Estimated Average Operating Profit of 240 Listed Companies in Q3 Up 17.87% YoY

Samsung Benefits from Huawei Sanctions

Hyundai, Kia See Strong New Car Sales

Kumho Petrochemical, SKC Show Significant Earnings Growth

[Asia Economy Reporter Oh Ju-yeon] As expectations for improved earnings in the third quarter of this year are rising, attention is being drawn to upward revisions in earnings estimates centered on the chemical, semiconductor, and automobile sectors.

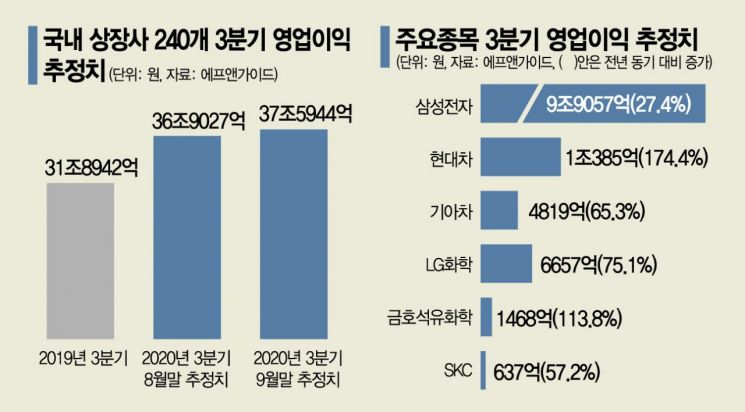

According to financial information provider FnGuide on the 21st, the average operating profit estimate for 240 domestic listed companies with estimates from three or more securities firms for the third quarter of this year is projected at 37.5944 trillion KRW, a 17.87% increase compared to 31.8942 trillion KRW in the same period last year. Recently, third-quarter earnings estimates have been trending upward. Although some stocks were adjusted due to the resurgence of COVID-19 and strengthened social distancing measures, expectations are high that the upward trend will remain unchanged. Compared to a month ago (36.9027 trillion KRW), this is a 1.87% increase. Among these, the semiconductor sector is the most notable.

Samsung Electronics' operating profit for the third quarter of this year is expected to reach 9.9057 trillion KRW, a 27.4% increase compared to the same period last year. This figure is 9.7% higher than the 9.0273 trillion KRW estimated a month ago. It also increased by 6.6% compared to a week ago. As the U.S. has intensified sanctions against Chinese semiconductor companies including Huawei, the market is analyzing that Samsung Electronics is in a favorable position to expand market share and secure new customers. KB Securities forecast that Samsung Electronics' operating profit for the third quarter of this year will achieve the highest ever since the third quarter of 2018 after two years, showing an 'earnings surprise.' KB Securities researcher Kim Dong-won stated, "Reflecting strong sales of smartphones and home appliances, we are raising the third-quarter operating profit estimate from 10 trillion KRW to 11.1 trillion KRW," emphasizing, "This will be the highest performance in two years since 17.5 trillion KRW in the third quarter of 2018."

The automobile sector is also considered a promising candidate for earnings improvement in the third quarter of this year. Following better-than-expected results in the second quarter despite COVID-19 concerns, operating profit is expected to turn to an increase compared to the previous year starting from the third quarter. Strong new car sales are linked to earnings improvement, while new businesses such as electric vehicles and hydrogen cars raise expectations for future growth. Additionally, the government's Green New Deal policy encouraging new businesses along with the eco-friendly trend is also positive. Hyundai Motor's operating profit estimate for the third quarter of this year is 1.0385 trillion KRW, expected to increase by 174.4% compared to the same period last year. Although the estimate a month ago also showed an increase compared to the previous year, it was expected to be 945.9 billion KRW, falling short of 1 trillion KRW, indicating that expectations are gradually rising. Kia Motors is also expected to record 481.9 billion KRW, a 65.3% increase compared to the same period last year.

Kim Ji-yoon, a researcher at Daishin Securities, analyzed, "Growth stocks that led the KOSPI rise have entered a consolidation phase since August, while cyclical value stocks (automobiles, securities, chemicals, etc.) continue to show strength," adding, "Looking at the consensus changes in operating profit for this year and next over the past month, value stocks have shown a larger increase." Kim emphasized, "In the case of automobiles, it is becoming increasingly likely to lead the KOSPI upward trend as one of the sectors expected to drive KOSPI earnings improvement next year."

The chemical sector is also expected to see increased earnings in the third quarter compared to the same period last year, including LG Chem, Kumho Petrochemical, SKC, Hansol Chemical, SK Chemicals, and Hanwha Solutions. Kumho Petrochemical's operating profit for the third quarter of this year is expected to be 146.8 billion KRW, a 113.8% increase compared to the same period last year, and SKC is expected to increase by 57.2% to 63.7 billion KRW, showing a remarkable growth trend. Although LG Chem's stock price recently dropped sharply after announcing the spin-off of its battery business division, there is analysis that the strengthening of the petrochemical and battery divisions will lead to a surprising stock price rise. Meritz Securities researcher Noh Woo-ho said, "The strengthened hegemony of the new battery corporation and the synergy with the remaining business divisions are positive for enhancing corporate value," adding, "The existing investment points remain unchanged." LG Chem's third-quarter operating profit estimate is expected to increase by 14.0% from a month ago to 665.7 billion KRW, a 75.1% increase compared to the same period last year.

Lee Kyung-soo, a researcher at Hana Financial Investment, explained, "Along with the upward revision of Samsung Electronics' earnings, the focus should be on value stocks whose earnings improvement is influenced by the recent confirmation of the interest rate bottom (global normalization)." Lee diagnosed, "By the end of the year, new earnings improvement targets that did not benefit much this year will attract attention," adding, "The areas with significant recent upward revisions are semiconductors, home appliances, automobiles, and chemicals."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)