Hansung University Global Economic Research Institute Announces First Domestic Analysis of Social External Costs of Smoking

Assuming Equal Harmfulness... Appropriate Tax on Heated Tobacco Products Should Be 493.7 Won Lower Than Current

IQOS Approved by US FDA as ‘Reduced Risk’... “Contradicts MFDS Research... Scientific-Based Regulation Needed”

[Asia Economy Reporter Lee Seon-ae] The tax controversy over heated tobacco products has reignited. The tobacco industry has intensified its voices that it is inappropriate to regulate heated tobacco products, which are fundamentally different from conventional cigarettes, using existing methods and imposing excessive taxes. Although the government raised taxes based on the Ministry of Food and Drug Safety's (MFDS) research results on the harmfulness of heated tobacco products, scientific evidence continues to show that they are less harmful. Moreover, research results have emerged suggesting that if the external costs of smoking are estimated on the premise that all tobacco products have the same harmfulness, the appropriate tax amount for heated tobacco products should be lower than the current level. While the MFDS has yet to provide scientific answers to the harmfulness controversy, many countries overseas are implementing differential taxation, and the tobacco industry is strongly demanding changes to discriminatory regulations.

Heated Tobacco Products Have Lower Social Costs... Taxes Should Be Reduced

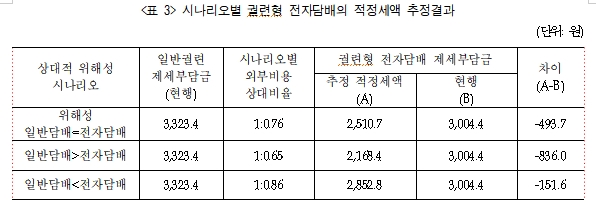

According to a recent report titled "A Study on Estimating the External Costs of Smoking and Rational Tobacco Taxation Measures (2020)" published on the 25th by the Global Economic Research Institute of Hansung University (Professor Park Young-beom, Hong Woo-hyung, Lee Dong-gyu team), when estimating the external costs of smoking on the premise that all tobacco products have the same harmfulness, the appropriate tax amount for heated tobacco products is estimated to be 2,510.7 KRW, approximately 493.7 KRW lower than the current level. This report is the first in Korea to estimate the external costs of smoking by category and contains analysis results and empirical evidence showing significant differences in external costs between conventional cigarettes and heated tobacco products.

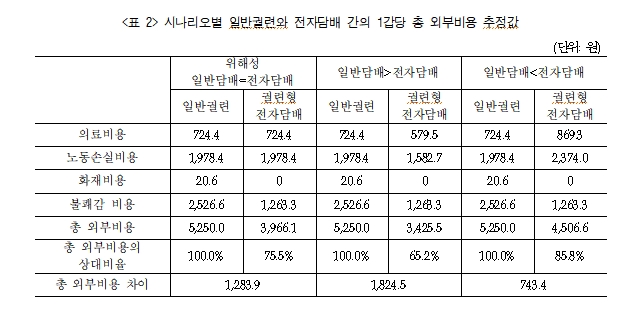

The Global Economic Research Institute cited the rapid increase in demand for electronic cigarettes and the imposition of similar tax burdens on conventional cigarettes and heated tobacco products under the current taxation system as the background for this study, highlighting ongoing issues of tax fairness between the two types of tobacco products. From the perspective of tax fairness, the theoretical justification for tobacco taxation can be found in corrective taxes, and the standard for appropriate taxation should be set based on the external costs of smoking. According to the theory of corrective taxes, it is socially desirable to tax tobacco products according to the magnitude of their external costs to effectively guide tobacco consumption. The study categorized the social external costs of conventional cigarettes and heated tobacco products into medical and labor loss costs, fire costs, and discomfort costs, estimating each cost accordingly.

Previous studies on the external costs of smoking mainly focused on medical costs (meaning medical expenses incurred by non-smokers due to secondhand smoke and increased health insurance premiums for non-smokers caused by smokers' higher medical costs) and labor loss costs (meaning opportunity costs due to labor and productivity losses related to smoking). However, this study also scientifically analyzed and rigorously estimated fire costs (costs of human and property damage and firefighting expenses caused by cigarette butt fires) and discomfort costs (estimated as the willingness to pay for cleanliness due to discomfort non-smokers feel from cigarette odors), which the research institute explained as a significant contribution.

Assuming equal health risks between conventional cigarettes and heated tobacco products, the relative ratio of total external costs was found to be conventional cigarettes : heated tobacco products = 1 : 0.76, indicating that the total external costs of heated tobacco products are relatively lower. The research team estimated that, assuming the current tobacco tax burden on conventional cigarettes is maintained, the appropriate tax amount for heated tobacco products is 2,510.7 KRW per pack, about 493.7 KRW lower than the current 3,004.4 KRW. Notably, the study is based on survey and analysis results related to the social costs of smoking conducted on approximately 4,500 Korean citizens (2,158 smokers and 2,356 non-smokers).

