COVID-19 Situation Calms Faster Than Expected, Economic Normalization Starting Q1 Next Year

Yuan Strength May Not Last Long... Depends on Speed of Rebound in Bottomed US Economy

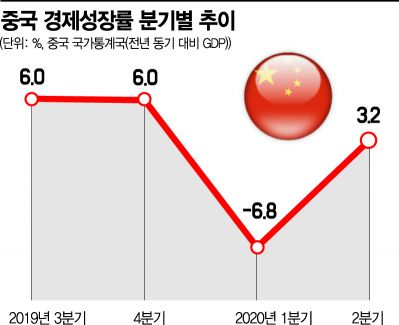

[Asia Economy Beijing=Special Correspondent Jo Young-shin] There is a claim that China's economic growth rate (GDP) will recover to the 6% range in the fourth quarter of this year.

It is expected that the novel coronavirus infection (COVID-19) situation will calm down faster than anticipated, and the Chinese economy will return to normal in the fourth quarter.

According to the Chinese state-run Global Times on the 21st, Ma Jun, a member of the Monetary Policy Committee of the People's Bank of China and director of the Financial Development Research Center at Tsinghua University, forecasted, "China's GDP will recover to the 6% range in the fourth quarter of this year, and economic recovery will be completed in the first quarter of next year."

Commissioner Ma diagnosed that "production activities are normalizing in most regions of China," and added, "Next year, China's macro policies will return to normal."

Regarding the current background of China's economic recovery, he predicted, "If the Chinese economy rebounded relying on government fiscal policies such as infrastructure investment after the COVID-19 outbreak, going forward, manufacturing investment and industrial production activities will normalize."

He was particularly confident that consumption, which had been sluggish, would soon get back on a normal track.

Commissioner Ma also mentioned the yuan, which has recently shown strength against the US dollar. He said, "The rise in the yuan's value is happening because China's economic recovery is faster than that of other advanced countries such as the United States." He explained that this reflects expectations for the Chinese economy and the inflow of foreign capital into China.

However, he also pointed out that the yuan's situation could change 180 degrees.

He forecasted, "There is a possibility that the pace of recovery of the US economy will catch up with China within the next six months." Since the US economy is currently almost at the bottom, its recovery speed could be faster than China's. In this case, the dollar's weakness and yuan's strength could change to dollar strength and yuan weakness, he said.

He also mentioned financial risks in China. He evaluated, "During the spread of COVID-19, financial support policies such as interest rate cuts for small and micro enterprises were effective in maintaining jobs and extending the lifeline of small and micro enterprises."

However, he said that going forward, the profits of medium and large banks must also be considered. Commissioner Ma said, "Appropriate interest rate hikes will not cause financial risks but rather stabilize the real economy early."

The Standing Committee of the National People's Congress supported a total of 1.5 trillion yuan (approximately 250.8 trillion Korean won) in June for deferring principal and interest repayments on loans for small and medium-sized enterprises.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)