[Asia Economy Reporter Jang Hyowon] Hyundai Livart's sales revenue in the first half of this year increased by 18%. After struggling in a slump for several years, the performance gained upward momentum as furniture demand rose due to the COVID-19 pandemic. The company’s financial structure is solid, and the ‘Smart Work Center’ under construction since 2017 is nearing completion, showing growth potential. However, sustained losses in overseas markets such as Canada and Malaysia, where it ambitiously expanded, remain a hurdle to its performance.

◆Strong Domestic Performance... Overseas Subsidiaries in ‘Deficit’

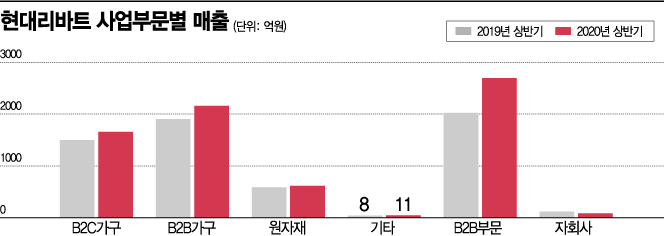

Hyundai Livart is a subsidiary of the Hyundai Department Store Group engaged in the manufacturing and sales of furniture and wood products. Its business segments are divided into B2C (business-to-consumer) furniture (23.2%), office furniture (5.9%), built-in furniture (24.4%), material distribution (8.7%), and B2B (business-to-business) segment (37.8%).

In the first half of this year, it posted favorable results. Consolidated cumulative sales for the first half reached 722.2 billion KRW, up 17.8% compared to the same period last year. Operating profit and net profit also increased by 56.9% and 32.3%, reaching 24.9 billion KRW and 17.9 billion KRW, respectively. Operating profit had been on a downward trend since 2017 but reversed in the first half of this year. The increase in time spent at home due to remote work and social distancing is estimated to have boosted interest in home decoration, contributing to the improved performance.

By segment, the B2B division showed the largest growth, with sales increasing by 33.3% year-on-year. The B2B segment deals with intermediary distribution of industrial materials, construction materials, packaging materials, uniforms, and more. Hyundai Livart entered this business by absorbing Hyundai H&S in 2017.

The furniture business division recorded sales growth rates in the double digits for both B2C and B2B. B2C includes home and kitchen furniture, while B2B covers built-in, office, and ship furniture. Online sales in the B2C segment grew by 17.2%, outpacing the offline sales growth rate of 7.5%. In the B2B segment, domestic order volume increased, leading to significant sales growth in built-in furniture (15.2%) and ship furniture (46.9%).

The furniture business segment is expected to maintain a positive outlook in the second half of this year. In July, retail sales of furniture increased by 30.3% compared to the same period last year. Additionally, a 1,000-pyeong (approximately 3,306 square meters) combined home and kitchen store is planned to open in Busan at the end of August, suggesting favorable sales in the third quarter despite the off-season.

Although performance has turned upward, this is mainly due to domestic sales, while the overseas business segment showed sluggish results.

Hyundai Livart operates a B2B business supplying built-in furniture and other products to construction companies in Canada through its Canadian subsidiary. The Canadian subsidiary recorded a loss of 2.5 billion KRW in the first half of this year. While the loss was 200 million KRW at the end of the first quarter, a sudden loss of 2.3 billion KRW occurred in the second quarter. As a result, the Canadian subsidiary fell into a state of complete capital erosion.

The Malaysian subsidiary recorded no sales in the first half and posted a loss. This subsidiary is also in a state of complete capital erosion. Hyundai Livart set aside bad debt provisions of 2.2 billion KRW and 1.7 billion KRW for accounts receivable from the Canadian and Malaysian subsidiaries, respectively. Consequently, Hyundai Livart’s consolidated operating profit for the second quarter was 10 billion KRW, falling short of the market consensus.

Kim Misong, a researcher at Cape Investment & Securities, analyzed, “The reason the performance fell short of expectations was due to the approximately 4 billion KRW in provisions set aside for overseas subsidiaries,” adding, “We expect losses to continue at the Canadian subsidiary, so we are revising downward our earnings estimates.”

◆‘Level Up’ with the Smart Work Center

Hyundai Livart is financially stable. As of the end of the first half, its debt ratio stood at 74%, and the current ratio was 142%. Although long-term debt increased significantly since last year, this was due to accounting standard changes that required lease liabilities to be recorded on the balance sheet. At the end of last year, Hyundai Livart recognized 10.2 billion KRW in current lease liabilities and 30.7 billion KRW in non-current lease liabilities as debt.

The debt ratio slightly increased from around 60%, which is attributed to the 20 billion KRW in borrowings raised this year. Hyundai Livart secured a 20 billion KRW short-term loan from SMBC in the first half of this year at an annual interest rate of 1.61%, resulting in approximately 300 million KRW in annual interest expenses.

The reason for raising the loan was to invest in the ‘Smart Work Center’ being constructed in Yongin, Gyeonggi Province. Hyundai Livart announced in 2017 that it would invest a total of 139.5 billion KRW to expand the Yongin plant and build a logistics center. As of the end of the first half of this year, 120.8 billion KRW had been invested, and most of the factory construction is complete.

The logistics center has been operational since June. According to the company, loading and unloading capacity has increased 2.3 times, improving logistics efficiency. Starting early next year, the company plans to fully operate the smart factory, which is expected to enhance production capacity.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)