Professor Park Young-beom of the Department of Economics at Hansung University explained, "The government's stance on tobacco taxation has so far been based on the premise that conventional cigarettes and heated tobacco products are 'the same tobacco,' but this study found that the social costs caused by conventional cigarette smoking were higher than those of electronic cigarettes."

IQOS Scientifically Proven Less Harmful... Need for Science-Based Regulation

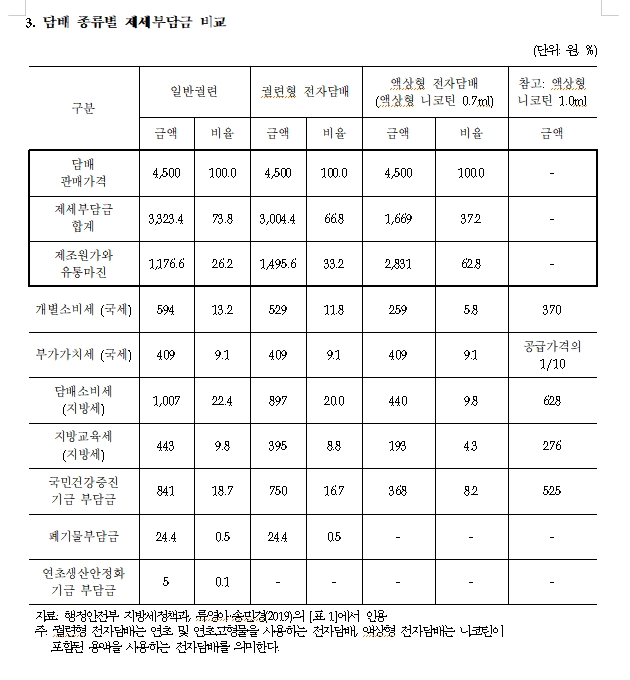

In the past, taxes on heated tobacco products were only about half of those on conventional cigarettes. This was because there were no standards for heated tobacco products, and tobacco companies classified and reported them under 'tobacco solid material,' which had the lowest tax among tobacco types. At that time, the individual consumption tax on conventional cigarettes was 594 KRW per pack (20 sticks), while the individual consumption tax on heated tobacco products (such as IQOS 'Heets') was 126 KRW per pack, about 21% of that on conventional cigarettes. Later, as heated tobacco products expanded their market share by advertising lower harmfulness compared to conventional cigarettes, the government prepared a revision based on the MFDS's harmfulness research results, considering tax fairness. Currently, taxes on heated tobacco products are about 90% of those on conventional cigarettes.

In 2018, the MFDS announced research results on the harmfulness of heated tobacco products, analyzing that they have higher tar levels than conventional cigarettes and negatively affect the human body. Philip Morris challenged the reliability of the research results and engaged in litigation. Philip Morris argued, based on overseas research cases, that the MFDS research simply compared tar levels. Subsequently, the Seoul Administrative Court ruled in May this year that some parts of the harmfulness analysis of heated tobacco products should be disclosed to Philip Morris, but the MFDS has not yet complied.

In this situation, Philip Morris's heated tobacco brand 'IQOS' recently received the first-ever marketing authorization for a 'Modified Risk Tobacco Product (MRTP)' from the U.S. Food and Drug Administration (FDA). This was based on extensive scientific evidence, including eight preclinical studies and ten clinical studies. A modified risk tobacco product refers to a product that reduces or has the potential to reduce harm when smokers switch to it. Notably, the FDA judged that IQOS has a reasonable likelihood of significantly reducing individual smokers' disease incidence or mortality. This means it was confirmed that IQOS produces and exposes users to fewer harmful substances compared to conventional cigarettes.

Baek Young-jae, CEO of Philip Morris Korea, stated, "The FDA decision proves that IQOS vapor contains fewer harmful substances and reduces exposure to harmful substances," emphasizing, "This is fundamentally different from conventional cigarettes, so regulating it in the same way is inappropriate." He added, "If ideological approaches are emphasized without science, it is difficult for experts to conduct transparent and constructive discussions," urging, "Opinion leaders' encouragement and interest are needed to establish rational regulation."

BAT Korea also emphasized that more rational and scientifically based regulatory policies for heated tobacco products should be implemented.

Additionally, the industry believes that attention should be paid to global trends. The tax burden ratio of heated tobacco products compared to conventional cigarettes is 90.4% (conventional cigarettes : heated tobacco products = 1 : 0.90), which is the highest among major countries. Japan has the highest tax burden ratio among major countries at 78.0%, Russia is at 63.1%, Greece at 52.9%, and other countries have even lower ratios ranging from 20% to 40%. Professor Park said, "Looking at cases in major developed countries, tobacco regulations and tax rates are applied proportionally to the harmfulness of each tobacco product type," emphasizing, "The Korean government should seriously consider introducing tobacco regulation policies proportional to tobacco harmfulness, such as strengthening regulations on more harmful tobacco and relaxing regulations on less harmful tobacco."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.