[Asia Economy Reporter Hwang Yoon-joo] SK Inc. has recovered its principal investment after three years by selling part of its stake in the global logistics company ESR (e-Shang Redwood Group), in which it had invested.

On the 17th, SK Inc. announced that it sold 140 million shares, equivalent to 4.6% of its 11.0% stake in ESR, through a block deal at HKD 22.50 per share. The sale amount was approximately KRW 480 billion, marking a first-stage recovery of the principal investment through this partial stake block deal. After this block deal, SK Inc. will still hold a 6.4% stake in ESR, with the value of its holdings reaching about KRW 740 billion based on the closing price on the 16th.

Founded in 2011, ESR is a global logistics infrastructure company operating about 270 logistics centers worldwide, with over 200 global clients including Amazon, Alibaba, and JD.com. As the Asia-Pacific e-commerce market rapidly expands, ESR’s competitiveness with its specialized, state-of-the-art logistics infrastructure has been continuously highlighted in the market. SK Inc. made proactive investments twice before ESR’s listing, in August 2017 and September 2018, which turned out to be highly successful.

Especially after ESR was listed on the Hong Kong Stock Exchange on November 1 last year, its corporate value surged further. With the acceleration of the e-commerce market growth, ESR’s stock price rose about 47% from the IPO price of HKD 16.8 to HKD 24.75 as of September 16, and SK Inc.’s stake value increased approximately 2.5 times compared to its investment.

Considering ESR’s growth momentum, the value of the remaining stake held by SK Inc. is expected to increase further. This year, SK Inc. plans to continuously realize a virtuous investment cycle by reinvesting the cash secured through the listing of SK Biopharm, interim dividends from SK E&S, and the sale of ESR shares into future growth engines.

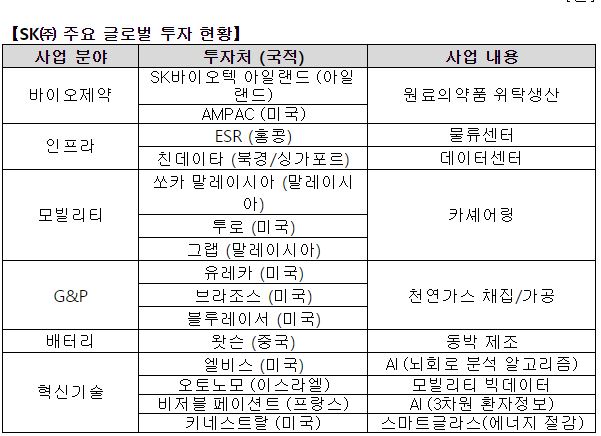

Based on its global investment expertise, SK Inc. continues to invest in various fields such as biopharmaceuticals, materials, and renewable energy. In particular, the market’s trust and expectations are growing regarding SK Inc.’s growth investment strategy, which evenly invests in future growth sectors including biopharmaceuticals, semiconductors, batteries, materials, AI, and big data.

Leading the meaningful achievements in new drug development is SK Biopharm, and the value of unlisted subsidiaries such as SK E&S is also attracting market attention. Notably, SK Pharmteco, an integrated CMO (Contract Manufacturing Organization) wholly owned by SK Inc., is being mentioned as the next candidate for listing following SK Biopharm.

Additionally, SK Inc. has been steadily making proactive investments in emerging technologies with high growth potential, such as antibody drug development, AI, and big data. This is part of a ‘seeding’ investment strategy that secures innovative technologies by investing in early-stage companies pioneering new markets based on their own technological capabilities and creating synergies with existing businesses.

An SK Inc. official said, "As an investment holding company, SK Inc. has built a solid portfolio incomparable to other domestic holding companies. As the timing for global investment recoveries arrives, investment performance realizations like ESR will continue, and we will persist in efforts to realize a virtuous investment cycle that meets market expectations."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.