Buying Sentiment at Low Prices Amid Market Adjustment

[Asia Economy Reporter Minji Lee] As global stock markets entered a correction phase this month, so-called 'Seohak Ants'?individual investors investing overseas?have been buying products that bet on index rises. Some individual investors also boldly invested in the limited 3x leverage products available in the domestic stock market.

According to the Korea Securities Depository's securities information system, SEIBRO, from the 1st to the 22nd of this month, domestic investors purchased leveraged exchange-traded funds (ETFs) and exchange-traded notes (ETNs) betting on index rises in overseas markets worth 132.6 billion KRW. Based on net purchase settlements, the 'ProShares UltraPro QQQ' product, which tracks three times the rise of the Nasdaq 100 index, was bought for 67.3 billion KRW, and FUGU (MicroSectors™ FANG+™ Index 3X Leveraged ETN) was net purchased for 65.3 billion KRW. FUGU includes FAANG stocks (Facebook, Apple, Amazon, Netflix, Google) as well as Alibaba, Baidu, Nvidia, Tesla, and Twitter in equal proportions. All are representative stocks of the Nasdaq index, maintaining a flow similar to the index, and investors can earn profits three times the ETN's rise.

As the Nasdaq index experienced a sharp correction this month, it is interpreted that among individual investors, the sentiment to use this as an opportunity for bargain buying has expanded. The Nasdaq index fell about 7% from 11,775.46 to 10,963.64 (closing price on the 22nd) this month. After surging 75% to a record high of 12,056.44 as of March 2nd following the spread of the novel coronavirus (COVID-19), it then shifted to a sharp decline. The burden from the rapid short-term rise and the lack of data to explain the stock price weakened the momentum for further gains.

In the domestic stock market, some individual investors are also betting on the rise of U.S. indices. Over the past 20 trading days, the ETF most net purchased by individuals was 'TIGER U.S. Nasdaq 100,' with about 91.8 billion KRW bought. Among ETNs, money flowed into 'TRUE Leverage Nasdaq 100 ETN' (5.3 billion KRW), which yields twice the profit of the rise. Money also poured into 'KINDEX U.S. S&P 500' (29 billion KRW) and 'TIGER U.S. S&P 500' (4.2 billion KRW), which bet on the rise of another U.S. index, the S&P 500. It is analyzed that the judgment that U.S. stocks will not collapse at this point stimulated individual buying momentum.

Experts agree that while a broad decline in tech stocks is unlikely, additional short-term declines may occur. With the U.S. presidential election approaching in November, some advise reducing the proportion of U.S. assets considering political uncertainties.

Researcher Jaehwan Heo of Eugene Investment & Securities explained, "Looking at the scale of the global stock market correction in September, the Nasdaq, which is home to U.S. tech stocks, as well as the UK and Mexico, experienced large declines, while Germany, India, Japan, and Korea performed relatively well, indicating that the correction is limited to certain regions and industries. Political uncertainty is a unique risk to the U.S., so rather than changing the overall positive view of the stock market, a strategy to reduce the proportion of U.S. stocks is effective."

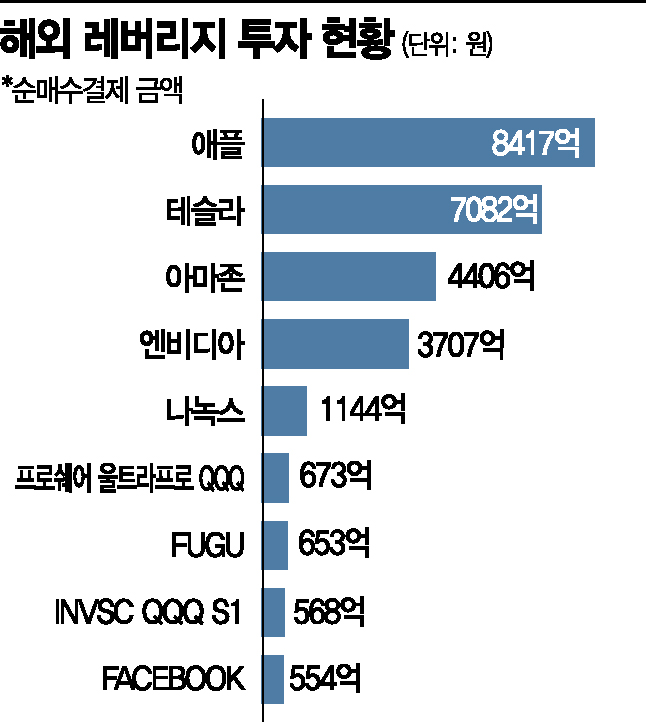

Additionally, the ranking of stocks purchased by individuals included Apple (841.7 billion KRW), Tesla (708.2 billion KRW), Amazon (446.0 billion KRW), Nvidia (370.7 billion KRW), and Facebook (55.4 billion KRW), all of which influenced the Nasdaq index decline. Individuals also invested in the precious metals ETF 'ISHARES COMEX GOLD TRUST' (34.3 billion KRW) and the inflation-protected bond ETF 'ISHARES TIPS BOND ETF' (30.1 billion KRW). Following hydrogen fuel cell vehicle maker Nikola, Israeli medical device company Nanox, which has been embroiled in fraud allegations, was also purchased for 114.4 billion KRW.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.