"Non-traditional Monetary Policy to be Incorporated into Routine Monetary Policy"

"Regulations on Compensation Liability for Monetary Policy Committee Members Should be Abolished"

"For-Profit Company Loans Should Also be Granted Exclusive Inspection and Supervision Authority"

[Asia Economy Reporter Eunbyeol Kim] There has been a call to consider adding employment or economic stability as objectives in the Bank of Korea Act. It has been pointed out that the provision for liability for damages against Monetary Policy Board members should also be abolished to prevent passive policy decisions due to concerns over future accountability disputes in crisis situations like the COVID-19 pandemic.

Jang Min, Senior Research Fellow at the Korea Institute of Finance, stated at an online seminar hosted by the Seoul National University Financial Economics Research Institute on the 22nd, "As the role of central banks is increasingly demanded in socio-economic issues such as climate change and income inequality, the use of unconventional monetary policies is expanding, and these unconventional policies are expected to eventually become part of routine monetary policy," adding that institutional reforms and improvements to the monetary policy framework are essential to flexibly utilize policies such as forward guidance, quantitative easing (QE), and credit easing beyond adjusting policy interest rates. Jang is a financial expert who previously served as the head of the Bank of Korea’s Research Department.

First, Jang mentioned that the current purpose clause of the Bank of Korea Act, which focuses on price stability, should be amended. He explained, "While the use of unconventional monetary policy by central banks can be interpreted as limited to financial stability, in reality, it is used with an emphasis not only on stabilizing financial markets but also on stabilizing the real economy," and added, "To assign a more proactive role in economic defense in the future and to eliminate the gap between law and reality, it is necessary to consider adding employment stability or economic stability to the purpose clause of the Bank of Korea Act, similar to the case of the U.S. Federal Reserve (Fed)."

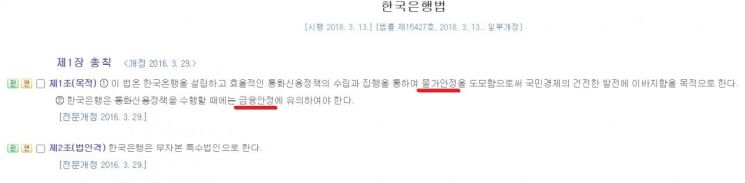

According to the current Bank of Korea Act, the Bank of Korea prioritizes 'price stability' as its primary mission under Article 1, Paragraph 1, and pursues efforts for 'financial stability' under Paragraph 2.

Recently, the U.S. Fed announced that it would place more emphasis on employment rather than curbing inflation in its monetary policy. This has led some to suggest that the Bank of Korea should also set employment or economic conditions as monetary policy goals, but internally, the Bank of Korea remains cautious.

Regarding this, Senior Research Fellow Jang said, "One might think that having three monetary policy goals within the Bank of Korea Act could make it difficult to respond effectively given the limited policy tools," and advised, "It is also possible to consider removing the financial stability goal and newly adding employment or economic stability goals."

He continued, "If inflation rises but the economy remains sluggish, the current structure forces the Bank to implement tight monetary policy, which could negatively impact the economy," pointing out that since the global financial crisis, monetary policy has focused on employment and economic stability. He also expressed the view that explicitly stating these goals in the monetary policy objectives could provide greater flexibility for the Bank of Korea’s policies rather than hiding them.

Senior Research Fellow Jang also argued that the provision on liability for damages against Monetary Policy Board members stipulated in Article 25 of the Bank of Korea Act should be abolished. This provision states that if the Monetary Policy Board causes damage to the Bank of Korea through intentional or gross negligence, all members attending the meeting, except those who clearly expressed dissent, are jointly liable for damages to the Bank of Korea.

He said, "Imposing liability for damages on Monetary Policy Board members retrospectively could restrict active policy decisions in urgent economic crisis situations, such as financial instability, where rapid policy responses like credit support to profit-seeking companies are necessary," and added, "Article 25 of the Bank of Korea Act is a provision not found in other central bank laws and acts as a factor limiting the active execution of monetary policy by Monetary Policy Board members."

To respond to the COVID-19 crisis, the Bank of Korea has actively implemented unconventional monetary policies this year. It has provided loans to a special purpose vehicle (SPV) to support non-investment grade corporate bonds and commercial paper (CP), supplied liquidity to financial institutions through unlimited repurchase agreement (RP) purchases, and established a special financial stability loan system.

Senior Research Fellow Jang emphasized, "Currently, loans are being extended to profit-seeking companies without proper inspection of which companies they are, so since the Bank of Korea is playing an active role, it should also be granted authority," and stressed, "When directly supplying funds through credit or bond purchases, the Bank of Korea should be given prior and subsequent exclusive inspection and supervisory functions." He added, "Providing loans without supervisory or inspection authority is truly an imbalance."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)