Chinese Games Double Growth, K-Games Revenue Halved

Japanese Anime Characters and Genres Integrated in Chinese Market Strategy

Korea Faces Limits with PC-Based Mobile Games

New IPs Like Soccer Aim for Reputation Recovery

[Asia Economy Reporter Jin-gyu Lee] K-mobile games, whose export routes to China have been blocked due to the Chinese government's suspension of game licensing (distribution permits), are also struggling in Japan. After peaking in 2017, their performance has been halved since 2018. Meanwhile, Chinese games have rapidly grown, widening the gap. This is the result of leveraging animation intellectual property rights (IP) familiar to Japanese gamers. Korean games, which have been striving to improve, are aiming to restore their reputation with blockbuster titles that have already succeeded domestically.

K-mobile Games’ Sales Halved in Japan

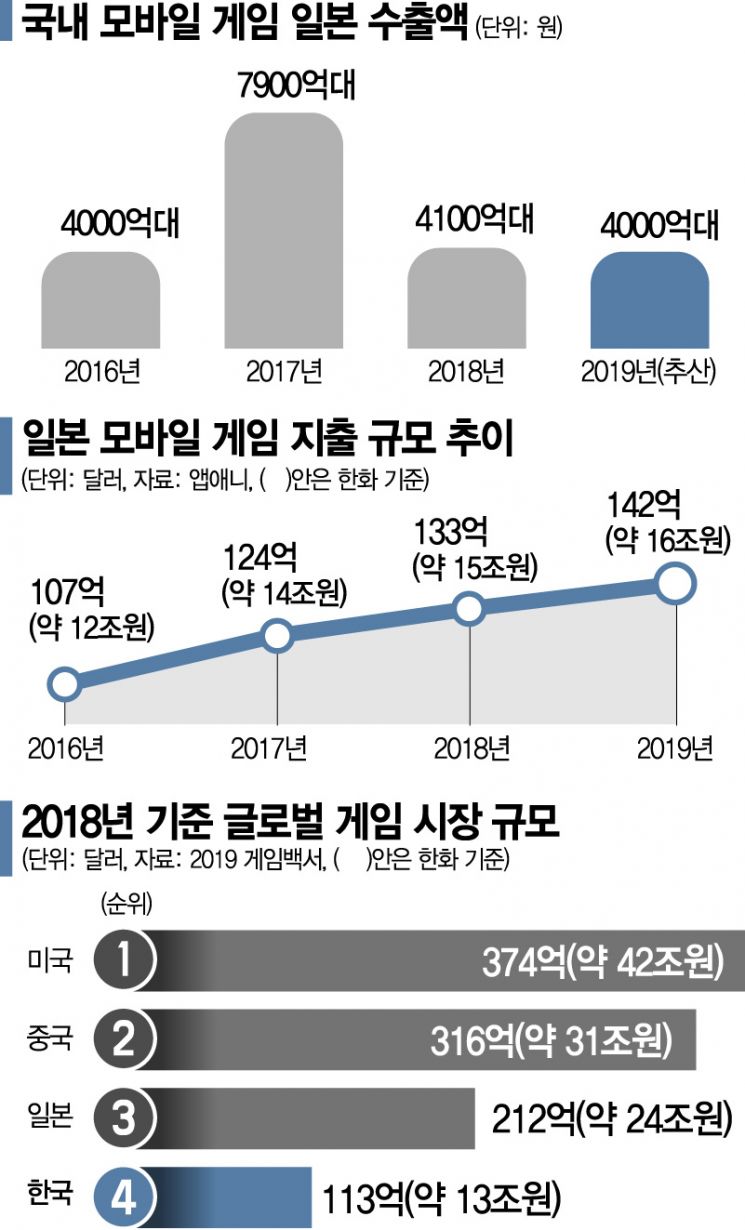

According to the global mobile game spending analysis data from the mobile data analytics platform App Annie on the 18th, the scale of mobile game spending in Japan’s two major app markets, Google Play and Apple App Store, has grown annually from around 12 trillion won (10.7 billion USD) in 2016 to about 16 trillion won (14.2 billion USD) last year. This year also benefited from the COVID-19 pandemic. During the second quarter, when COVID-19 was rampant in Japan, the average daily mobile game usage time was 3.6 hours, a 12% increase compared to last year’s average.

In this situation, the export of domestic mobile games to Japan has shown a sluggish trend. The export scale of domestic mobile games to Japan peaked at around 790 billion won in 2017 but dropped to about 410 billion won in 2018. The decisive reason is being outcompeted by Chinese mobile games. Only two Korean games, PUBG by PUBG Corporation and Seven Deadly Sins: Grand Cross by Netmarble, ranked within the top 30 mobile game revenues on Japan’s Apple App Store. In contrast, nine Chinese mobile games, led by Happy Elements’ idol training game Ensemble Stars, ranked within the top 30. Chinese mobile games are targeting the market by utilizing animation or comic intellectual property rights (IP) familiar to Japanese game users. Professor Jeong-hyun Wi of Chung-Ang University, who serves as the president of the Korea Game Society, explained, “Chinese game companies are targeting the mobile game market by considering Japanese gamers’ preferences and using animation characters and genres familiar to them. On the other hand, domestic game companies’ mobile games are based on existing domestic PC games that are somewhat unfamiliar to Japanese game users, limiting their popularity.” An industry insider said, “Domestic PC games performed relatively well in Japan, where PC games were less common in the 2010s, but recently, during the transition to the mobile game era, they are being outcompeted by Chinese mobile games.”

K-games Strike Back with New Mobile Titles

With the Chinese government’s suspension of game licensing blocking exports to China for over three and a half years, Japan, considered one of the world’s top three game markets, remains an indispensable market for domestic game companies. According to the Korea Creative Content Agency’s “2019 Game White Paper,” Japan’s total game market exceeds 20 trillion won, ranking third largest after the United States and China. Domestic game companies plan to fiercely compete with Chinese game companies by launching new IP-based mobile games locally in Japan in the second half of the year. Nexon plans to officially release the mobile massively multiplayer online role-playing game (MMORPG) V4 on Japan’s Google Play, Apple App Store, and PC Windows on the 24th. Released domestically in November last year, V4 is a mobile game utilizing a new IP that did not previously exist as a PC game. It has maintained a top position in domestic Google Play revenue for about 10 months since its launch, serving as Nexon’s cash cow. Additionally, FIFA Mobile, utilizing the FIFA IP, will also enter the Japanese market in the second half of the year. Since soccer is a popular sport in Japan, there is high expectation that it will succeed there as it has domestically. Professor Wi advised, “While retro mobile games are popular domestically, to target the Japanese market, it is necessary to develop mobile games in various genres using new IPs.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.