General Subscription 'Like Catching Stars in the Sky'... Funds Flowing into IPO Funds

[Asia Economy Reporters Bomryeong Kim, Eunmo Koo] Ahead of Big Hit Entertainment's IPO, funds are pouring into public offering stock funds. As individual investors find it nearly impossible to subscribe to public offering stocks, public offering stock funds have emerged as an alternative. However, since each public offering stock fund has a different management strategy, investors need to exercise caution.

According to the financial investment industry on the 24th, Big Hit is conducting demand forecasting for domestic and foreign institutional investors from today until the 25th. General investor subscription is scheduled for the 5th and 6th of next month.

As Big Hit's IPO, considered one of the biggest in the second half of the year, approaches, investors aiming for it are turning their attention to public offering stock funds. They realized from the SK Biopharm and Kakao Games public offerings that investing in public offering stocks with a small amount is difficult. Even with an investment of 100 million KRW, SK Biopharm and Kakao Games allocated an average of 13 shares and 5 shares respectively.

Public offering stock funds participate as institutional investors in subscriptions during new listings to generate profits. Considering that public offering stock allocation is typically 60% for institutions, 20% for the general public, and 20% for employee stock ownership, it is possible to invest in public offering stocks with a small amount through public offering stock funds.

Choi (33), an office worker, said, "I wanted to invest in public offering stocks, but I didn't have billions of won to invest, so I just watched when subscribing to SK Biopharm or Kakao Games." He added, "I think I absolutely cannot miss Big Hit, so even if I cannot participate in the public offering subscription next month, I am looking into products to invest in public offering stock funds."

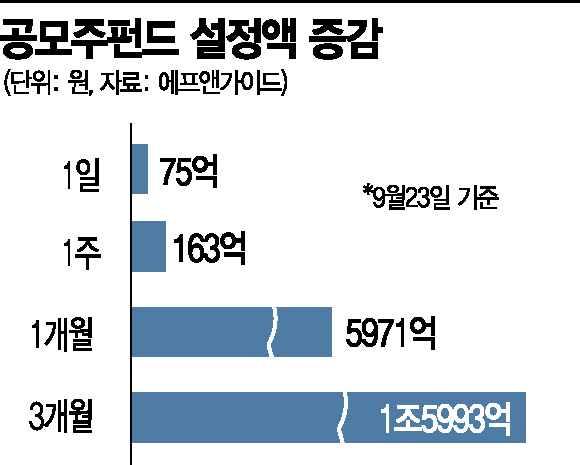

According to fund rating agency FnGuide, as of the previous day, the assets under management of public offering stock funds increased by 7.5 billion KRW in one day, 16.3 billion KRW in one week, 597.1 billion KRW in one month, and 1.5993 trillion KRW in three months. This indicates that funds are flowing into public offering stock funds ahead of Big Hit's IPO. The popularity of public offering stock funds can also be inferred from the number of funds. The number of public offering stock funds increased by 10 from 113 on the 15th to 123 on the 23rd.

There are also public offering stock funds openly targeting Big Hit. Kiwoom Securities announced today that it will sell the 'Coreate KOSDAQ Venture Plus Fund (Mixed Stock Type)'. Coreate Asset Management is raising funds for one day only to participate in Big Hit's institutional demand forecasting. Afterward, until Big Hit's listing, it will implement a soft closing (temporary suspension of sales) to prevent dilution of returns for existing investors. Korea Post Securities is also launching a KOSDAQ Venture Fund investing in public offering stocks today. Korea Post Securities explained that the fund invests in Big Hit and KOSDAQ venture new stocks and bonds.

However, even among public offering stock funds, the assets held and management strategies differ by type, so it is necessary to examine them carefully before investing. This is because performance varies greatly depending on the management strategy. The average return of 123 public offering stock funds over the past three months was 4.4% as of the 23rd. Looking at individual funds, performance varies widely. Some funds achieved returns as high as 41.4%, while others barely avoided negative returns, staying in the 0% range.

Oh Kwang-young, a researcher at Shin Young Securities, said, "Since some funds are concurrently implementing additional management strategies or have stocks under mandatory holding commitments, it is necessary to check the holdings list." He added, "Especially, poorly performing funds often hold many stocks trading below the public offering price after listing, which can lead to a vicious cycle where the proportion of such stocks increases due to capital outflows, causing continued poor performance."

Concentrating funds on high-risk, high-return public offering stock funds aiming for preferential allocation benefits can also be risky. Public offering stock funds are divided into general public offering stock funds, which hold 10-30% public offering stocks and invest the rest in domestic government and corporate short-term bonds, as well as high-yield funds and KOSDAQ venture funds (Koben funds).

Among these, high-yield funds and Koben funds receive policy benefits that prioritize allocation of public offering stocks to support financing for low-credit rating companies and venture companies. High-yield funds, which hold non-investment grade bonds rated BBB or below, receive 10% priority allocation of public offering stocks, while Koben funds, which invest 50% in stocks of venture companies or KOSDAQ-listed companies that have been delisted from venture status for less than seven years, receive 30% priority allocation.

These funds are advantageous for securing public offering stocks but hold high-risk assets sensitive to market changes, so their stability is relatively lower. Kim Jong-hyup, head of strategy operations at Kiwoom Asset Management, explained, "General public offering stock funds mostly hold only short-term bonds, so they are not very sensitive to bond interest rate fluctuations, but high-yield funds hold assets sensitive to interest rates and credit, so if the market changes rapidly or interest rates rise, there can be sharp fluctuations in returns."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.