilted playing field.' On the Yogiyo screen, Yo Mart banner ads near the first Yo Mart store are displayed before those of existing convenience stores. By emphasizing their own services, franchise owners of convenience stores who previously paid entry fees are relatively disadvantaged.

There are claims that Baedal Minjok and Yogiyo have been free from neighborhood commercial district protection regulations because they are foreign-affiliated companies. Since their parent company, Germany's Delivery Hero, is a foreign company, they are in a regulatory blind spot. Large marts face restrictions from entry to business operations and even receive mutual cooperation evaluations to protect traditional markets and neighborhood commercial districts, but foreign companies are exempt. This is seen as reverse discrimination against domestic companies.

This issue is expected to be addressed as an agenda item in this year's comprehensive national audit. Witnesses scheduled to appear before the National Assembly's Industry, Trade, Energy, Small and Medium Business Committee include Kim Bong-jin, chairman of Woowa Brothers; Kang Shin-bong, CEO of Delivery Hero Korea; and Kim Wan-su, executive vice chairman of the Federation of Small Business Owners. The main agenda is expected to focus on coexistence measures between delivery app platforms and small business owners and self-employed individuals.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)