LG Chem Executes Physical Division to Own 100% of Battery New Corporation Shares

'LG Energy Solution (Tentative Name)' Officially Launches on December 1

[Asia Economy Reporter Hwang Yoon-joo] LG Chem is spinning off its world No. 1 battery business.

On the 17th, LG Chem held a board meeting and announced that it resolved a company split plan to enhance corporate value and shareholder value by focusing on specialized business areas. Accordingly, after approval at the extraordinary general meeting of shareholders scheduled for October 30, a newly established corporation dedicated to the battery business, tentatively named ‘LG Energy Solution,’ is expected to officially launch on December 1.

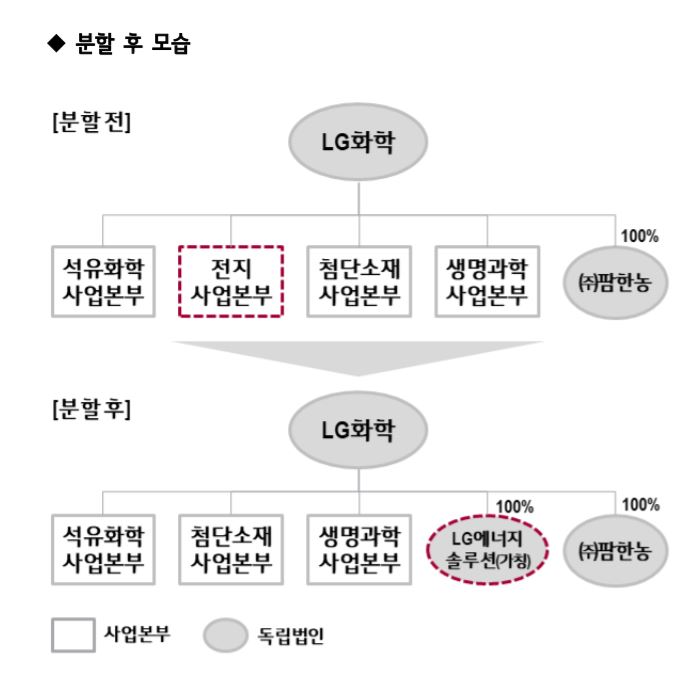

This split will be a physical division in which LG Chem will own 100% of the shares of the newly established unlisted battery corporation created through the split.

Regarding the company split, LG Chem stated, "We judged that the current timing is optimal for the company split as the battery industry is rapidly growing and structural profit generation in the electric vehicle battery sector is beginning in earnest. Through the company split, we can focus on specialized business areas, improve management efficiency, and elevate corporate value and shareholder value to the next level."

On the physical division, it added, "The increase in corporate value of the new corporation due to its growth will positively impact the corporate value of the parent company. We also considered the synergy effects between the two companies, including R&D cooperation and the connection with battery material businesses such as cathode materials."

LG Chem plans to grow the new corporation into the world’s top energy solutions company centered on batteries, aiming to achieve sales exceeding 30 trillion KRW in 2024. The new corporation’s expected sales for this year are approximately 13 trillion KRW. Regarding the IPO (initial public offering) of the new corporation, LG Chem said, “Nothing has been specifically decided yet, but we will continuously review it in the future.” It added, “Capital expenditures for facility investments driven by the expansion of electric vehicle demand will be funded by cash generated from business activities, and since LG Chem holds 100% ownership, various funding methods are possible if necessary.”

"Strengthening Expertise and Expanding Efficiency Ahead of Electric Vehicle Popularization"

LG Chem decided to split because it judged that, considering the battery business’s performance and market conditions, this is the optimal time to be re-evaluated for corporate value and to maximize shareholder value. In fact, in the second quarter, LG Chem established a foundation for structural profit generation in the electric vehicle battery business and achieved record-high operating profit in the battery sector.

Additionally, with an order backlog exceeding 150 trillion KRW in the electric vehicle battery business and annual facility investments exceeding 3 trillion KRW, the need to secure large-scale investment funds in a timely manner has increased. Through this split, LG Chem can secure a foundation to attract large-scale investment funds and establish an independent financial structure for each business division, thereby alleviating financial burdens.

Moreover, the need for swift decision-making and flexible organizational management to respond to rapidly changing markets has also been a factor behind the split. Through this company split, LG Chem will be able to receive appropriate business value evaluations for each business area, including the battery business, and the increase in corporate value of the new corporation will be reflected in the parent company’s corporate value, enhancing corporate value and maximizing shareholder value.

It is also expected that focusing capabilities on specialized businesses and enabling independent and swift decision-making tailored to business characteristics will significantly improve management and operational efficiency.

LG Chem plans to develop the new corporation into the world’s best energy solutions company with differentiated competitiveness not only in battery materials, cell, and pack manufacturing and sales but also in the E-Platform sector, which provides various services across the entire battery lifetime, including battery care, leasing, charging, and reuse.

Alongside this, LG Chem plans to focus timely investments in petrochemicals, advanced materials, and bio sectors to establish itself as a ‘Global Top 5 chemical company’ with a balanced business portfolio alongside the battery business.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)